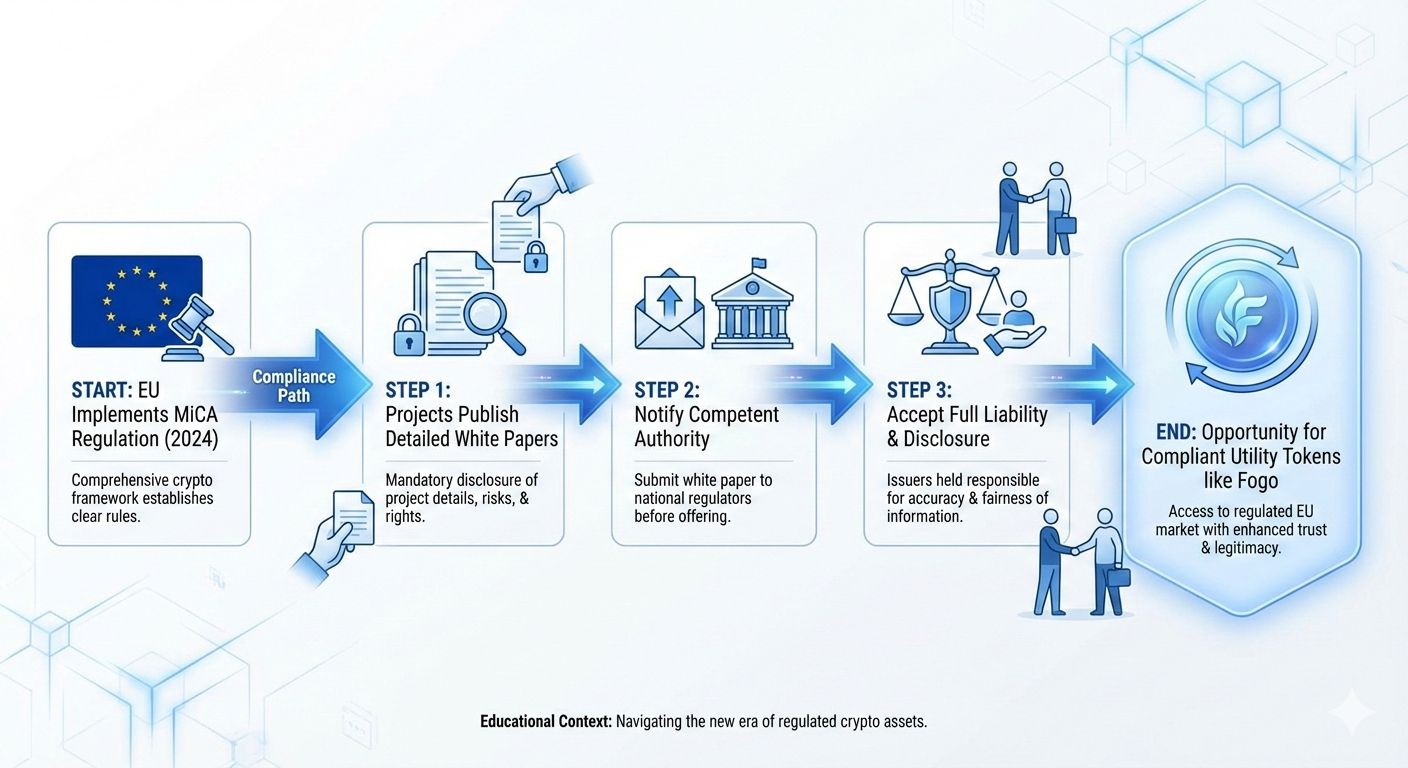

The European Union's Markets in Crypto-Assets Regulation (MiCA) has reshaped how crypto projects approach public offerings and exchange listings in the region. Since full implementation in late 2024, any project seeking to admit a crypto-asset to trading on EU or EEA platforms must publish a detailed white paper, notify a competent authority, and accept full responsibility for its contents. This creates a structured path for utility tokens while imposing strict disclosure, risk warnings, and liability rules.

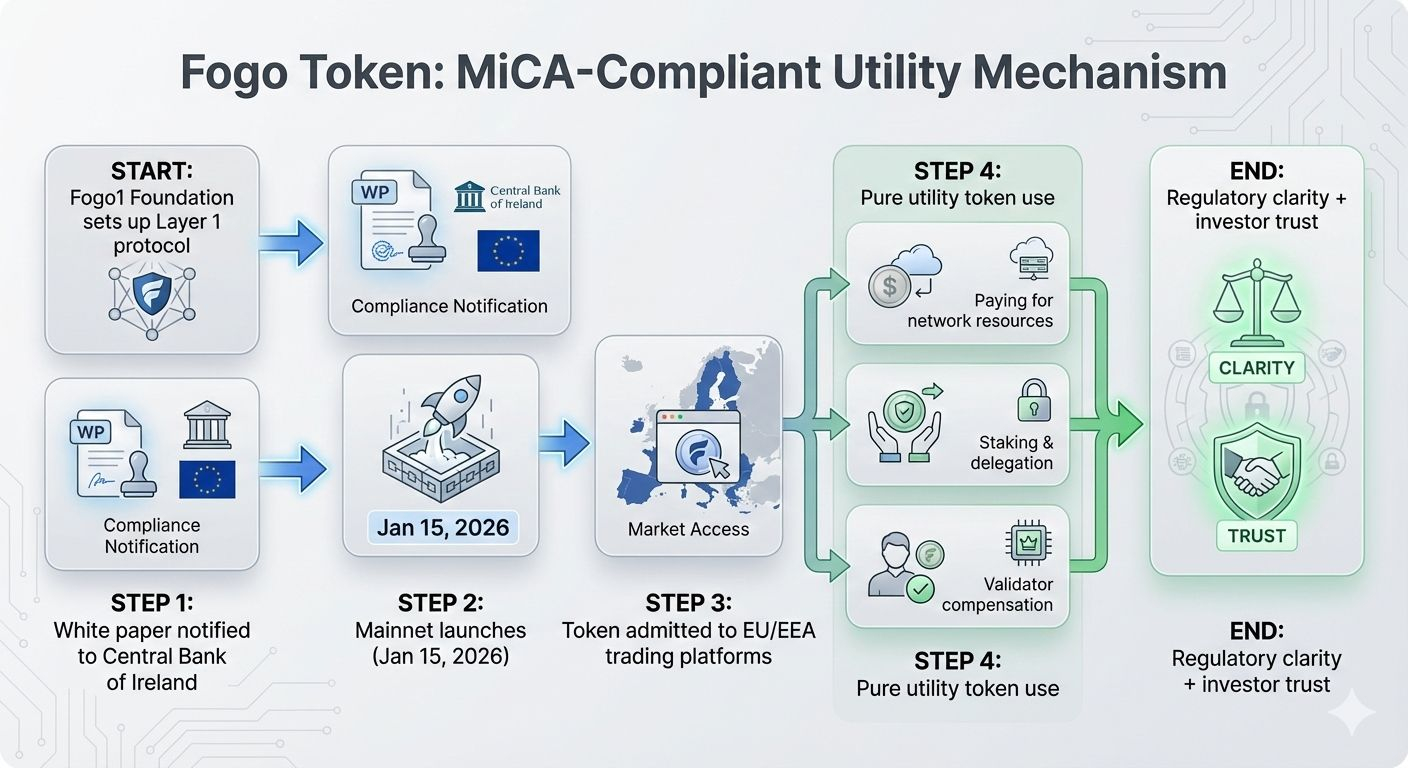

Fogo token (FOGO) stands out as one of the early projects to navigate this regime successfully. Its white paper was notified to the Central Bank of Ireland on October 22, 2025, paving the way for compliant admission to trading. By February 2026, with mainnet live since January 15, 2026, and the token trading on major exchanges, Fogo demonstrates how a high-performance Layer 1 can align technical ambition with regulatory clarity.

This article breaks down the MiCA-compliant aspects of the Fogo token white paper, explains the project's utility design, and explores why this structured approach matters for investors and builders in a maturing market.

What MiCA Requires from Crypto-Asset White Papers

MiCA (Regulation (EU) 2023/1114) mandates a white paper for asset-referenced tokens, e-money tokens, and other crypto-assets offered to the public or admitted to trading in the EU/EEA. The document must follow a standardized format covering the issuer (or person seeking admission), project details, rights/obligations, technology, risks, and sustainability impacts.

Key mandatory statements include:

No prior approval by any EU competent authority.

Sole responsibility of the drafter for content.

Compliance affirmation that the document is fair, clear, and not misleading.

Warnings that the asset may lose value, lack liquidity, or become non-transferable.

For utility tokens, explicit note that they may not be redeemable if the project fails.

The white paper must be published before any EU trading admission and notified to the relevant authority (here, Ireland as home member state). It enables passporting across the EU/EEA.

Fogo's white paper follows this template precisely, with sections labeled from 00 (Table of Contents) through Part J (sustainability indicators). This structured approach signals seriousness about compliance.

Who Stands Behind the Admission: Fogo1 Foundation

The entity seeking admission to trading is the Fogo1 Foundation, a Cayman Islands foundation company limited by guarantee without share capital. Registered address: c/o Highvern Cayman Limited, Elgin Court, Elgin Avenue, P.O. Box 448, George Town, Grand Cayman KY1-1106.

The Foundation was established as an ecosystem steward. It raised approximately $13 million in earlier funding rounds and holds about 39% of the initial token supply in treasury, alongside roughly $6.5 million in cash and stablecoins as of late 2025. Operating expenses since registration totaled around $7 million, mainly for development, marketing, and engineering.

Importantly, the white paper states the Foundation is not the issuer under MiCA. The protocol operates as a decentralized Layer 1 maintained by global developers, validators, and users. No single entity controls token creation in a way that qualifies as an "issuer" per MiCA's Recital 20 and Article 3(1)(5). This classification avoids certain issuer obligations while still requiring the white paper for trading admission.

The Token Itself: Pure Utility, No Securities Features

Fogo token (FOGO, commercial name often stylized as FOGO) is explicitly classified as a utility token. It provides access to the Fogo blockchain protocol without conferring ownership, equity, governance rights (beyond programmatic staking), profit sharing, or revenue entitlement.

Core utilities include:

Paying for network computational resources to deploy and execute smart contracts or interact with dApps.

Accessing data storage, compensating validators for state maintenance.

Staking by validators to secure the network and earn rewards.

Delegation by holders to validators for shared rewards.

The token launches fully functional—no phased rollouts or promised future features that could trigger additional scrutiny. All tokens admitted to trading are freely transferable, with no built-in restrictions noted beyond standard protocol mechanics.

This pure utility framing aligns with MiCA's distinction from asset-referenced or e-money tokens, reducing classification risks.

Admission to Trading Mechanics and Safeguards

The Foundation seeks admission on EU/EEA trading platforms (exact names and MIC codes listed in later sections, though specifics evolve post-notification). No public fundraising target, minimum/maximum goals, or oversubscription rules appear, suggesting no ICO-style raise tied to the white paper.

Key protections:

No early purchase discounts or time-limited offers mentioned.

Safeguarding arrangements for any offered funds/crypto (though limited given utility focus).

Payment methods via crypto or fiat through CASPs.

Right of withdrawal and refund mechanisms if applicable.

Conflicts of interest disclosures.

emphasizes that admission does not constitute a financial instrument offer. It is not a prospectus under Regulation (EU) 2017/1129.

Technology and Risks: Transparent Disclosures

The underlying technology builds on Solana's architecture but optimizes for performance:

Firedancer-based client for high throughput.

Multi-local consensus with zone-based colocation and dynamic rotation.

Proof of History, Tower BFT, and SVM compatibility.

Risk sections cover standard categories: admission-related, issuer-related (limited due to no issuer), crypto-asset volatility, project implementation, and technology failures. Mitigation measures include decentralized governance and audited components.

Sustainability disclosures address energy consumption under the consensus mechanism, with methodologies provided.

These disclosures fulfill MiCA's emphasis on fair, non-misleading information.

Mainnet Launch and Market Reality in Early 2026

Fogo's public mainnet launched January 15, 2026, following testnet phases. The token generation event coincided, with immediate listings on Binance (spot with Seed tag), OKX, Bybit, Bitget, Gate.io, MEXC, and others. A strategic token sale on Binance raised about $7 million at a $350 million valuation for 2% supply.

Performance claims include 40-millisecond block times and sub-second finality in colocated zones, enabling real-time DeFi like on-chain order books and precise liquidations. Early ecosystem includes Ambient perps, Valiant spot, FogoLend money markets, Brasa liquid staking (stFOGO), and integrations like Pyth Lazer oracles and Wormhole bridges.

As of mid-February 2026, circulating supply stands around 3.78 billion out of 10 billion total, with market cap fluctuating near $95-100 million and 24-hour volume in the tens of millions. Price has shown volatility post-launch, typical for new infrastructure tokens.

Token unlocks begin in September 2026 for advisors, institutions, and contributors, creating future supply pressure that investors monitor.

Why This Compliance Path Matters for the Broader Market

MiCA forces projects to choose: treat tokens as utilities with clear access rights or face securities-like scrutiny. Fogo's approach—decentralized protocol, no issuer, utility-only classification, detailed white paper—reduces delisting risk on EU platforms and builds trust.

For investors, it means transparent risk warnings: value can drop to zero, no investor compensation schemes apply, no deposit guarantees. This honesty contrasts with vague promises elsewhere.

For builders, SVM compatibility allows seamless migration of Solana tools, while low-latency design attracts high-frequency DeFi and trading apps.

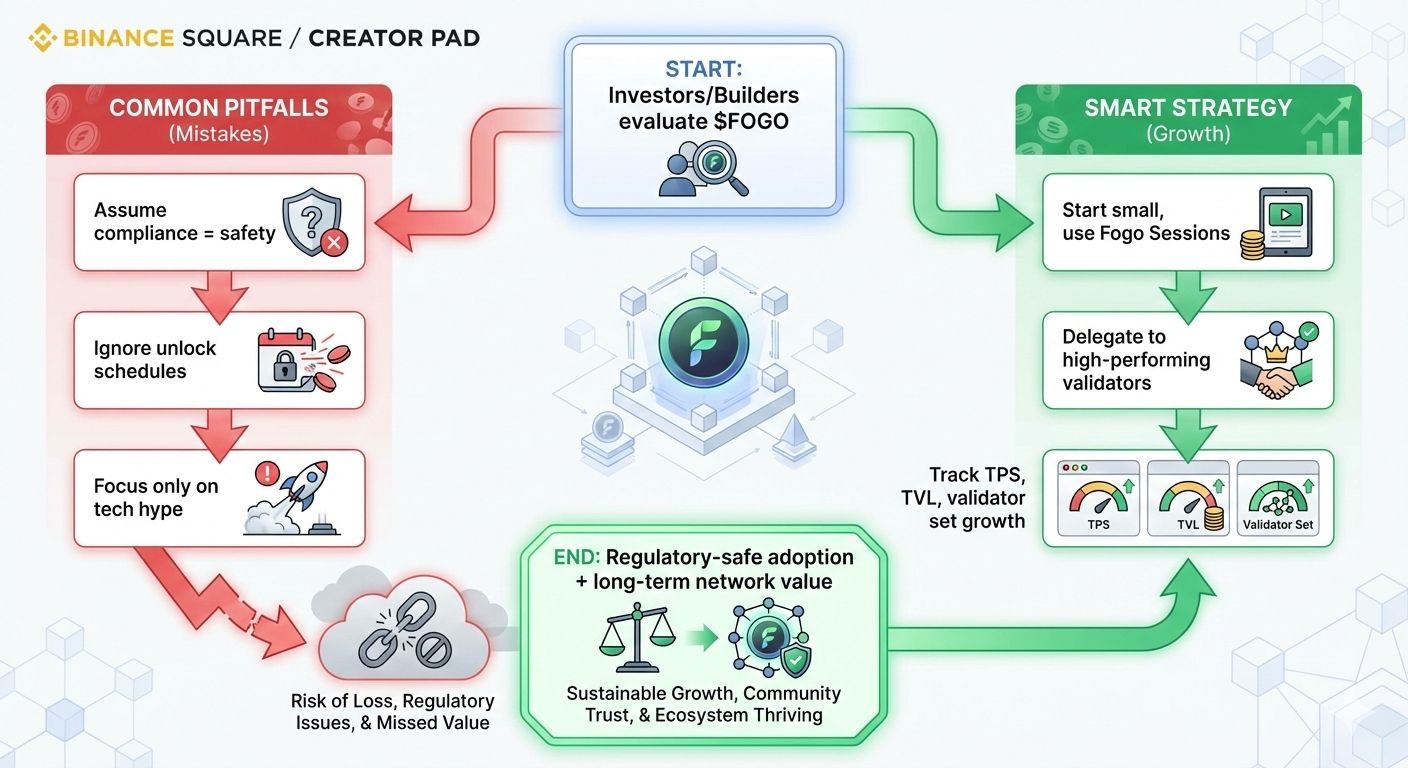

Common Pitfalls When Evaluating MiCA-Compliant Tokens

Assuming compliance equals safety — MiCA ensures disclosure, not success. Volatility, execution risks, and competition remain.

Overlooking the "no issuer" distinction — It limits certain liabilities but does not eliminate protocol risks.

Ignoring unlock schedules — September 2026 unlocks (advisors, team, institutions) could pressure price if adoption lags.

Focusing only on tech hype — Test real usage via Fogo Sessions (gasless, limited-permission interactions) to gauge UX.

Strategies for Engaging with $FOGO

Start small: Bridge assets, create a Fogo Session, interact with dApps gas-free within limits.

For staking: Delegate to high-performing validators; monitor zone rotations for temporary yield differences.

Long-term view: Track on-chain metrics like TPS under load, TVL growth in DeFi protocols, and validator set expansion.

Regulatory lens: MiCA compliance supports EU access, but global risks (e.g., US securities questions) persist.

Future Outlook: Execution Over Hype

Fogo's path forward hinges on sustaining claimed performance during global zone rotations, expanding the validator set without quality drops, and growing organic DeFi activity beyond speculation.

If it delivers consistent sub-100ms blocks and attracts volume to on-chain perps/DEXes, it could carve a niche in real-time finance. Token value ties directly to network usage (fees, staking demand).

The white paper's disclaimers remind everyone: this is high-risk infrastructure in an experimental space.

Fogo shows MiCA can enable innovation when projects prioritize transparency over shortcuts.