I’ve seen a lot of new Layer-1 projects over the years. Most of them follow the same script — promise massive speed, talk about big ecosystems, and hope the market does the rest.

Fogo feels different to me.

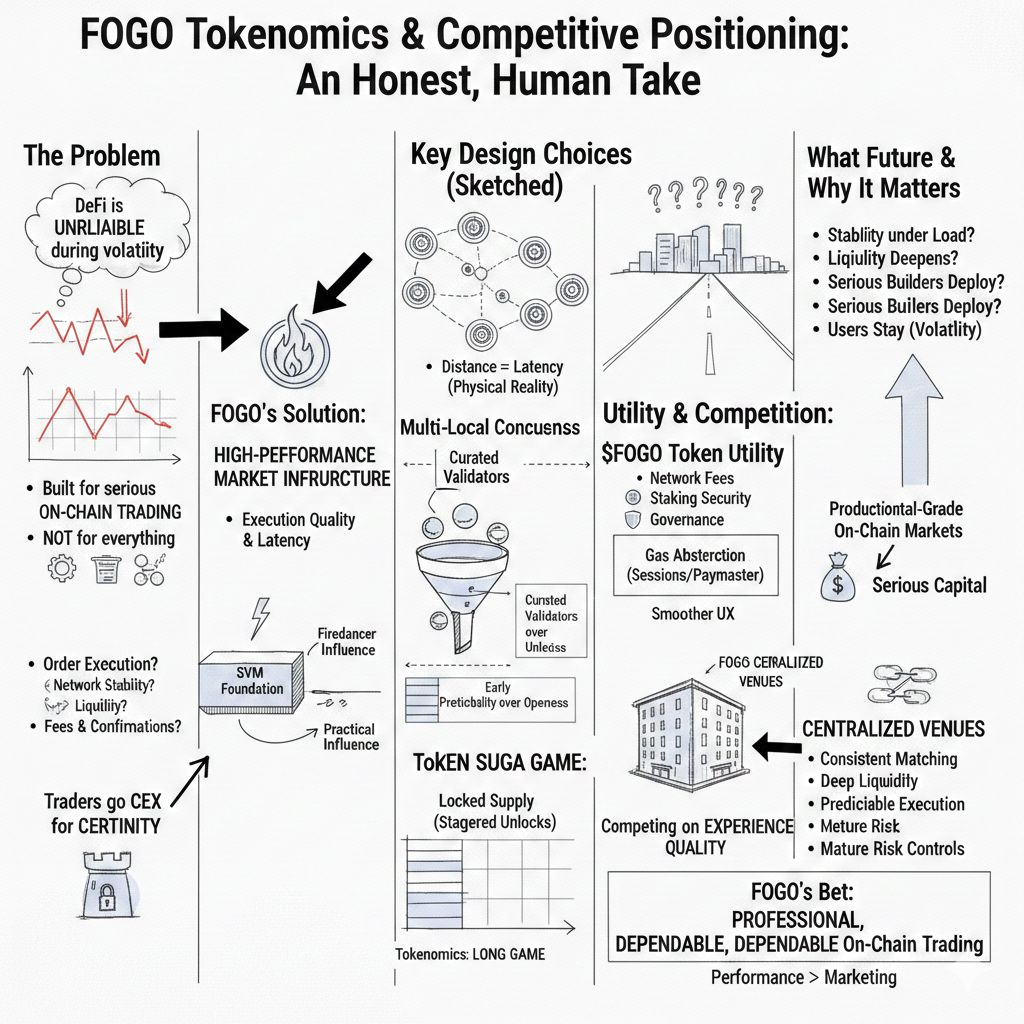

Not because it invented something completely new… but because it seems very clear about what it wants to be. Fogo is not trying to support every possible use case. It is positioning itself as high-performance market infrastructure — something built for serious on-chain trading.

That narrow focus shapes almost every design choice they’ve made.

The real problem Fogo is trying to fix

Let’s be honest about something many people don’t like to say out loud:

DeFi doesn’t usually lose because it’s decentralized.

It loses because, during volatile moments, it can feel unreliable.

Traders care about a few very simple things:

Will my order execute on time?

Will the network stay stable during spikes?

Will liquidity actually be there when I need it?

Will fees or confirmations suddenly behave strangely?

When markets get messy, many traders quietly move back to centralized platforms. Not because they love custody risk — but because they value certainty.

Fogo’s entire thesis seems built around this reality.

Built to perform, not to impress

One thing I respect about Fogo’s approach is that it doesn’t try to reinvent every piece of the stack just to sound innovative.

Instead, it builds on the SVM foundation and focuses heavily on execution quality and latency discipline. That tells me the team understands where the real bottlenecks usually appear.

The Firedancer influence

By leaning into a high-performance client approach, Fogo is clearly prioritizing raw execution efficiency. In trading environments, milliseconds matter. Small delays compound into real slippage and missed opportunities.

This is not flashy marketing — it’s plumbing work. And plumbing is exactly what serious market infrastructure needs.

Multi-local consensus: a practical compromise

The zone-based validator idea is one of the more interesting parts of Fogo’s design.

In simple terms, they are acknowledging a physical reality:

Distance creates latency.

Instead of pretending global distribution has zero cost, Fogo tries to keep active validator groups physically tight while still rotating responsibility over time.

Is it perfectly decentralized in the philosophical sense? Maybe not.

Is it practical for high-frequency on-chain trading? Very possibly.

This is one of those design decisions that shows Fogo is optimizing for real-world performance, not just theoretical purity.

The curated validator approach (why it’s controversial)

Another area where Fogo takes a firm stance is validator quality.

Most proof-of-stake networks talk about open participation, but in practice, high-performance validators already dominate many networks. Fogo is simply being more explicit about performance expectations.

From a trader’s perspective, this makes sense. If your infrastructure depends on ultra-fast confirmation, you cannot afford a large portion of nodes running underpowered setups.

From a decentralization purist’s perspective, this will always be debated.

Both views can be valid.

What matters is that Fogo is clearly choosing predictability over maximum openness, at least in the early performance phase

Tokenomics: designed for the long game

When I look at Fogo’s token structure, the biggest signal I see is restraint.

A large portion of supply is locked with multi-year vesting. Core contributors, advisors, and early participants don’t get immediate full liquidity. Unlocks are stretched across multiple years.

Why does this matter?

Because fast-unlock token models often create the same pattern:

1. early hype

2. early distribution

3. early sell pressure

4. long recovery phase

Fogo’s structure suggests the team is trying to avoid that exact cycle.

Of course, tokenomics alone never guarantees success. But the intent here appears to be long-term alignment rather than quick rotation.

Utility: more subtle than “just gas”

At first glance, $FOGO plays the familiar roles:

network fees

staking security

governance participation

But the interesting twist is the push toward gas abstraction through Sessions and paymaster-style flows.

If apps can sponsor user transactions, the experience changes dramatically. Users stop worrying about maintaining small gas balances. The product starts to feel smoother and more finance-like.

That shift may sound small, but UX friction is one of the biggest hidden barriers in on-chain trading today.

The real competition: not other chains

This is the part many people misunderstand.

Fogo is not really trying to beat every Layer-1 on paper metrics.

The real question is:

Can on-chain execution become reliable enough that traders stop defaulting back to centralized venues during stress?

Centralized platforms still dominate because they offer:

consistent matching

deep liquidity

predictable execution

mature risk controls

Fogo’s strategy looks like a direct response to that reality.

Instead of arguing ideology, it’s trying to compete on experience quality.

What needs to happen next

Right now, Fogo’s story is promising — but infrastructure projects always face the same test.

The market will eventually ask:

Does the network stay stable under heavy load?

Does liquidity actually deepen over time?

Do serious builders choose to deploy real trading products here?

Do users stay during volatility — or leave?

This phase cannot be rushed. It has to be proven in real conditions.

Why Fogo could matter

If Fogo executes well, it could help push the industry toward a very important shift:

From experimental DeFi

→ to production-grade on-chain markets

That transition is where the next wave of serious capital will likely pay attention.

But if performance slips, liquidity stays thin, or reliability falters under pressure, the market will quickly move on — because traders are extremely unforgiving.

Final thoughts

Fogo is making a focused bet.

Not on hype.

Not on being everything for everyone.

But on one difficult goal:

Make on-chain trading feel professional and dependable.

If they succeed, the conversation around where serious capital prefers to trade could slowly begin to change.

If they don’t, it will become just another fast chain that couldn’t hold attention.

The difference will not be marketing.

It will be performance when it matters most.