Understanding why VANRY’s price rises or falls isn’t just about luck or hype—it’s rooted in a set of interconnected factors that any savvy trader or long-term holder should watch closely. Whether you’re new to Vanar Chain or looking to deepen your analysis, here’s an expanded look into the real drivers behind VANRY’s price movements, with added insights to help you get ahead of the curve.

1. Real Ecosystem Utility and User Adoption

The core of any blockchain project’s value is real-world usage within its ecosystem. For Vanar Chain, tangible growth shows up in the form of new decentralized applications (dApps), partnerships in gaming and NFTs, and a steady rise in the number of active wallets and on-chain transactions. VANRY isn’t just a speculative asset—it fuels transaction fees (gas), staking, and governance. Sustained or accelerating on-chain activity usually signals healthy demand, which can support upward price pressure. Conversely, if network activity stagnates or declines, it may indicate waning interest or competition from better alternatives, putting downward pressure on the price.

Pro tip: Go beyond official press releases. Dive into blockchain explorers and analytics dashboards to track daily active users, transaction counts, and smart contract deployments. These hard numbers often reveal the true health of the ecosystem well before headlines catch up.

2. Token Supply Dynamics and Tokenomics

Price is always affected by supply and demand mechanics, but in crypto, tokenomics can make or break a project. Monitor the circulating supply closely: major unlock events or the end of vesting schedules can flood the market with newly available tokens, often triggering short-term price drops as early investors take profit. On the other hand, mechanisms like token burns, staking lockups, or innovative deflationary models can reduce available supply, acting as a tailwind for price appreciation.

Advanced tip: Study the token release schedule and distribution breakdown. Are the team and early investors locked in for years, or are large portions about to come into circulation? Watch how much is staked or burned relative to total supply—these are strong signals for future price action.

3. Exchange Listings and Liquidity Developments

Where and how VANRY can be traded plays a huge role in its price dynamics. Major exchange listings—especially on platforms with global reach like Binance or Coinbase—can dramatically boost visibility and liquidity, drawing in fresh capital and triggering price surges. Similarly, the creation of new trading pairs or liquidity pools can lower slippage and make it easier for both retail and institutional investors to enter or exit positions, increasing both trading volumes and price volatility.

Insider’s angle: Not all listings are equal. Listings on high-volume, trustworthy exchanges tend to have a much more significant impact than obscure or low-liquidity platforms. Also, watch for integrations with decentralized exchanges (DEXs), which can open up new user bases and cross-chain opportunities.

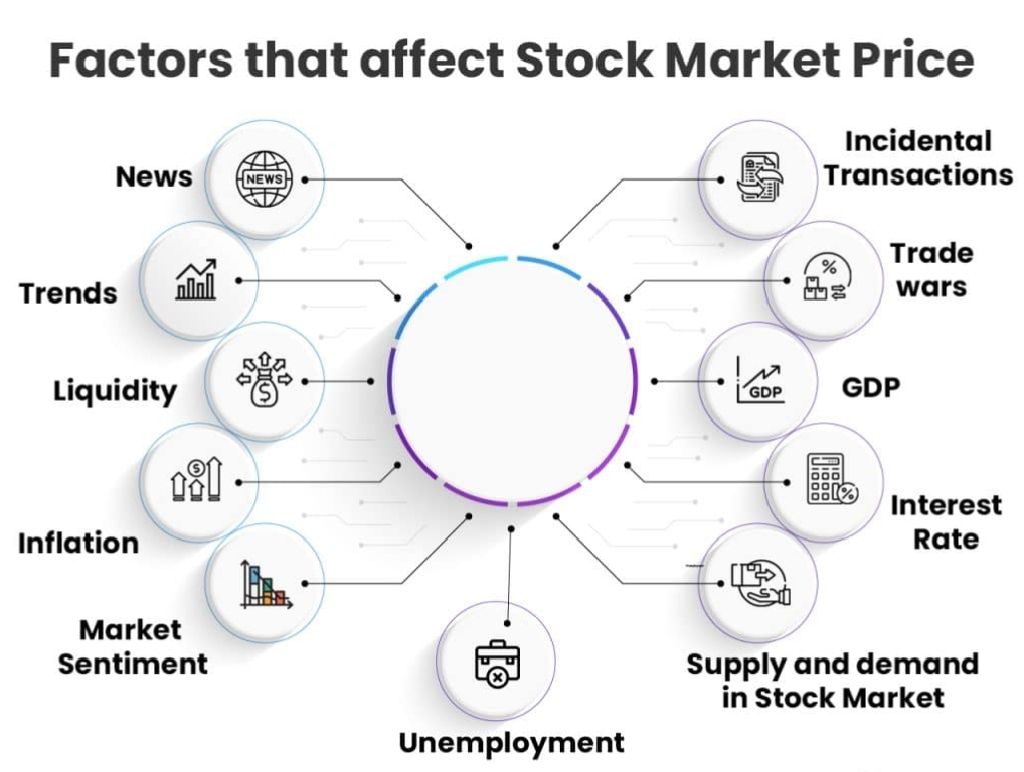

4. Macro Crypto Market Sentiment

VANRY’s fate is closely tied to the broader crypto market mood. When Bitcoin surges, capital often rotates into altcoins like VANRY as traders seek higher returns. However, during bear markets or sudden BTC corrections, altcoins usually fall harder, as investors seek safety or exit riskier positions. Key indicators like Bitcoin dominance, the crypto fear and greed index, and even global economic conditions (such as interest rate hikes or inflation fears) all ripple through to VANRY’s price.

Strategic tip: Track macro sentiment not just through charts, but also by following major news events, regulatory developments, or changes in global risk appetite. Altcoins often amplify whatever direction the overall market is heading.

5. Technology Upgrades and Project Development

Confidence in Vanar Chain’s future is directly linked to its technical progress. Regular network upgrades, improvements in scalability and security, and the successful rollout of new features all serve to attract developers, users, and investors. On the flip side, missed deadlines, lack of transparency, or buggy releases can erode trust and lead to price dips.

Growth mindset: Pay attention to developer activity on public repositories, frequency of project updates, and the quality of partnerships. Teams that communicate clearly and deliver on their roadmap tend to maintain stronger long-term price support.

6. Social Sentiment, Narrative, and Hype Cycles

Price action in crypto is often driven by narrative as much as fundamentals. Viral social media trends, influential endorsements, and coordinated marketing campaigns can push VANRY into the spotlight, attracting speculative demand that drives rapid price movements. Sometimes, this hype precedes actual adoption, resulting in pumped prices that may later correct if fundamentals don’t catch up.

Smart approach: Separate genuine community growth from manufactured hype. Look for organic engagement, developer enthusiasm, and real-world use cases—these are more sustainable than short-lived influencer buzz.

7. Regulatory Landscape and Global Trends

The regulatory environment and macroeconomic backdrop have an outsized impact on all cryptocurrencies, including VANRY. Policy shifts in major economies, new legislation, or even central bank pronouncements can quickly reshape market sentiment. Favorable regulations (such as clearer guidelines or pro-crypto legislation) can open doors to new investors and institutional interest, while crackdowns or bans can sap confidence and liquidity overnight.

Forward-looking tip: Stay updated on both local and global regulatory news. Often, early signals from regulators or policymakers can foreshadow big moves in the broader market, affecting VANRY and its peers.

How to Build a Holistic VANRY Analysis Framework

Don’t fall into the trap of relying solely on price charts or social media trends. True edge comes from combining multiple forms of analysis: technical indicators (price action, volume, support/resistance), fundamental research (growth metrics, tokenomics), macro market trends, and on-chain analytics. By layering these perspectives, you’ll develop a more nuanced and actionable understanding of where VANRY might be headed.

The Bottom Line

VANRY’s price is shaped by a blend of ecosystem adoption, token economics, liquidity, wider market sentiment, technological progress, narrative, and the global regulatory environment. Mastering these drivers will give you the ability to anticipate moves, instead of simply reacting to them. Whether you’re planning your next trade or investing for the long haul, a well-rounded approach is your best advantage.

Ready for more? I can break this down into a tweet thread, craft it for Binance Square, or build a step-by-step trading or investment guide tailored to VANRY. Just let me know what you need next."