Whenever a new SVM-based chain shows up, the comparison to Solana is automatic.

It doesn’t matter how the project introduces itself. The architecture alone triggers the question. If it’s built around the Solana Virtual Machine, people assume it’s either trying to replicate Solana’s success or benefit from its momentum.

That’s the lens many are using when they look at Fogo right now.

And it’s not an unfair question.

Solana has already proven that high-throughput, parallelized execution can support real trading volume, consumer apps, and a culture that moves fast. The SVM narrative isn’t theoretical anymore. It has liquidity, developers, and real usage behind it.

So when Fogo enters the scene as an SVM chain, the immediate assumption is that it’s riding that wave.

The more interesting question is whether it’s doing anything beyond that.

There’s a difference between benefiting from a category’s growth and simply copying its surface traits.

Every successful ecosystem creates a halo effect. Ethereum did it for EVM chains. Solana is now doing it for SVM chains. Once an architecture proves itself viable, others adopt it sometimes to differentiate, sometimes to fragment, sometimes to specialize.

The key distinction is intent.

If Fogo’s positioning is primarily about speed benchmarks and throughput claims, it risks being measured directly against Solana’s existing performance. And that’s a hard comparison to win, especially against a network with deep liquidity and established developer tooling.

But if Fogo is leveraging SVM architecture to optimize for a specific behavior or niche, the equation changes.Architecture is a foundation, not a destination.

The SVM model favors parallel execution and low latency. That naturally aligns with high-frequency trading, orderbook-style applications, gaming engines, and real-time systems. Solana has demonstrated that these use cases can thrive under that design.

The question is whether Fogo is simply replicating that ecosystem or attempting to refine it.

New chains sometimes emerge not because the original design failed, but because certain trade-offs can be adjusted. Performance tuning. Governance differences. Economic design. Infrastructure layering. Incentive structures. Even cultural positioning.

In other words, building “something new” doesn’t always mean inventing a new architecture. It can mean changing how that architecture is deployed.

Right now, it feels like Fogo sits at an inflection point.

On one hand, it clearly benefits from the Solana wave. The SVM narrative has regained credibility. Traders understand the performance thesis. Developers are increasingly comfortable with Rust-based tooling. The market is receptive to high-throughput infrastructure again.

On the other hand, benefiting from a wave doesn’t guarantee differentiation.

Crypto has seen this pattern before. When EVM compatibility became the standard, dozens of chains emerged promising similar environments with minor tweaks. Only a handful built ecosystems that felt distinct. The rest blended into the background.

The same risk applies here.

If Fogo’s long-term identity is simply “another SVM chain,” then attention may be cyclical. It will rise when the Solana ecosystem is strong and fade when attention consolidates.

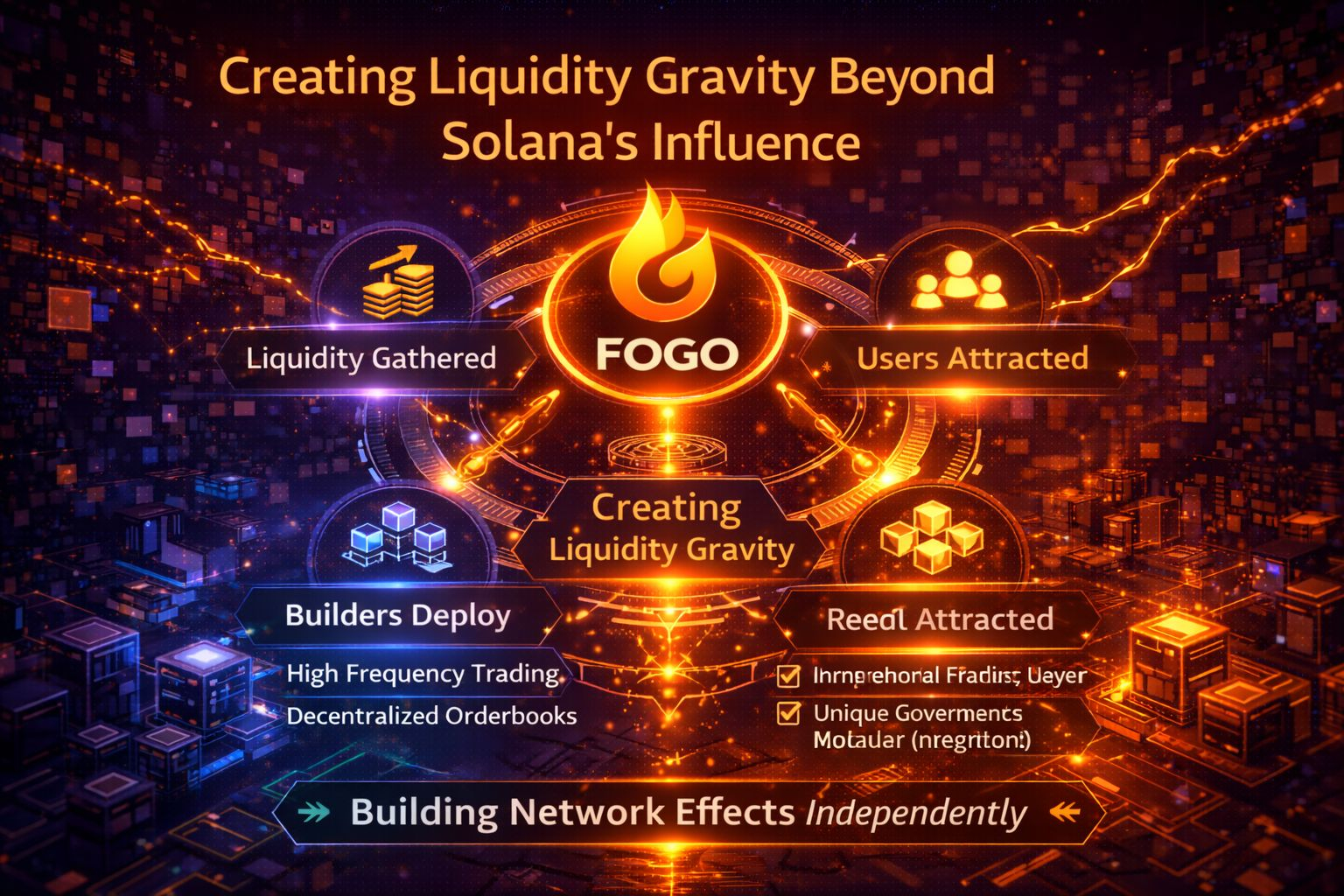

If, however, Fogo defines a clear use case whether that’s optimized trading infrastructure, specialized execution layers, modular integration, or something more vertical then it starts to build an identity separate from the wave.

Another layer to consider is liquidity gravity.Solana’s ecosystem benefits from network effects that are hard to replicate quickly. Builders deploy where liquidity exists. Liquidity flows where users gather. That loop reinforces itself.

For Fogo to avoid being perceived as just an extension of Solana momentum, it will need to create its own gravity either through standout applications, strong institutional alignment, or a developer culture that feels differentiated.

That’s not easy.

But it’s also not impossible.

Sometimes new infrastructure emerges because certain participants want slightly different trade-offs. Slightly different governance. Slightly different economics. Or simply a fresh environment that isn’t as saturated.

In that sense, Fogo doesn’t have to compete directly with Solana to be relevant. It just has to justify why its version of the SVM stack exists.

The market will eventually answer that.

For now, it’s fair to say Fogo is benefiting from a broader architectural shift. Interest in SVM-based systems has grown. Performance narratives are resurfacing. Traders and developers are paying attention.

The real test will be whether Fogo’s identity becomes dependent on Solana’s trajectory or independent of it.

If it’s riding the wave, that may be enough for short-term attention.

If it’s building something meaningfully distinct within the SVM category, that’s where durability begins.

At this stage, it’s too early to say which path it’s on.

But the distinction matters.

Because in crypto, waves pass.

Infrastructure either stands on its own or fades with the tide.