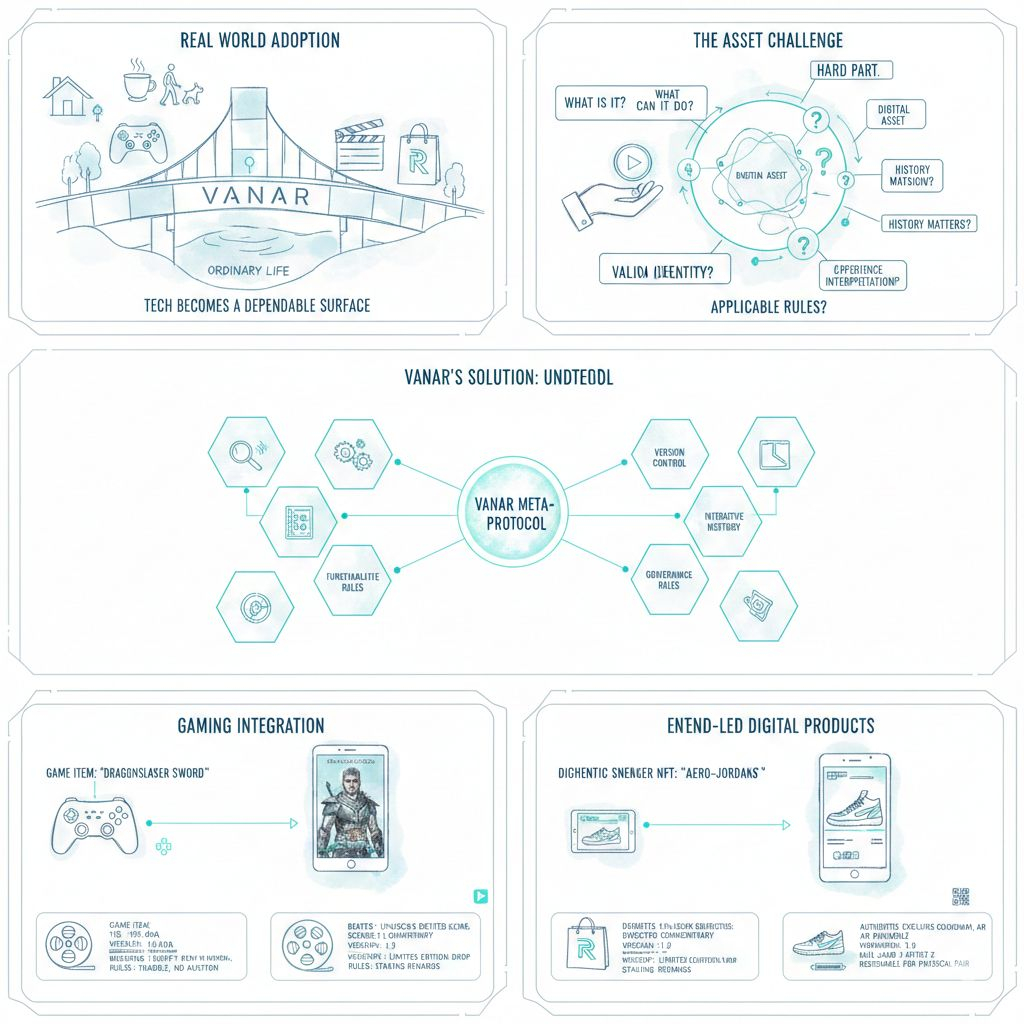

When people say “real world adoption,” they usually mean bigger numbers, more apps, louder partnerships. For me it’s simpler: adoption happens when the tech stops feeling like “tech” and starts feeling like a dependable surface you can build ordinary life on. That’s the lens I use for Vanar.

Most chains are excellent at moving value and recording ownership. But if you’ve ever been close to gaming, entertainment, or brand-led digital products, you know the hard part is not minting an asset. The hard part is keeping the asset understandable over time. What is it, what can it do, what version is valid, what history matters, what rules apply, and how do different experiences interpret it without rebuilding the same backend again and again.

That’s why Vanar catches my attention. It’s trying to turn “onchain” from a shoebox of receipts into something closer to a living archive. Not just proof that something happened, but enough context so the network can remember what that something means. Vanar itself frames this as an AI native stack with Vanar Chain at the base and layers like Neutron (semantic memory) and Kayon (reasoning) above it. I don’t treat those terms as magic words. I treat them as a design statement: the chain isn’t only about execution, it’s about memory and interpretation being normal parts of the system.

I also like checking whether the “boring reality” matches the narrative. The Vanar explorer shows a chain that isn’t just alive, it’s busy: 8,940,150 total blocks, 193,823,272 total transactions, and 28,634,064 wallet addresses. Those numbers don’t automatically prove mainstream adoption, but they do show a network that’s been stressed by real usage patterns, not just a quiet test environment.

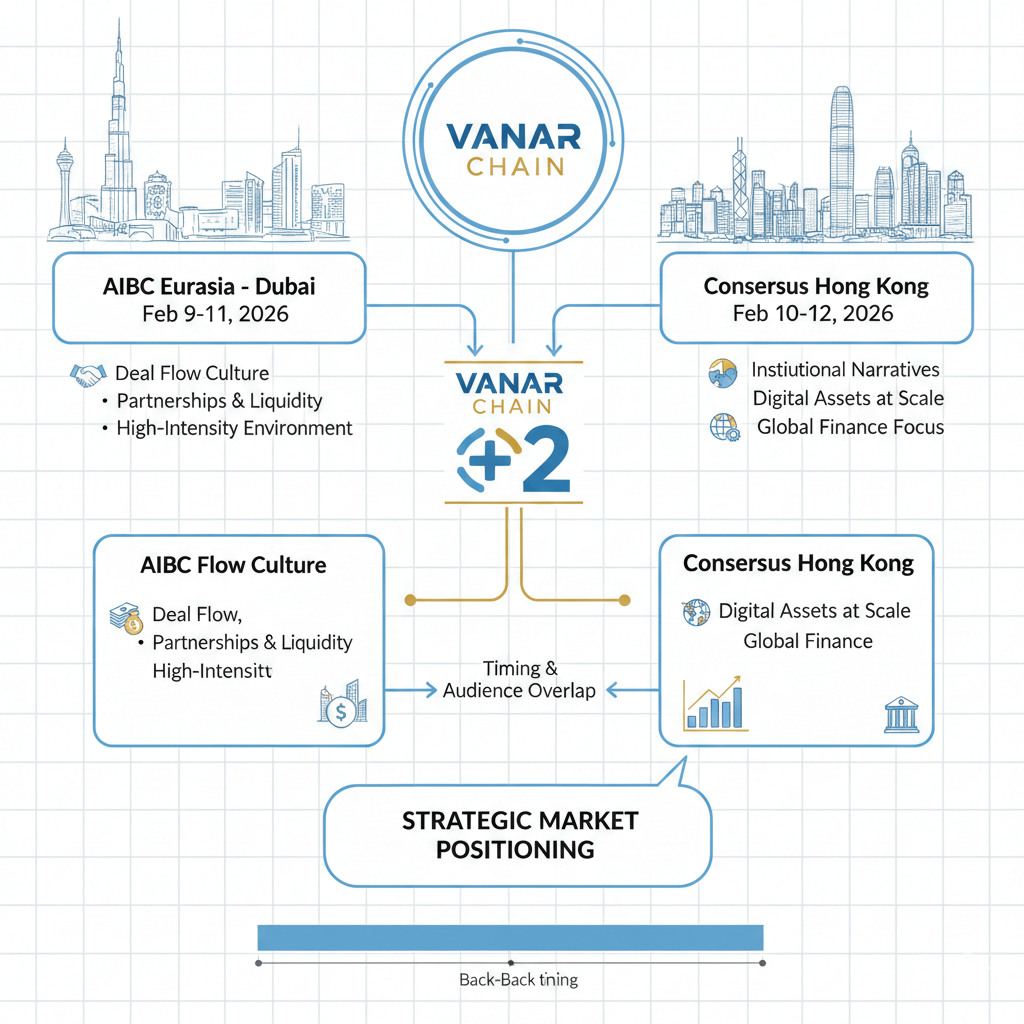

Now the latest update that matters, especially if you care about where Vanar is trying to place itself in the market: Vanar’s own events list shows it actively showing up in two very specific rooms in February 2026, back to back.

AIBC Eurasia in Dubai is listed for Feb 9 to 11, 2026.

Consensus Hong Kong is listed for Feb 10 to 12, 2026 at the Hong Kong Convention and Exhibition Centre, which CoinDesk also markets as a major institutional scale gathering.

What I find interesting is not the conference name-dropping. It’s the timing and the audience overlap.

Dubai is a proving ground for “deal flow culture.” People come to cut partnerships, source liquidity, and test whether a product can survive in a high intensity environment. AIBC Eurasia itself positions the Dubai stop as deal-driven networking, with programming hosted at Dubai Festival City venues.

Hong Kong is different. It’s where institutional narratives get sharpened. Consensus Hong Kong is explicitly framed as digital assets at institutional scale, with a huge international attendee mix and heavy finance representation.

Put those together and you get a clear signal: Vanar isn’t only trying to be understood by crypto native builders. It’s trying to be legible to two groups that decide whether “real world adoption” becomes real distribution.

First, the builders who ship consumer experiences. Games and entertainment teams don’t want ten new primitives. They want one reliable environment where identity, assets, and permissions can be carried across experiences without breaking. Vanar’s presence in a Dubai-heavy networking environment fits that. It’s where ecosystems often form around execution and distribution, not ideology.

Second, the allocators and enterprises who demand predictability. Institutions don’t care how poetic the roadmap is. They care whether systems can be audited, whether integrations are stable, whether the story makes operational sense. Consensus Hong Kong is exactly the kind of stage where “AI native” claims get tested against real questions: what is onchain, what is offchain, what is verifiable, what can be standardized, and what is actually deployable.

So the way I’d describe Vanar right now is this: it’s trying to become the chain you don’t have to babysit.

If you are building for mainstream users, you can’t ask them to learn your quirks. You can’t ask brands to accept unpredictable costs. You can’t ask game studios to rebuild context every season. A chain that wins those markets has to feel like infrastructure, not a science project. Vanar’s public direction, its onchain footprint, and the way it is positioning itself through Dubai and Hong Kong this month all point toward that same goal.

My takeaway is simple: Vanar is aiming to make onchain feel less like a transaction layer and more like a memory layer that consumer products can rely on, and the February 2026 conference schedule shows it is actively taking that thesis into the rooms where real distribution gets decided.