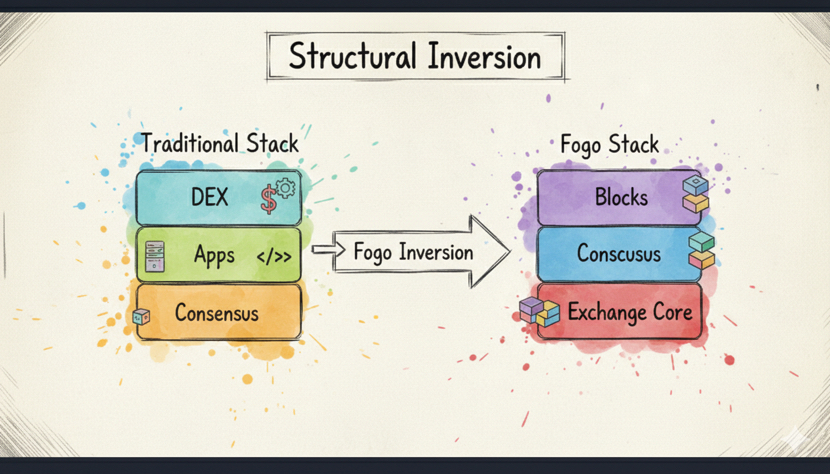

I tried to frame Fogo like every other L1 at first. Consensus layer. Execution layer. Applications on top. Markets forming later if liquidity shows up.

That framing kept breaking.

Because here, the exchange logic is not something deployed after launch. It is enshrined at the base layer. Matching is not a contract competing for blockspace. Native price feeds are not external attachments introducing timing drift. Liquidity is not scattered across isolated surfaces. The validator set itself is curated with execution quality in mind.

That changes what a block represents.

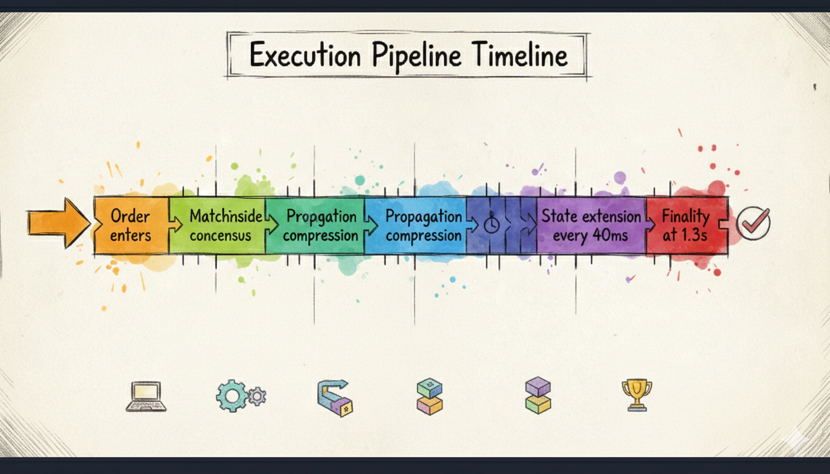

At 40ms cadence, the chain is not just advancing state. It is rotating a venue. Order submission, matching, propagation, and ledger extension move through one deterministic pipeline. Multi local consensus keeps the surface aligned. Turbine compresses the propagation path so convergence happens fast. At 1.3s finality, settlement is anchored without a soft intermediate phase where interpretation lingers.

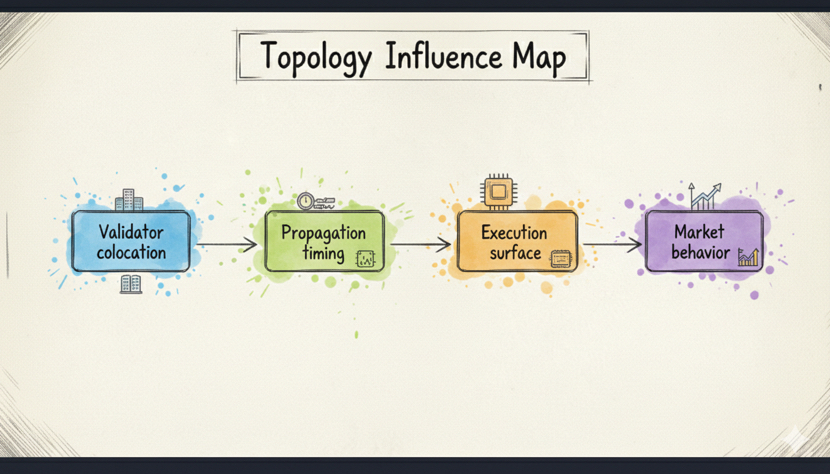

There is something less discussed.

If exchange infrastructure is embedded at consensus, neutrality becomes structured. Validator colocation is no longer just performance tuning. It shapes the physical topology where price discovery occurs. Geography influences execution timing. Execution timing influences participant behavior. The venue design sits inside protocol rules.

Most chains expose generic infrastructure and let markets self organize.

Fogo integrates the market into its base assumptions and lets blocks emerge from that design.

It does not feel like a blockchain hoping liquidity arrives.

It feels like a financial engine that decided what it is before anyone asked.