I used to treat DeFi composability like a pure convenience upgrade

Fewer clicks fewer approvals fewer hops and suddenly you have a position that would take ten steps on a centralized venue

Then I started paying attention to what happens when lending and trading snap together too tightly

The same financial Lego feeling can hide a hard truth

Small timing gaps can become solvency risk

The scary part is how quietly it happens

Your dashboard looks fine

Your health factor is green

But executable reality is already drifting away from what the risk engine thinks is true

My misalignment moment what I did and what I learned

I did a routine move that looked clean on paper

I deposited stablecoins into a lending market

I borrowed a volatile asset because I wanted to run a strategy

I traded that borrowed asset across spot and perps

I watched the UI and stayed calm because the health factor stayed green

Then a fast move hit

Not a slow trend a sudden wick type move

In that window I realized something uncomfortable

The oracle price still looked calm

The real tradable price had already slipped

Liquidators did not instantly jump because liquidation is a market and hedging gets expensive in chaos

And I was staring at my screen thinking

I was safe two minutes ago so where did this danger zone come from

That was the moment composability stopped feeling like a shortcut and started feeling like a responsibility

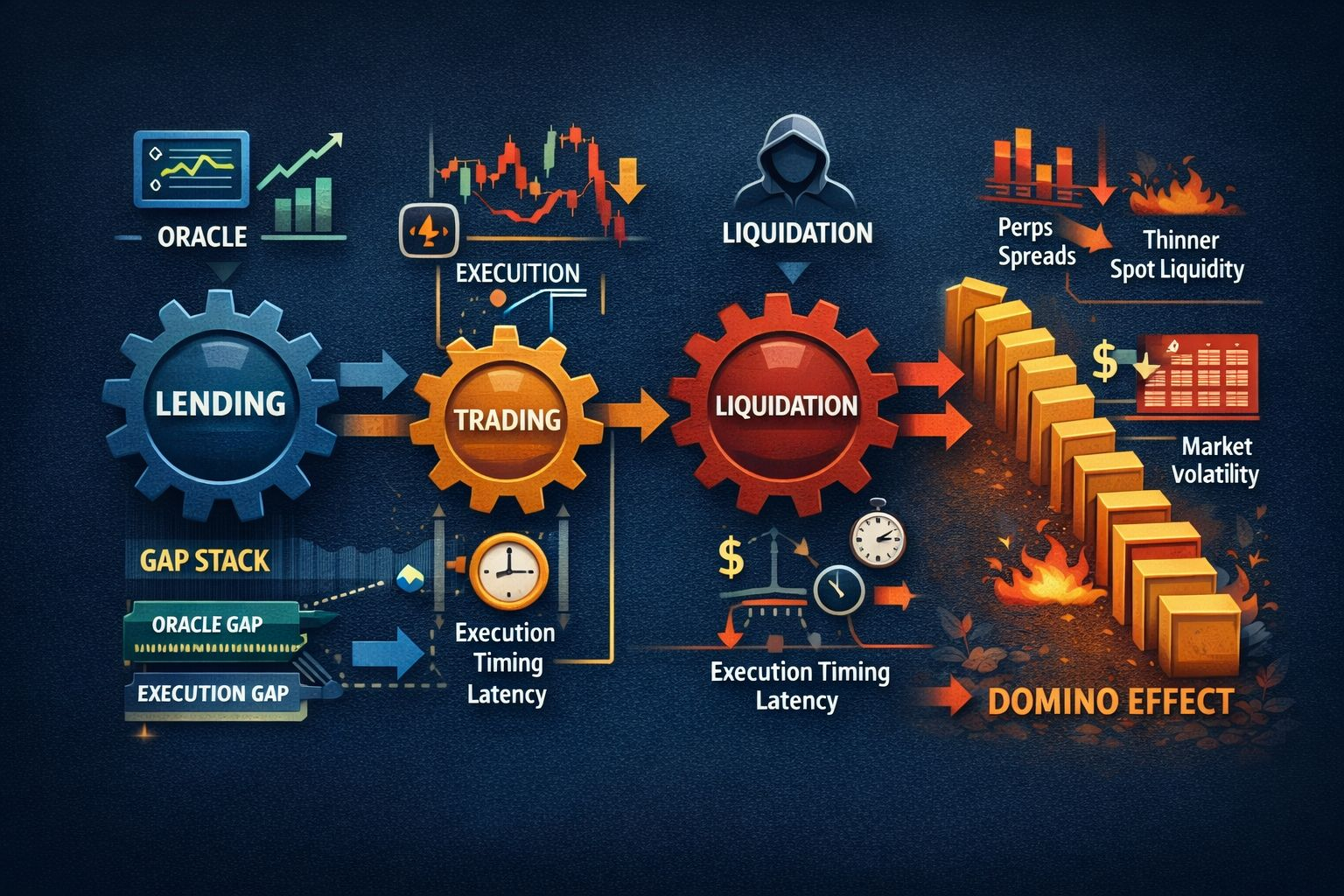

The real issue is not composability the real issue is the gap stack

When lending and trading are tightly integrated risk does not come from one place

It comes from small mismatches that stack up and activate together under stress

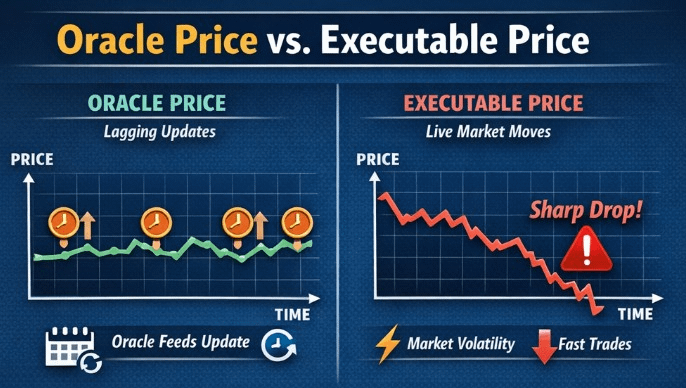

Gap one oracle price versus executable price

Lending systems rely on oracle prices to decide solvency

Trading systems fill you at the market price

In fast markets those two can diverge

Oracles update on their schedule

Markets move on their own schedule

So you can be safe on paper and unsafe in execution

That is how bad debt starts to form without anyone noticing immediately

Gap two execution latency versus liquidation latency

I used to assume liquidation is automatic

Threshold crossed liquidation happens

Reality is more human

Liquidation is a market

Liquidators need capital

They need a hedge

They need reliable fills

They need a margin of safety

When volatility spikes spreads widen and hedging gets costly

Liquidators hesitate

That hesitation stretches the window where a position can drift underwater

Gap three cross protocol domino effects

This is the one people feel only after they get hit once

Perps spreads widen

Spot liquidity thins

Collateral values drop

Liquidations spike

Forced selling increases volatility

Volatility makes liquidators demand higher incentives

And the whole system starts feeding itself

You think you are managing one position

But you are inside a network reaction

Why Fogo belongs in this conversation

Fogo is positioned as a trading first chain with very low latency and fast confirmations

In a lending plus trading world speed is not just about user experience

Speed can shrink some of the windows that create solvency risk

Faster settlement can reduce the time between a price move and a liquidation completing

That matters when markets move violently

But I want to be blunt

Speed helps

Speed alone does not guarantee safety

Safety depends on the rules built on top

Risk checks collateral factors caps oracle handling liquidation incentives circuit breakers

A fast chain can give builders better physics

Builders still have to write better rules

Three organic examples what I did what I learned

Example one the one click leverage illusion

I used a product that built the whole position in one clean flow

It felt addictive because it removed friction

Then I asked myself three questions

If the market wicks eight to ten percent what is the unwind path

Are there circuit breakers or does the strategy keep looping into stress

Who enforces borrow caps and exposure caps

That is when I learned

A smart interface is not the same thing as a smart risk model

Example two sessions make things smooth but permissions are a risk surface

I tested session style flows where everything feels gasless and frictionless

It feels like a web2 login experience

Then my security brain woke up

If permissions are too wide a small bug or edge case can create unintended exposure

So my personal rule became simple

Keep sessions short

Keep permissions narrow

Revoke when done

Example three health factor is not a liar it is often late

Health factor is not always wrong

It can be late in fast markets

I watched a health factor stay green while my execution prices got worse

That taught me a clean lesson

Health factor is a dashboard light

It is not the road itself

What safe composability actually means

If you combine lending and trading you need more than integration

You need seatbelts at every boundary

Seatbelt one risk checks at every boundary

Before borrowing

Before trading

After trading

Before looping again

Seatbelt two dynamic guardrails

Static parameters look fine in calm markets

They fail in stress

Good systems adapt to volatility liquidity depth and oracle behavior

Seatbelt three caps and circuit breakers

Max borrow per asset

Max leverage per account

Limits for correlated collateral

Limits on how fast exposure can grow in a short window

Slow mode or pause logic for extreme conditions

These are boring features

They are also what prevents death spirals

If I used lending plus trading composability on Fogo today what I would do

I would start small and scale only after observing real stress behavior

I would avoid using thin liquidity assets as collateral for leverage loops

I would treat health factor as an indicator not a guarantee

I would understand the oracle model and liquidation design before trusting it

I would use sessions only with tight scope and short duration

Because the lesson I learned the hard way is simple

In DeFi everything is possible

Not everything is safe

Closing

I still like composability

I just do not treat it like a shortcut anymore

I treat it like a seatbelt system

Fogo style trading first infrastructure can shrink timing gaps

But true safety comes from how lending and trading are stitched together with rules

One click is nice

One click with rules is survival