Most people still misunderstand what @Fogo Official is actually building.

They hear “high performance Layer 1” and immediately compare it to every other chain chasing TPS numbers. But if you zoom out and really study the architecture, you realize something deeper is happening.

$FOGO is not trying to win the generic smart contract race.

It is designing institutional grade market infrastructure where compliance does not automatically mean surveillance, and where privacy does not mean regulatory escape.

That distinction matters.

Right now, the market is split into two extremes.

On one side, you have compliance heavy systems that collect everything. Identity layers, transaction metadata, analytics hooks, monitoring pipelines. They treat data as the core asset.

On the other side, you have privacy maximal systems that reject oversight entirely. They treat opacity as the only protection.

Fogo is positioning itself differently.

It is building infrastructure optimized for capital markets performance while minimizing unnecessary data exposure at the base layer.

That is a structural design choice.

Let’s break it down in simple words.

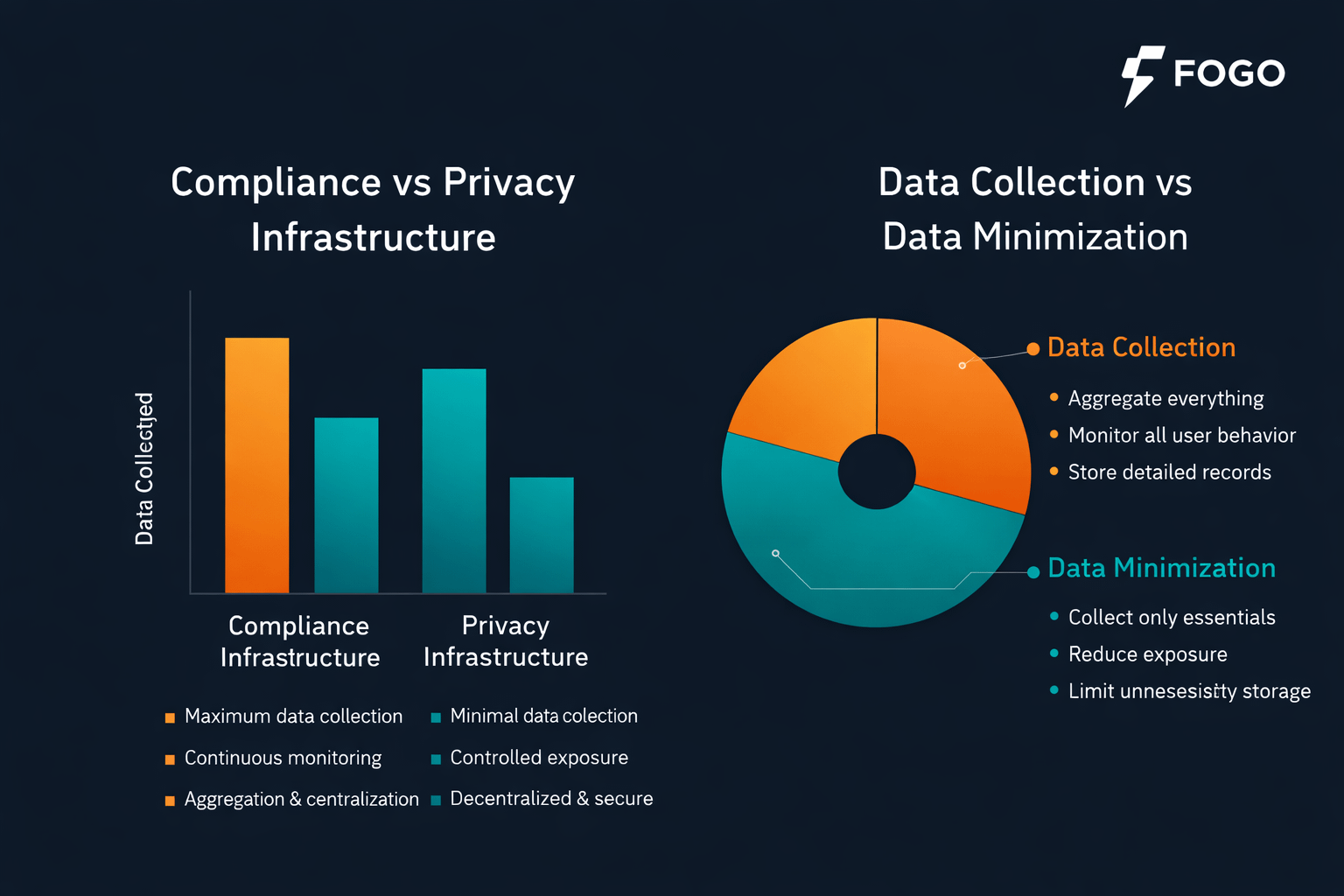

Compliance vs Privacy Infrastructure

Traditional compliance driven systems usually operate like this:

Collect maximum data

Store everything

Monitor continuously

Analyze patterns

Enforce rules after detection

This approach assumes more data equals more safety.

But in capital markets, more data also equals more attack surface. More leakage risk. More centralization pressure.

Fogo’s architecture flips the logic.

Instead of maximizing data collection, the base layer focuses on deterministic execution, low latency ordering, and efficient settlement. Compliance logic can be implemented at the application layer where required, rather than embedding surveillance into the protocol core.

This separation is important.

It means the protocol is not inherently designed to harvest information. It is designed to process transactions with speed and fairness.

In institutional trading, performance is not optional.

Latency affects pricing.

Execution quality affects spreads.

Settlement speed affects capital efficiency.

Fogo leverages the Solana Virtual Machine design philosophy but restructures the environment around high performance execution specifically for professional trading flows.

That focus creates a cleaner boundary between performance infrastructure and regulatory logic.

Now let’s talk about Data Collection vs Data Minimization.

In Web2 finance, the dominant model is data aggregation. Every click, every order, every interaction is logged and stored.

But in decentralized finance, especially for professional market participants, unnecessary data exposure creates competitive risk.

If you are a market maker, your strategy is alpha.

If your order flow is visible, your edge erodes.

If latency leaks exist, arbitrage becomes extraction.

Fogo’s performance oriented model reduces the window for exploitation by tightening execution intervals and minimizing unnecessary protocol level complexity.

When block times drop toward tens of milliseconds, and ordering logic becomes more deterministic, the environment becomes less exploitable.

This is not about hiding illegal activity.

It is about reducing structural inefficiencies that harm legitimate participants.

There is a difference between privacy and secrecy.

Privacy is controlled exposure.

Secrecy is opacity without accountability.

Fogo leans toward controlled exposure.

By not embedding heavy data harvesting mechanisms at the protocol level, it allows application builders to decide how much compliance logic to integrate depending on jurisdiction and use case.

That flexibility is powerful.

Institutional adoption does not require turning blockchains into surveillance engines.

It requires predictable infrastructure.

And predictability is exactly what high performance execution environments provide.

Now let’s connect this to recent developments around @fogo.

The network continues refining its performance model, focusing on trading optimized infrastructure rather than becoming a general purpose chain overloaded with every possible dApp category.

This specialization matters.

General purpose chains face coordination overhead.

Multiple client implementations increase governance friction.

Large validator sets increase propagation latency.

Fogo’s more curated infrastructure model prioritizes speed and reliability over maximal decentralization theater.

Yes, there are trade offs.

A smaller validator environment means different decentralization dynamics.

A focused architecture means narrower use cases.

But when your target is professional capital markets, specialization is strength.

Wall Street systems are not general purpose.

They are optimized for throughput and execution.

Fogo is taking that same mindset into decentralized infrastructure.

Now let’s talk token logic.

$FOGO is not just a speculative unit.

In performance driven systems, the token aligns incentives across validators, liquidity providers, and application builders.

If the chain attracts serious trading volume, fee dynamics become structurally meaningful.

Performance attracts liquidity.

Liquidity attracts strategies.

Strategies attract infrastructure builders.

That flywheel depends on execution quality.

You cannot build an institutional trading layer on 400 millisecond blocks and hope market makers treat it seriously.

Execution must be competitive with centralized venues while maintaining self custody advantages.

That is the challenge.

And that is where Fogo’s architectural philosophy stands out.

Instead of chasing hype cycles, the team is clearly building around a structural thesis:

Professional capital markets will eventually demand decentralized infrastructure that matches centralized performance standards.

When that shift happens, the chains that survive will not be the loudest. They will be the most structurally efficient.

Now think about global uncertainty.

As macro conditions evolve, trust between institutions fluctuates.

In uncertain environments, capital looks for neutral settlement layers.

But neutrality alone is not enough.

Performance matters.

Predictability matters.

Risk minimization matters.

Fogo is positioning itself as a neutral performance rail.

Not anti compliance.

Not surveillance heavy.

Not privacy extremist.

Balanced.

This balance is subtle, but it is powerful.

If you study infrastructure history, the systems that dominate long term are the ones that separate core infrastructure from policy overlays.

The internet itself is neutral transport.

Regulation exists at service layers.

Fogo applies a similar philosophy to financial rails.

Core layer focuses on execution.

Application layer handles compliance needs.

That modularity is future proof.

Now imagine the next phase of on chain capital markets.

Tokenized assets.

Real time settlement.

Cross border liquidity.

Programmable financial instruments.

All of that requires:

Low latency

Deterministic ordering

Fair execution

Minimal leakage

You cannot achieve that if the base layer is overloaded with non essential logic.

Simplicity at the core increases robustness.

This is why the compliance vs privacy debate is often framed incorrectly.

It is not binary.

You can have infrastructure that is compliant when required and private when appropriate.

Design choices determine that flexibility.

Fogo’s design suggests it understands this nuance.

That is what makes it structurally interesting.

While many chains compete for retail narratives, Fogo is quietly targeting professional infrastructure territory.

That is not a short term hype play.

That is a long term positioning strategy.

And if you are watching capital markets evolution carefully, you know where serious liquidity eventually flows.

It flows where execution is best.

It flows where risk is minimized.

It flows where infrastructure is predictable.

That is the environment @fogo is building toward.

For me personally, this is why I pay attention to $FOGO.

Not because of marketing noise.

But because of architectural intent.

In crypto, intent matters.

Some projects build features.

Others build foundations.

Fogo is building a foundation optimized for performance, fairness, and controlled exposure.

If decentralized finance is going to mature into real capital market infrastructure, it will need chains that understand these trade offs deeply.

Compliance vs Privacy is not a battle.

It is a spectrum.

Data Collection vs Data Minimization is not ideology.

It is architecture.

And architecture defines outcomes.

That is why I believe @fogo and $FOGO deserve serious attention right now.

Not as another Layer 1 in a crowded market.

But as a specialized execution layer for the next generation of decentralized capital markets.