While researching chain specialization i found that - FOGO's single-purpose(focused on trading only)is either brilliant or riskiest

What i found interesting:

most try everything. hedge bets.

FOGO: "institutional trading. period."

40ms, oracles, batching, SVM. everything HFT.

rare. afraid specialize limits market.

cuts both ways.

flexibility nobody models:

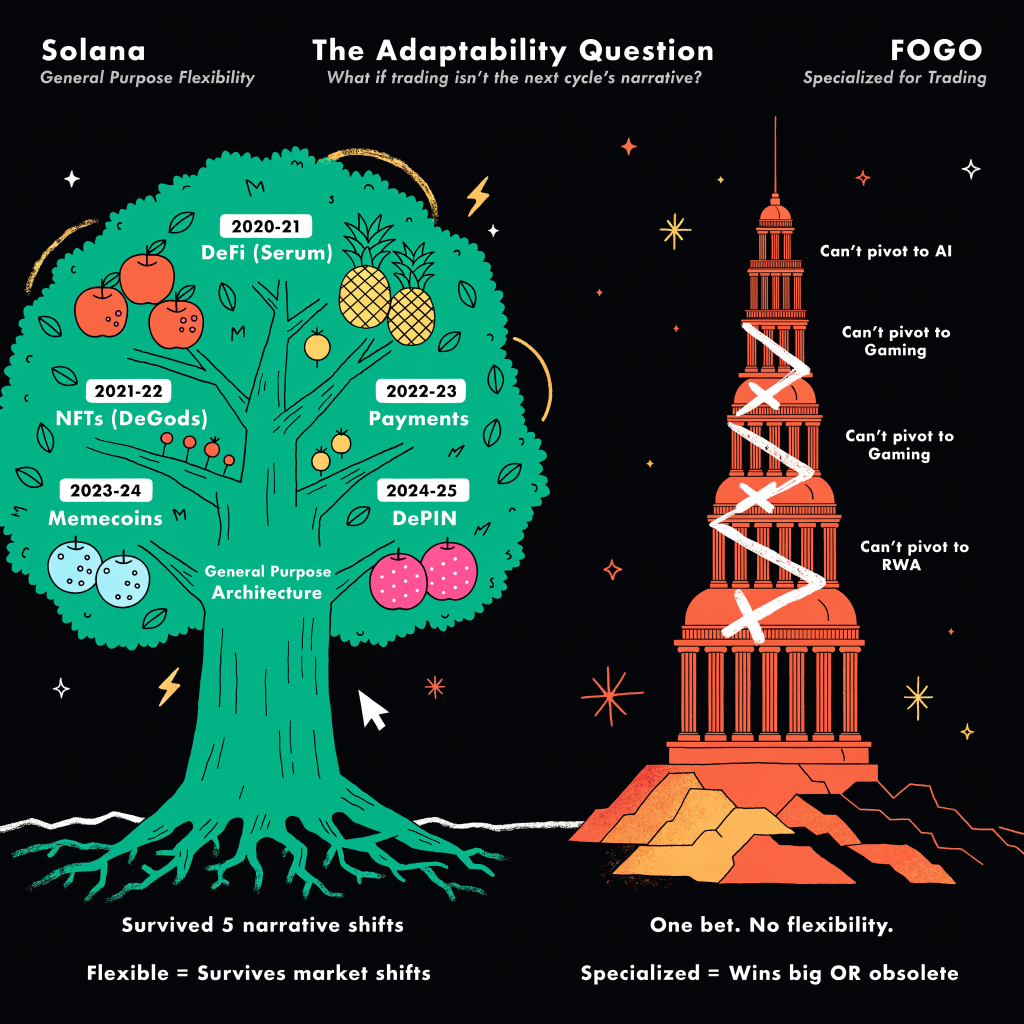

Solana survived general-purpose adapt.

2020-21: DeFi

2021-22: NFTs

2022-23: Payments

2023-24: Memecoins

2024-25: DePIN

five narratives. caught waves flexible.

FOGO built trading. not narrative? can't pivot.

Now here's the tricky part:

trading becomes THE - HFT on-chain, regulations - FOGO wins massive. Nasdaq of DeFi.but next cycle AI/gaming/social/RWA? can't pivot.

Fogo is making bet on:

"40ms matters everyone."

"institutional trading largest, stays largest years."

bold. wrong? overbuilt niche didn't scale.

Now the ecosystem:

5-6 protocols. Valiant, Pyron, LSTs.

Solana: hundreds categories. one slows, another picks.

FOGO can't diversify. everything trading. volume misses, entire suffers.

My concerns:

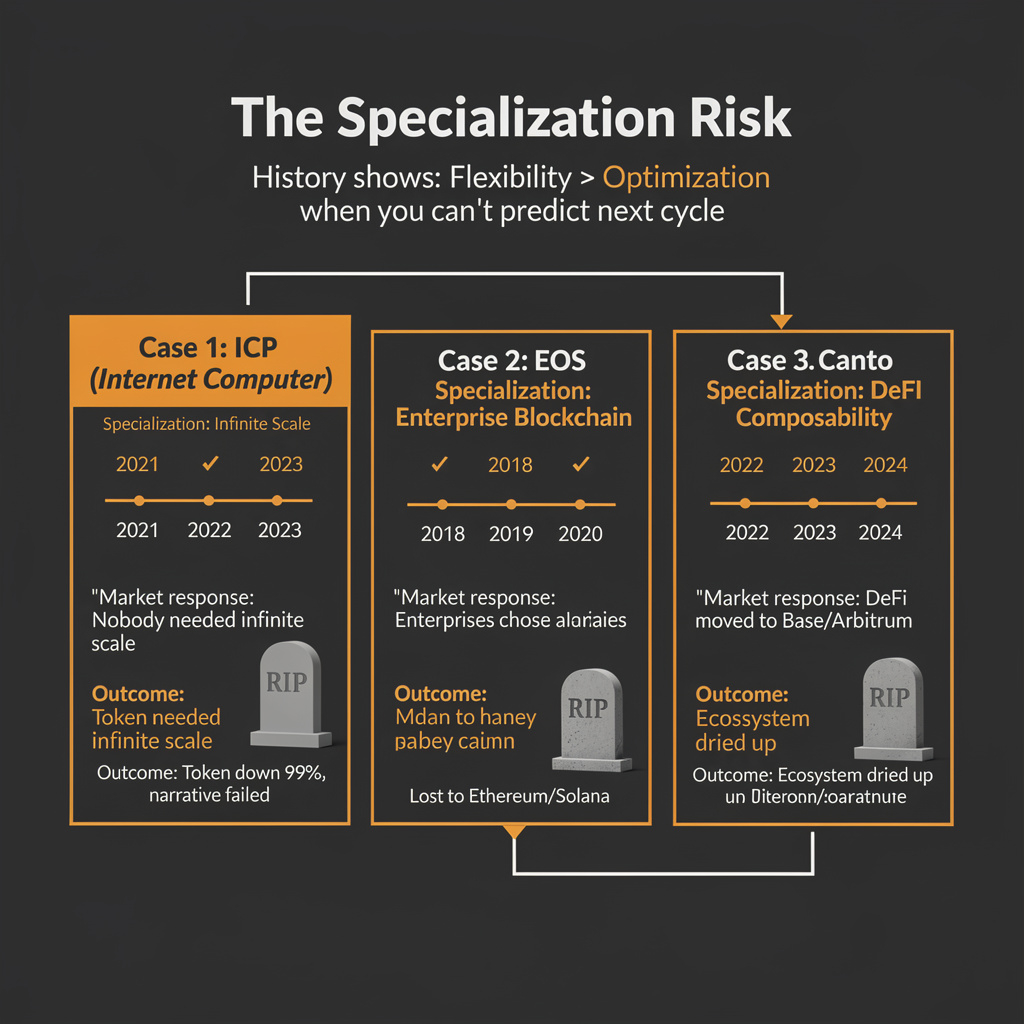

specialized fail market moved.

ICP: scale nobody cared.

EOS: enterprise didn't come.

Canto: composability moved.

hard choices specific. market picked different.

HFT needs beyond speed. compliance, custody, insurance.

40ms solves latency. not "legally trade on-chain." clarity absent or CEXs, speed doesn't matter.

What they get right:

hard choice. lane, optimized.

genuine HFT solves. CEX execution without custody.

JPMorgan, Jump. TradFi. $13.5M serious.

SVM compatible. thesis proves, ports.

trading dominant? genius.

Now this worries me:

narratives 12-18 months. dominated then faded.

general survive. specialized don't.

institutions slow. 3-5 years? momentum?

62% locked. up 174%. scale faster unlocks.

focused + unlocks = risks compound.

Nasdaq or fastest couldn't pivot?

power right, fragility wrong.

watching volume before: (1) shifts or (2) pressure.

strength focused or weakness can't adapt?? 🤔