My group chat is basically a casino with notifications

Someone is always up only

Someone is always early

Someone is always posting a chart like it is a birth certificate

Last night one guy dropped a screenshot and wrote Dinner paid

Another replied Bro I did 12x in two days

And then someone tagged me like Yasir say something smart

The problem is I was not looking at their coins

I was staring at Vanar

A chart so calm it almost feels disrespectful in a market that runs on adrenaline Low volume Flat price No fireworks

And that is exactly why I clicked deeper

Because when something is not performing for the crowd it forces a different question

Is it quiet because it is broken or quiet because it is being misunderstood

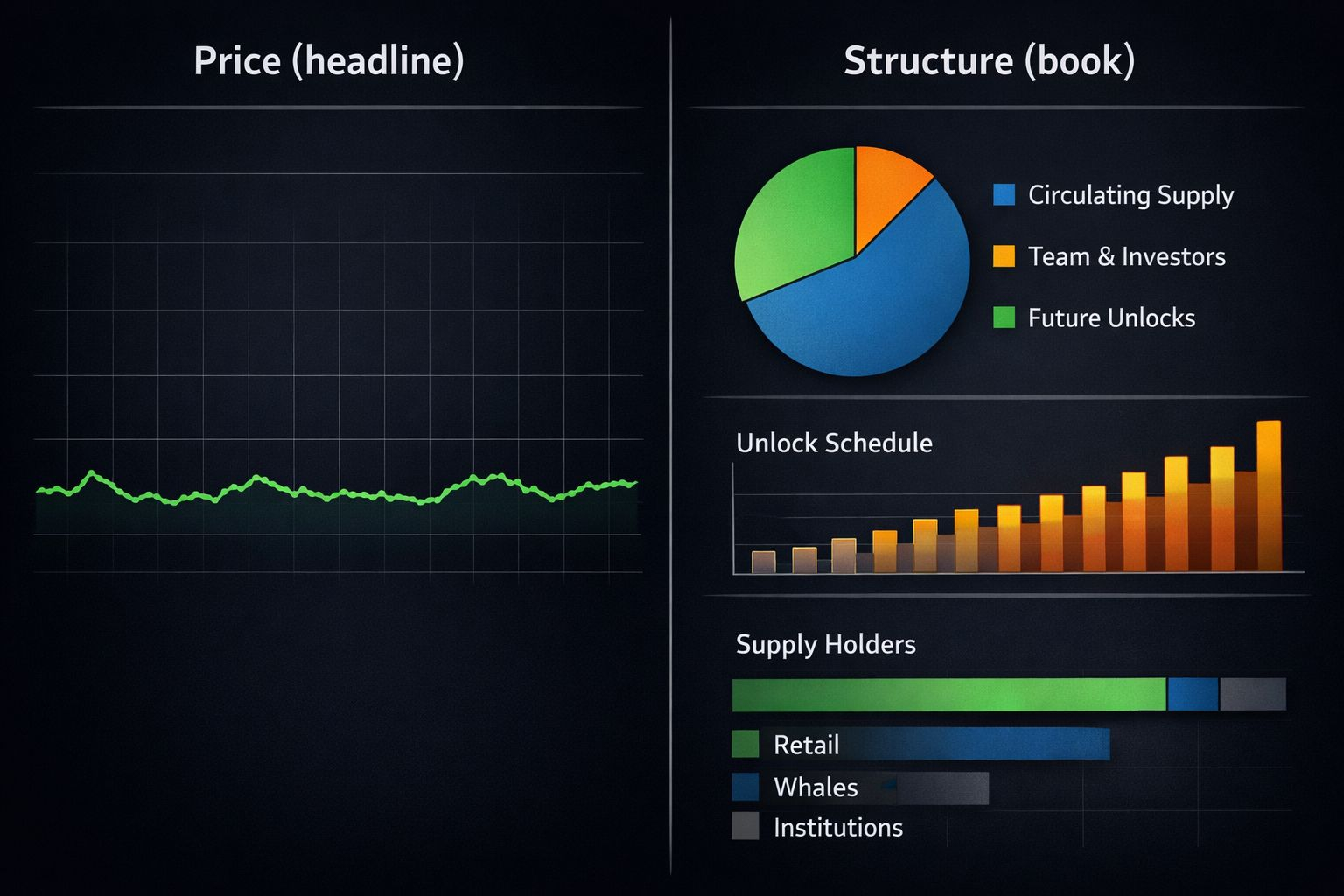

Forget the price Look at the structure

I know how this sounds

In crypto fundamentals is usually what people say after they are down 60 percent It becomes a coping mechanism A hoodie you throw on when the weather changes

But I am not using fundamentals as therapy

I am using them like a flashlight

So I told myself forget price for a moment look at distribution and structure

Price is a headline

Structure is the book

When I am looking at a token I am not asking Can this pump first

I am asking

Who is sitting on supply

Who got in cheap and is waiting to unload

Is the market being held hostage by future unlocks

Or is it mostly voluntary buying and selling

With Vanar VANRY I am not going to pretend I have a perfect view of every unlock and allocation detail in real time Without a verified current schedule in front of us that would be storytelling not analysis

But from what I can see from public info and the way the chart behaves it does not feel like the usual trap setup

It does not feel like a token being pushed uphill while someone waits at the top to dump

And I do not say that lightly

Honest markets are rare in crypto

Most charts are not markets They are negotiations between insiders and retail

A boring chart can sometimes mean there is less manipulation because there is less attention

That does not make it a winner

It just makes it worth studying

The SaaS thought that will not leave my head

Here is the mental shift that made Vanar click for me

Some tokens are basically lottery tickets

You buy them because you believe somebody else will buy them higher That is it No shame that is the game most people are playing

But infrastructure tokens if they are real should work more like a business model than a meme

That is where the SaaS analogy comes in

A good SaaS company does not need to trend every day

It needs usage

It needs renewals

It needs customers who keep paying because the product quietly solves something annoying

Think about what people actually pay for in real life

Spotify because silence is awkward

Google Drive because chaos is expensive

AWS because building servers is pain

Nobody screams to the moon about those subscriptions

But those subscriptions build empires

So when I look at chains like Vanar I am trying to see if the logic is closer to

Own a piece of infrastructure demand

rather than

Buy something and hope Twitter adopts it

Fees services reliability predictable costs these are not sexy words

But they are the words businesses live by

If the token is tied to usage the chart is just a lagging indicator

The part traders do not like it is not fun yet

Now let me be honest in the most human way

If you are a trader looking for dopamine Vanar can feel like watching paint dry in a quiet room with no WiFi

When I peek at a chain I do not need it to be exploding But I do look for life

Transfers Contract deployments Real interactions Signs that something is being built or used

And if what you find is minimal visible dApp activity limited contract interactions and not much noise that is not a side note

That is the main obstacle

This is why the market shrugs

Because there is no obvious DeFi casino

No farm this loop that borrow against your soul

No endless incentive games that turn a chain into a slot machine

Traders hate chains without entertainment

Because entertainment creates volume Volume creates charts Charts create attention

Vanar does not currently scream come gamble here

Which is either a flaw

or a choice

Some chains chase users Some chains wait for customers

And those are two different universes

Pattern recognition not prophecy

I am careful with comparisons because crypto loves lazy analogies

But I will still say this I have watched enough networks to recognize the rhythm

A lot of chains look irrelevant before they look obvious

Polygon had a phase where people treated it like a side quest

Fantom had long stretches where it did not feel main character

Even strong infrastructure often has a quiet period where the builders are working and the crowd is bored

I am not claiming Vanar will repeat that path

I am saying the sequence is familiar

Capability then builders then apps then users then attention

The crowd wants to skip to the last step

Reality does not

What gives it credibility and what I refuse to exaggerate

When I try to judge Vanar as infrastructure I look for product thinking

Predictable fee design or at least an intention to reduce fee chaos

Reliability as a feature not a wish

Enterprise friendly modules and workflows

The kind of boring decisions that only make sense if you want real adoption

On partnerships and integrations I am not going to hype anything I cannot verify

If it is confirmed from primary sources I will call it confirmed

If it is only reported then it is reported

Crypto marketing loves to turn we talked into we partnered

I would rather sound less exciting and stay accurate

Credibility is not what you claim It is what survives scrutiny

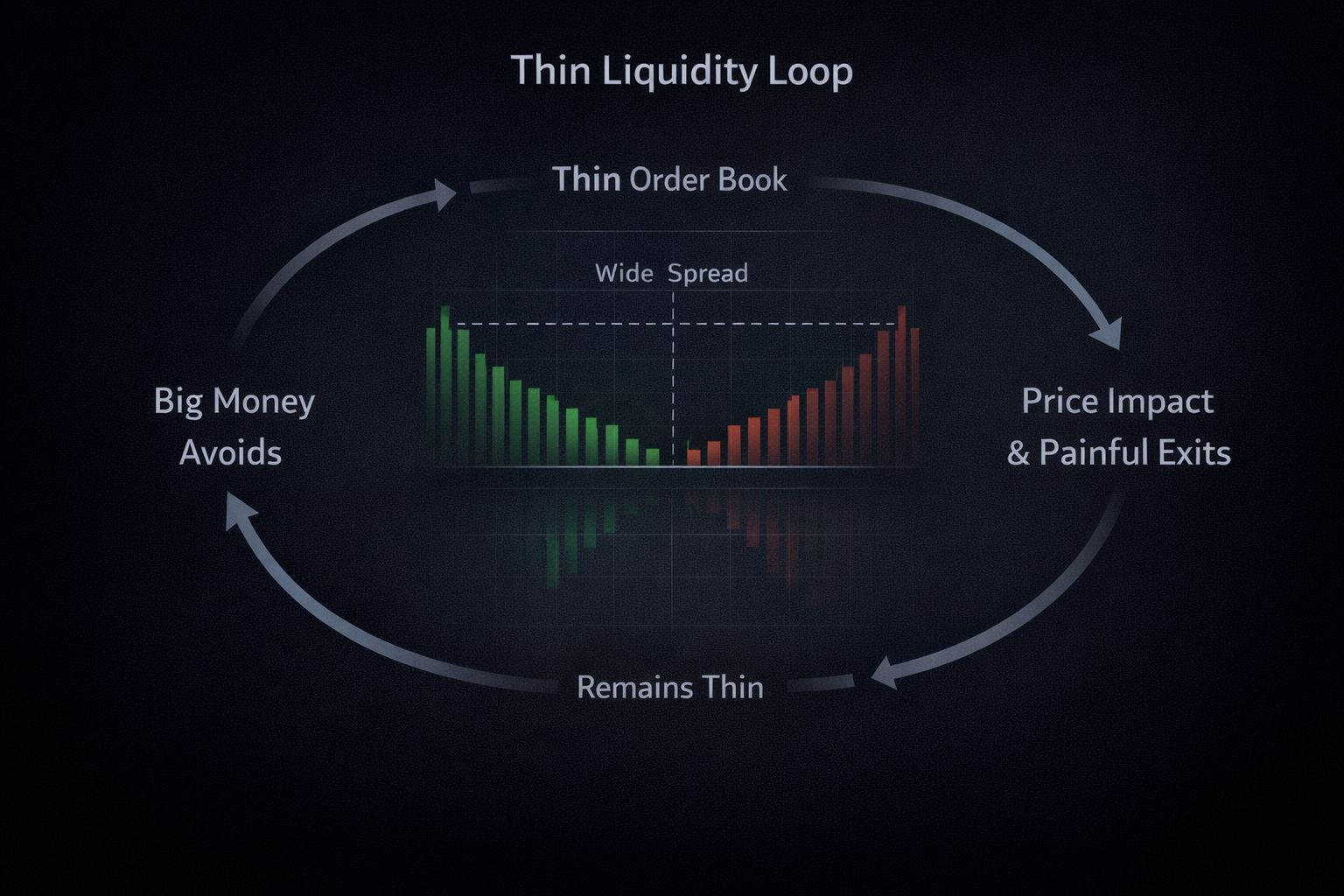

The biggest risk is not tech It is liquidity

Let us talk about the risk that can humble any thesis

Thin liquidity

Thin order books mean

Wide spreads

Price impact

Painful exits

A chart that jumps on small flows

And then you hit the loop

Big money avoids thin markets because they cannot move cleanly

Thin markets stay thin because big money avoids them

It is a real trap

Not a scam trap A structure trap

You can be right about the long term story and still suffer in the short term reality

And opportunity cost is real

Patience has a price tag

The macro shift I keep betting on

Here is the bigger thing I believe quietly stubbornly

Crypto is moving toward rails whether the meme crowd likes it or not

Businesses do not choose rails based on vibes

They choose rails based on friction

Predictable costs Compliance compatibility Reliability UX stability

The future winners will reduce friction until using the chain feels like using software not doing crypto

And that is why this whole thing keeps circling back to one idea for me

We are entering a friction economy

The chains that feel boring today might be the ones that fit tomorrow

Not because they pump

Because they work

How I package this trade in my head

Downside

Illiquidity can punish you

Adoption can move slower than your ego

Ecosystem growth might take longer than your attention span

You may miss faster opportunities elsewhere

Upside

If real usage arrives narrative changes quickly

If infrastructure demand grows value can compound quietly

Being early in boring can be a feature not a bug

I do not treat VANRY like a lottery ticket

I treat it like one fundamental position inside a portfolio that accepts crypto is still volatile and weird

Not a moonshot A systems bet

Poetic close because it is true

My group chat will keep chasing fireworks

And honestly sometimes fireworks pay

But I cannot unsee what I have learned from markets

Most people arrive when the road is crowded

Few people walk when it is empty

And sometimes the empty road is empty because nothing is there

But sometimes the empty road is empty because the city has not been built yet