When a new chain launches, the first thing everyone watches is TVL.

Numbers go up. Screenshots circulate. Charts look impressive. But the real question is always the same:

Is this capital productive, or is it temporary?

FOGO is still early. That’s exactly why this phase matters. Early liquidity patterns often decide whether a network becomes structurally strong or just another short-cycle experiment.

And what stands out right now is not just inflow — it’s the type of inflow.

There’s a difference between mercenary liquidity and aligned capital.

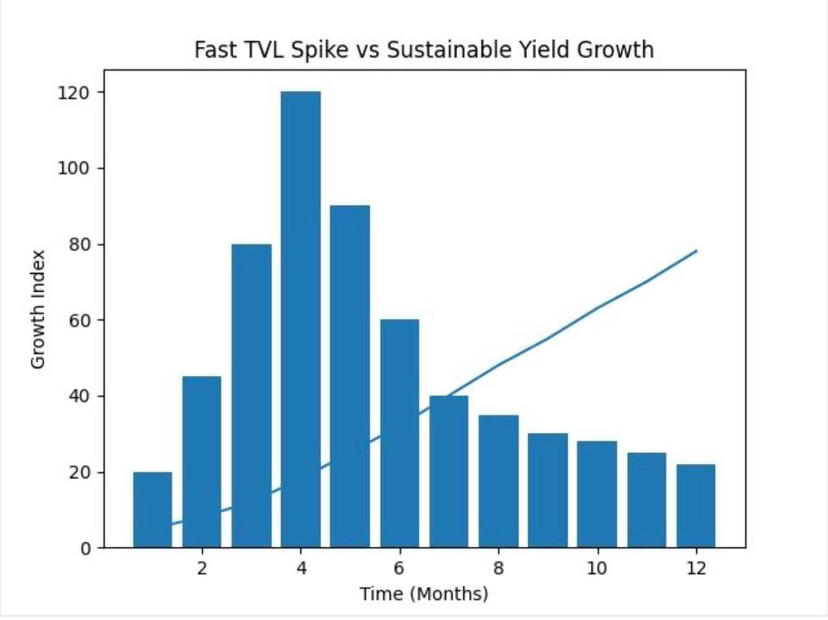

Mercenary liquidity moves fast. It chases the highest APY. It leaves as quickly as it arrived. It creates sharp spikes in usage but rarely builds durable depth.

Aligned capital behaves differently. It stays. It compounds. It participates in governance. It stakes. It provides liquidity with a longer horizon.

FOGO’s design increasingly favors the second type.

Yield on FOGO is not isolated from network function. It is connected to staking, validator security, and DeFi participation. That alignment changes everything.

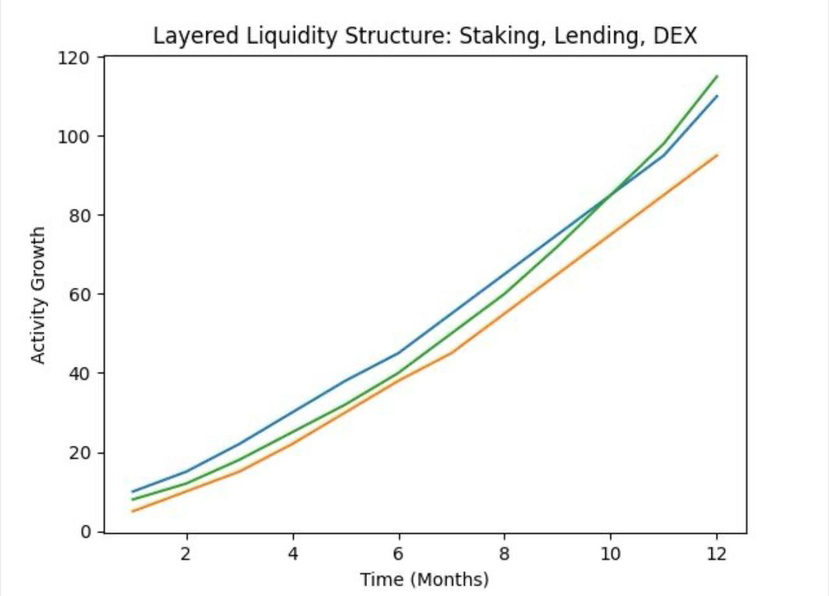

When staking grows, network security strengthens. When liquid staking integrates into DeFi, capital efficiency improves. When lending markets deepen, liquidity becomes reusable rather than idle.

That circular structure is important.

Sustainable yield does not come from inflation alone. It comes from real usage. From borrowing demand. From trading activity. From settlement.

If a network’s yield is supported by economic movement rather than pure emissions, it tends to stabilize over time.

And that stability attracts serious participants.

One overlooked aspect of early ecosystems is how quickly liquidity can concentrate. When only one or two protocols hold most capital, fragility increases. But when liquidity spreads across staking, lending, and AMMs simultaneously, resilience improves.

FOGO is gradually building that layered structure.

Liquid staking allows users to earn while staying active. Lending allows that same capital to circulate. DEX pools create trading depth. Validators secure consensus.

It’s not random activity. It’s connected.

That connection is what separates hype from foundation.

Sustainable yield also changes user behavior. When returns come from structured participation rather than short-term incentives, users become stakeholders. They care about validator health. They monitor governance. They choose integrations carefully.

That’s how ecosystems mature.

TVL spikes attract attention. Yield quality builds trust.

FOGO’s current stage is less about explosive numbers and more about distribution patterns. Where liquidity is placed. How long it remains. How evenly it spreads across validators and protocols.

If those patterns continue trending toward diversification and reuse rather than concentration, the network becomes harder to destabilize.

That’s structural growth.

Markets often reward velocity. But infrastructure rewards stability.

And in my view, FOGO is leaning toward stability-first architecture rather than chasing temporary headlines.

Early networks don’t need extreme numbers. They need the right behavior forming at the base layer.

Because behavior formed early tends to persist.

If staking remains healthy, if liquid staking stays integrated, if lending demand grows organically, then yield becomes an outcome of activity — not an artificial tool to attract it.

That distinction may not trend on a chart.

But it builds ecosystems that survive cycles.

FOGO is still building. That’s clear.

The important part is that it appears to be building with structure in mind.

And sustainable yield is the quiet signal that structure is forming.