In the ever-evolving world of cryptocurrency, where short-term price swings, market sentiment, and speculative narratives often dictate the direction of the market, there’s one project that stands apart—$FOGO. Amidst the chaos and noise, fogo has chosen to focus on something far more significant: the infrastructure needed to support the future of AI-driven economies. While others are consumed by the volatile nature of crypto trading, $FOGO is strategically positioning itself to be an integral part of the future’s digital ecosystem.

In a market dominated by quick profits and even quicker market moves fogo is focused on long-term growth and stability. Unlike projects that chase immediate returns, $FOGO is positioning itself to be part of the discussions shaping the future of AI, scalable infrastructure, and regulatory frameworks. These aren’t just buzzwords that sound good in a tweet or headline. These are the key topics that are driving conversations in conference rooms and closed-door roundtables—places where policymakers, industry leaders, and strategists are deciding what the digital economy of tomorrow will look like.

A Different Kind of Conversation

In a closed-door roundtable focused on AI infrastructure and capital allocation, the conversation wasn’t about token velocity or price speculation. The focus was on resilience. It was about understanding how emerging digital systems can build themselves on solid, reliable rails—rails that can support institutional capital and the growing demand for secure and scalable coordination in an increasingly complex digital landscape.

This emphasis on infrastructure—and the long-term value it offers—is where $FOGO’s positioning becomes truly interesting. While many projects are focused on trading opportunities and price movement, $FOGO is looking at the bigger picture: it is positioning itself in the conversations that matter, where decisions are being made about the foundational infrastructure that will sustain the AI-driven economies of the future.

The Macro Thesis: AI-Driven Economies and On-Chain Coordination

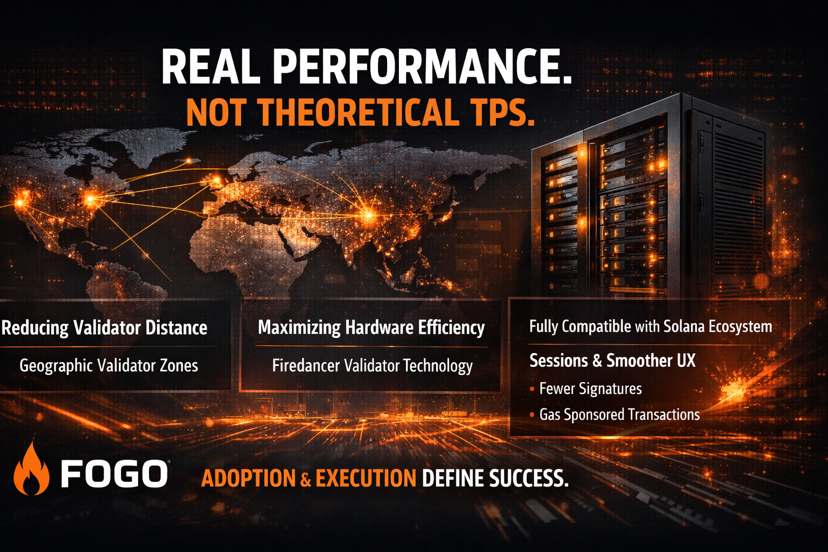

As we move further into an age dominated by AI, the need for secure, verifiable, and scalable on-chain coordination will only intensify. The growth of digital economies and the proliferation of AI applications demand systems that are built on stable, secure infrastructure, rather than on speculative cycles. In this context, $FOGO’s focus on building and reinforcing the infrastructure layer, rather than engaging in the short-term, high-risk nature of market speculation, places it in a unique position.

$FOGO’s strategic focus is to align itself with the growing demand for digital infrastructure. As AI technologies continue to expand, the infrastructure supporting them must evolve to be secure, scalable, and resilient. By focusing on this foundational layer, $FOGO is positioning itself as more than just a trading asset—it’s essentially offering investors an option on the future of digital coordination.

Contrarian Reality: Patience Over Immediate Rewards

While the market thrives on short-term volatility and bursts of excitement, true infrastructure rewards patience and long-term vision. It’s easy to get caught up in the hype of price surges, but real value is built when investors focus on creating and strengthening the systems that enable the market to function in the long run.

Short-term volatility and speculative cycles may often take center stage, but infrastructure—especially the kind that can support AI-driven economies—rewards investors who are willing to wait for long-term returns. $FOGO’s positioning may not immediately reflect in price movements, but for those able to look beyond the immediate noise, it is clear that this project is focused on something far more substantial.

The Big Question: Is $FOGO Hearing the Future Before the Noise Drowns It Out?

In cycles defined by noise and short-term trends, conviction often belongs to those who can hear the signal beneath the chaos. While most market players react to immediate movements and trades, fogo is positioning itself as an architect of the future. The real question is not whether $FOGO will face volatility—of course, it will. The real question is whether it is architecting relevance beyond the short-term noise.

As we continue to witness the rise of AI-driven economies, it’s clear that the demand for secure, scalable, and sustainable infrastructure will only grow. $FOGO’s focus on building this type of infrastructure means it is well-positioned for the long haul. Projects that focus on foundational systems, rather than speculative cycles, will be the ones that endure.

For those who are willing to listen beyond the immediate market noise, fogo could prove to be a key player in the digital economy’s future. It’s not just about the price today—it’s about the role it will play in the future. As the market rewards short-term bursts, infrastructure rewards those who can see past the noise, and fogo is building relevance in a quiet, but crucial, space.