I keep coming back to Fogo after studying more L1 stuff this year, and honestly one thing keeps popping in my head — this isn’t built for hype. It’s built for how markets actually work

At first glance, yeah it’s running the Solana Virtual Machine so devs can use the same tools they know. But that’s not even the main thing. The real story is in how it handles consensus

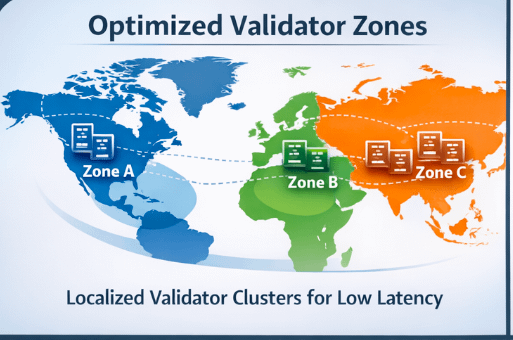

Everyone talks about speed right? But very few actually explain if that speed last when network is stressed. Fogo takes latency seriously. It knows speed isn’t just about computation — it’s about physics and geography. If validators are all over the place, communication slows down and finality get messy. So Fogo groups validators into zones that are optimized for performance. They talk faster, blocks happen more predictable, finality is more reliable. Not “maximal decentralization”, but consistent. And yeah that’s a conscious choice

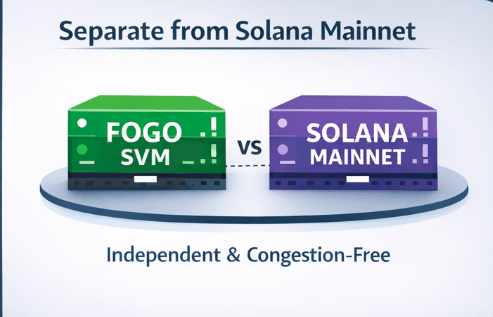

Also it runs SVM separate from Solana mainnet. So you get same dev experience but without inheriting congestion problems. That’s rare. Most “compatible” chains just bring over the bottlenecks

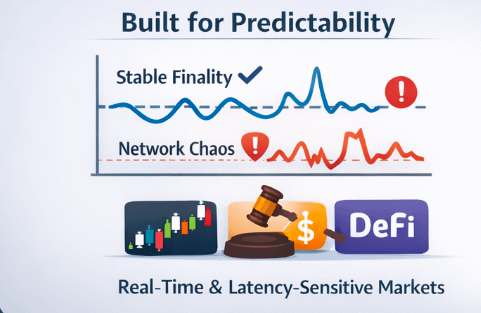

After looking at design, I feel like Fogo isn’t made for meme speculation or retail hype. It’s more for things like real-time derivatives, auction-style liquidity, latency-sensitive DeFi, structured finance — places where predictability actually matter more than ideology. Milliseconds matter. Determinism matter.

I’ve also changed how I look at L1s. Used to just check TPS and brag about it. Now I ask: how are validators spread geographically? How does finality behave under real load? Is performance predictable, or just shiny numbers on empty testnets? Fogo actually feels like it was built with those questions in mind from day one

It’s not trying to be popular. It’s trying to make a network where markets that can’t afford delays can actually function. And honestly, I respect that. So many projects act like physics doesn’t exist. Fogo doesn’t pretend — it works with reality, not against it