There’s a habit in crypto that feels harmless but is actually dangerous.

We benchmark chains by peak numbers.

Max TPS.

Lowest latency.

Fastest confirmation.

But peak throughput is not resilience.

And on a parallel SVM chain like Fogo, resilience is the real stress test.

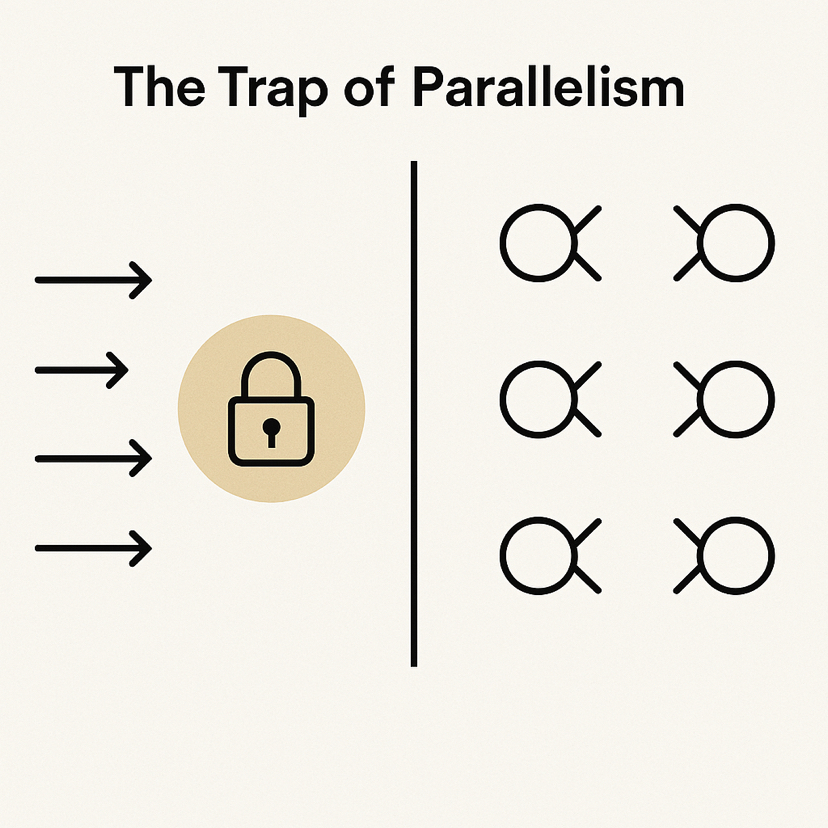

Because parallel execution doesn’t just reward independence.

It punishes correlation.

Here’s what I mean.

Most apps don’t fail under light load.

They fail under correlated load.

Volatility spikes.

Users rush the same function.

Everyone touches the same market.

Suddenly, independence disappears.

Even on a chain capable of processing independent transactions simultaneously, correlated access patterns force serialization.

And serialization under stress feels like failure.

This is where Fogo becomes brutally honest.

If your system routes every hot action through a shared writable account, it doesn’t matter how parallel the runtime is.

You created a single point of contention.

Parallelism only exists when transactions don’t fight over the same state.

And in real markets, users often want the same thing at the same time.

That’s the trap.

Designing for independence during calm periods is easy.

Designing for independence during correlated surges is hard.

I’ve started thinking about parallelism less as “can two random transactions run together” and more as:

Can two highly similar, high-frequency transactions avoid colliding?

Because that’s where real-world stress lives.

Two unrelated users minting NFTs? Easy.

Thousands of traders hitting the same pool during volatility? That’s reality.

If the pool logic mutates one global state object, the runtime will serialize them.

If the accounting model forces shared writes for fee tracking or liquidity updates, serialization intensifies.

Throughput charts won’t save you.

State layout decides your ceiling.

This is why I respect Fogo’s design constraints.

It doesn’t abstract state behind an opaque model.

Accounts are explicit.

Read and write sets are declared.

Conflicts are structural, not accidental.

That forces developers to confront correlation risk early.

Not after mainnet chaos.

Most builders optimize for feature completeness first.

Then they think about performance.

On an SVM environment, that sequence is backward.

Performance is a function of structure.

If you don’t design for isolated write paths from day one, you’ll end up refactoring under pressure.

And refactoring under live liquidity is a nightmare.

There’s another dimension people miss.

Shared state isn’t just a performance issue.

It’s a strategic vulnerability.

If one hot account becomes the bottleneck, it becomes the target.

Attackers don’t need to break the chain.

They just need to congest your choke point.

Spam the hot write path.

Exploit correlated behavior.

Force serialization.

Now your “fast chain” app feels unusable.

Not because the chain failed.

Because your architecture concentrated risk.

Resilience on Fogo is not about redundancy.

It’s about dispersion.

Dispersion of state.

Dispersion of write access.

Dispersion of contention zones.

If one component overheats, the rest should continue unaffected.

That’s true parallelism.

Not theoretical concurrency — practical independence under stress.

I think the market underestimates how rare that is.

It’s easier to centralize logic.

Easier to keep one authoritative state object.

Easier to update global metrics inline.

But ease creates fragility.

And Fogo’s runtime makes fragility visible faster than slower chains ever would.

The irony is that the more capable the chain becomes, the less forgiving it is of bad design.

High throughput environments magnify architectural mistakes.

They don’t compensate for them.

So the real edge on Fogo won’t belong to teams with the flashiest features.

It’ll belong to teams that model conflict patterns honestly:

Where will users collide?

Which accounts become hot?

What must truly be shared?

What can be isolated?

Those questions determine whether your app scales gracefully or collapses under its own success.

Throughput is easy to market.

Resilience is harder to build.

Fogo doesn’t guarantee either.

It simply makes the difference impossible to ignore.

And in crypto, that kind of honesty is rare.