At 3 42am my room wasnt a room anymore It was just a monitor glow a glass of water I kept forgetting to drink and that familiar feeling that the market was awake even if I wasnt

Id already done the disciplined stuff the stuff you tell yourself youll do every time closed the noise tabs kept the chart simple promised I wouldnt size up out of boredom promised I wouldnt fix a trade by clicking faster

And then the candle showed up

Not a fireworks candle Not the kind that screams FOMO It was the polite kind of green steady clean almost respectful The kind you look at and think okay this might actually be real

My model flagged the entry

That shouldve been the easy part People assume the hard part is finding the trade For me the hard part is always the same executing without letting emotion sneak into the mechanics

So I did it like a ritual

I checked the spread thin I checked the book deep enough to feel safe I kept size controlled because I know myself and I know how fast confidence turns into punishment

I placed the order

And for a second just a second I felt that calm that only comes when you think youve done everything correct Like youve finally stopped gambling and started operating

Then the market did the thing it always does when you get comfortable

The fill came back slightly worse than what I expected Not catastrophic Not blow up your account bad Just bad enough to bruise your certainty

It was the kind of slippage that doesnt scream It whispers

And thats what made it creepy

Because the candle still looked stable The chart still looked clean The book still looked deep But my entry my perfect little entry landed like it arrived late to its own party

Thats when the thought hit me fully formed and annoyingly poetic for that hour

My strategy wasnt wrong It was just one slot behind

Not behind in intelligence

Behind in position

Like I could see the same thing everyone saw I could make the same decision But my decision kept getting translated into action after the market had already assigned the best outcome to someone else

And the more I stared at it the more obvious it became the problem wasnt only price

It was ordering Timing Sequencing All the invisible stuff nobody posts screenshots of

The interesting part is what happened next

Instead of getting angry I got curious because I noticed something I hadnt admitted before

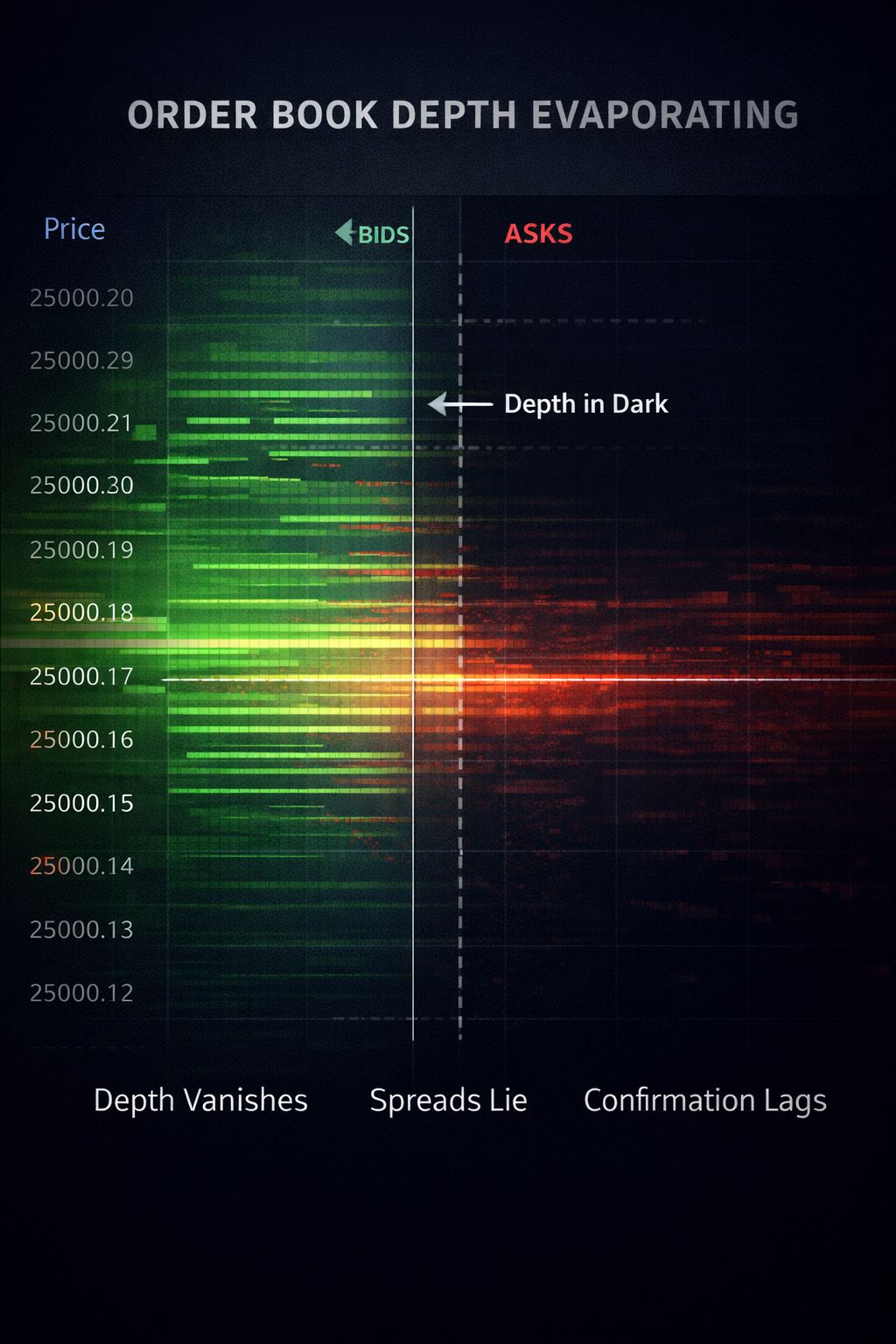

I rely on depth the way people rely on a railing in the dark Its not proof of safety Its just something to hold so you dont feel like youre floating

But depth can vanish Spreads can lie Confirmation can lag And when they do you find out the truth in these markets being right isnt enough

You also have to be on time

Thats why determinism suddenly became personal to me

Not as a tech word Not as a pitch deck line

As a survival thing

Because at 3 42am with a safe green candle in front of you the actual fight isnt whether your model is smart

Its whether the system lets your intent arrive as reality or whether you keep living in that tiny painful gap between I placed it and it happened

And if you trade long enough you start recognizing that gap the way you recognize a bad neighborhood

You dont need a crime to happen to know you shouldnt be there

That night I didnt rage close everything I just sat back and accepted the quiet lesson

Some strategies dont fail because theyre bad They fail because the environment makes late the default

And once you see that you cant unsee it

One slot behind stops being a complaint

It becomes a diagnosis