Early in 2026, Fogo has emerged as one of the most talked-about layer-1 blockchain projects in the Solana Virtual Machine (SVM) ecosystem, not because of flashy marketing but because of some thoughtful engineering choices and real world tests that are now transitioning into a live network. The project’s approach to consensus and validator geography stands out in a crowded field of high-performance chains, and it’s worth walking through what that means in plain terms.

At its heart, @Fogo Official was built with performance in mind. The team leaned into a single validator client implementation known as Firedancer designed for speed, rather than the usual model where many different clients must all work together. This simplifies coordination and reduces bottlenecks that often slow down other networks. The result is a chain capable of very fast block times and high throughput, bringing it closer to the latencies and responsiveness you’d expect in traditional financial systems.

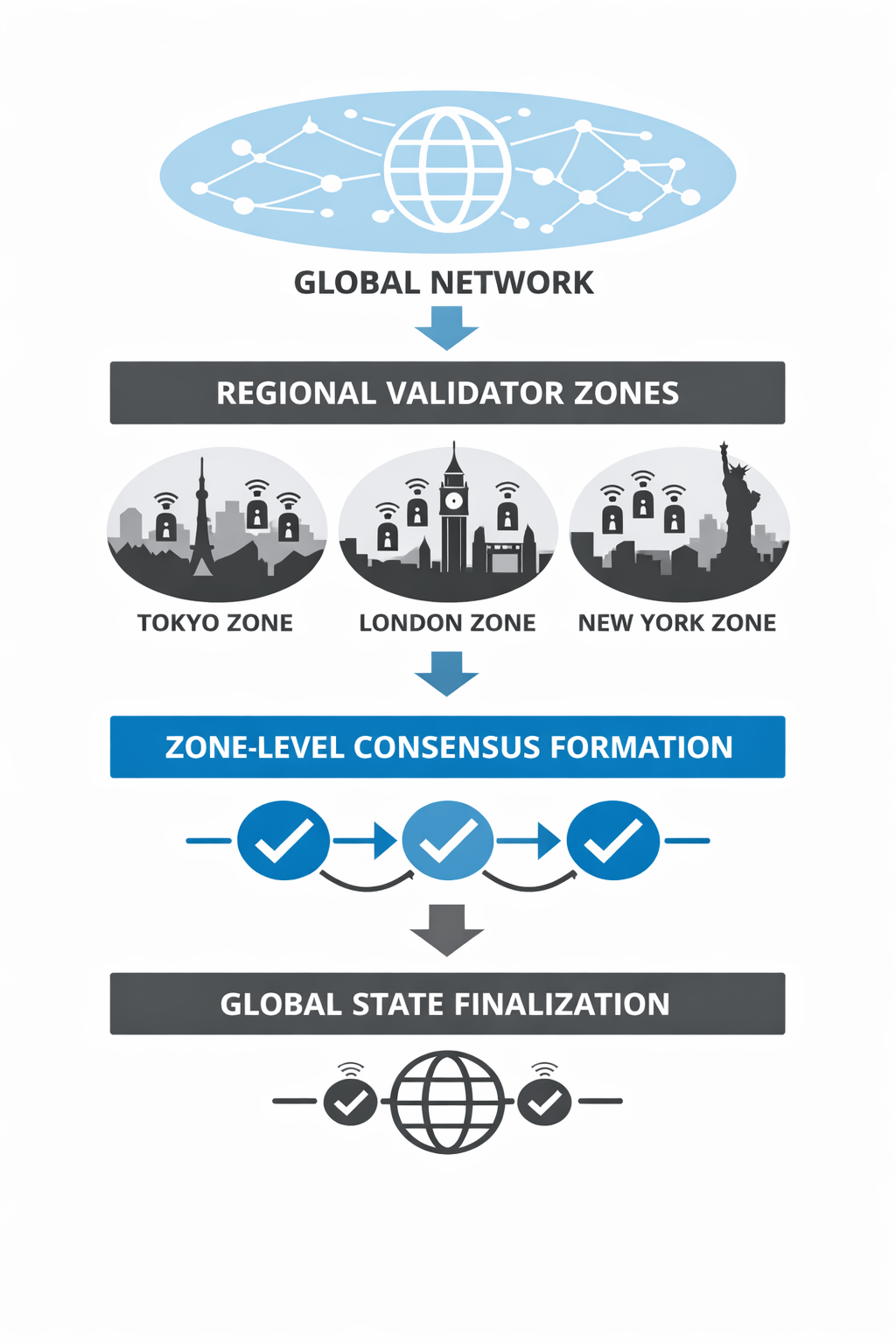

But raw speed isn’t the whole story. Fogo’s consensus model takes a different path from many blockchain protocols. Instead of one global process where every node everywhere helps decide the next block, Fogo uses what’s called multi-local consensus. Validators are grouped into geographic “zones.” These zones might be in cities like Tokyo, London, or New York. Within a zone, validators can communicate very quickly because they are close together in both distance and infrastructure. When it’s time to decide the next block, the network gives weight to the validators in the zone that’s most relevant at that moment.

The effect is a bit like having regional offices that take the lead when their markets are most active. For a chain focused on high-frequency trading and real-time finance, having consensus form quickly in the same region where traders are active can shave precious milliseconds off the time it takes to finalize a transaction. It’s a strategic layering of geography on top of blockchain consensus that tries to balance decentralization with latency.

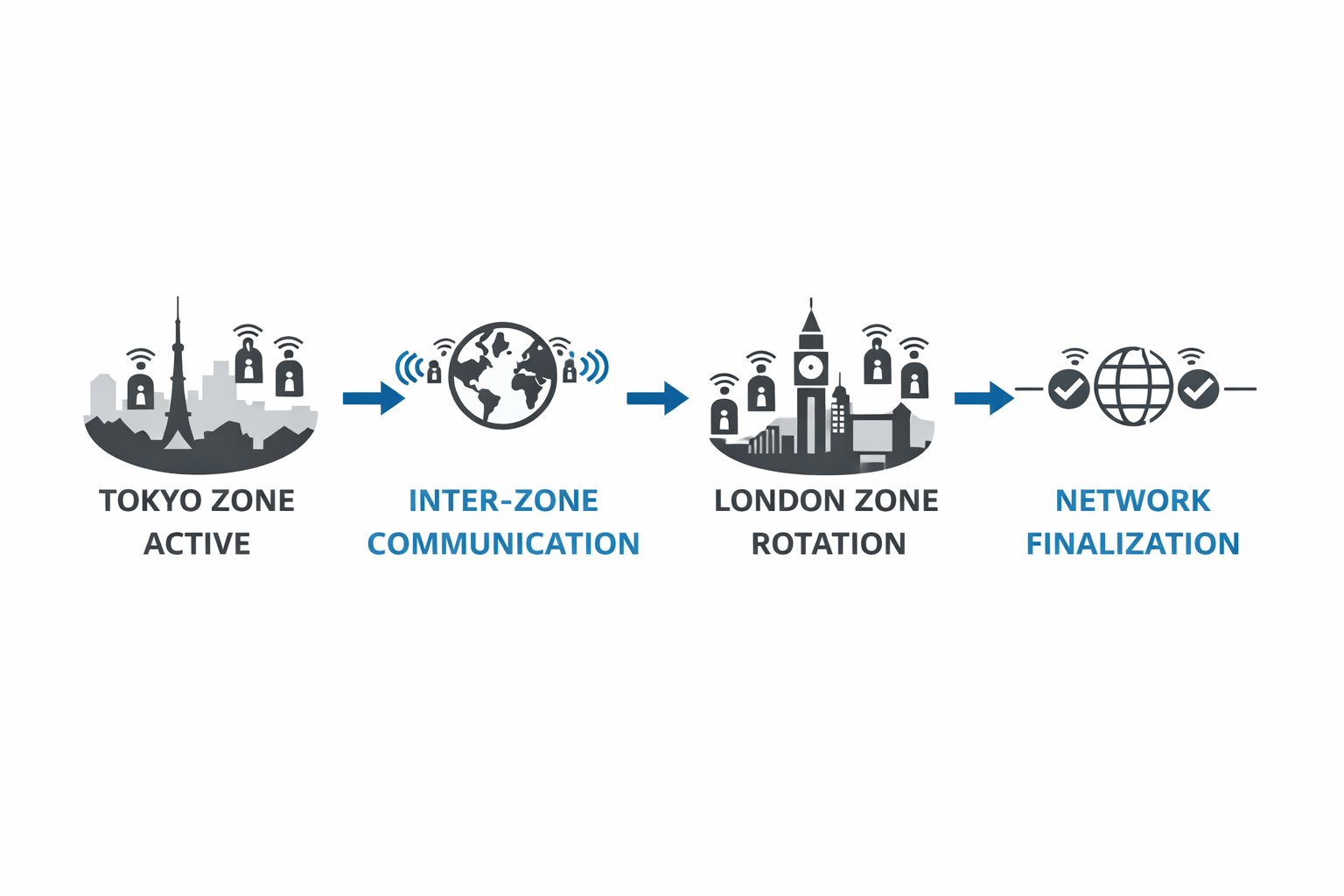

The Tokyo zone, in particular, illustrates both the promise and the challenge of this design. In mid-2025, during a testnet phase, the network experienced a significant halt when the Tokyo-London link became unstable. Network transitions between zones rely on tightly timed messages. When Tokyo’s connection lagged or dropped, validators couldn’t agree on the next step and the test network paused until engineers rerouted the consensus rotation. That incident lasted for more than 14 hours and underlined how delicate these cross-region handoffs can be.

This isn’t a reason to dismiss Fogo’s design, but it is a reminder that merging physical infrastructure realities with distributed systems introduces real engineering trade-offs. Any blockchain that leans on geographic co-location must contend with the vagaries of internet routing, undersea cables, and network latency in ways that purely abstract protocols do not.

More broadly, the network has now moved from testnet into a full mainnet phase, with block times around 40 milliseconds and ecosystem components like an integrated order book DEX gaining traction. But early adoption and liquidity are still in their infancy, and Fogo’s long-term success will depend on builders, traders, and other applications choosing to live and work on the chain. That’s a slow process, and it carries the same risks every emerging blockchain faces: volatile token markets, competing platforms that offer their own performance upgrades, and the need to prove out the technology under real economic pressure.

In a space where technical nuance often gets lost in slogans, Fogo’s geographic approach to consensus invites a grounded conversation about what performance means in a decentralized world. By anchoring parts of its network in specific locations and shifting leadership dynamically, it tries to respect both the physical and logical layers of blockchains. Whether that balance pays off will unfold over the months and years ahead, shaped by real usage, reliability under stress, and the broader growth of on-chain finance.