Navigating the Highest Economic Uncertainty in Modern History

1. Introduction: The Paradox of Record Highs and Rising Risks

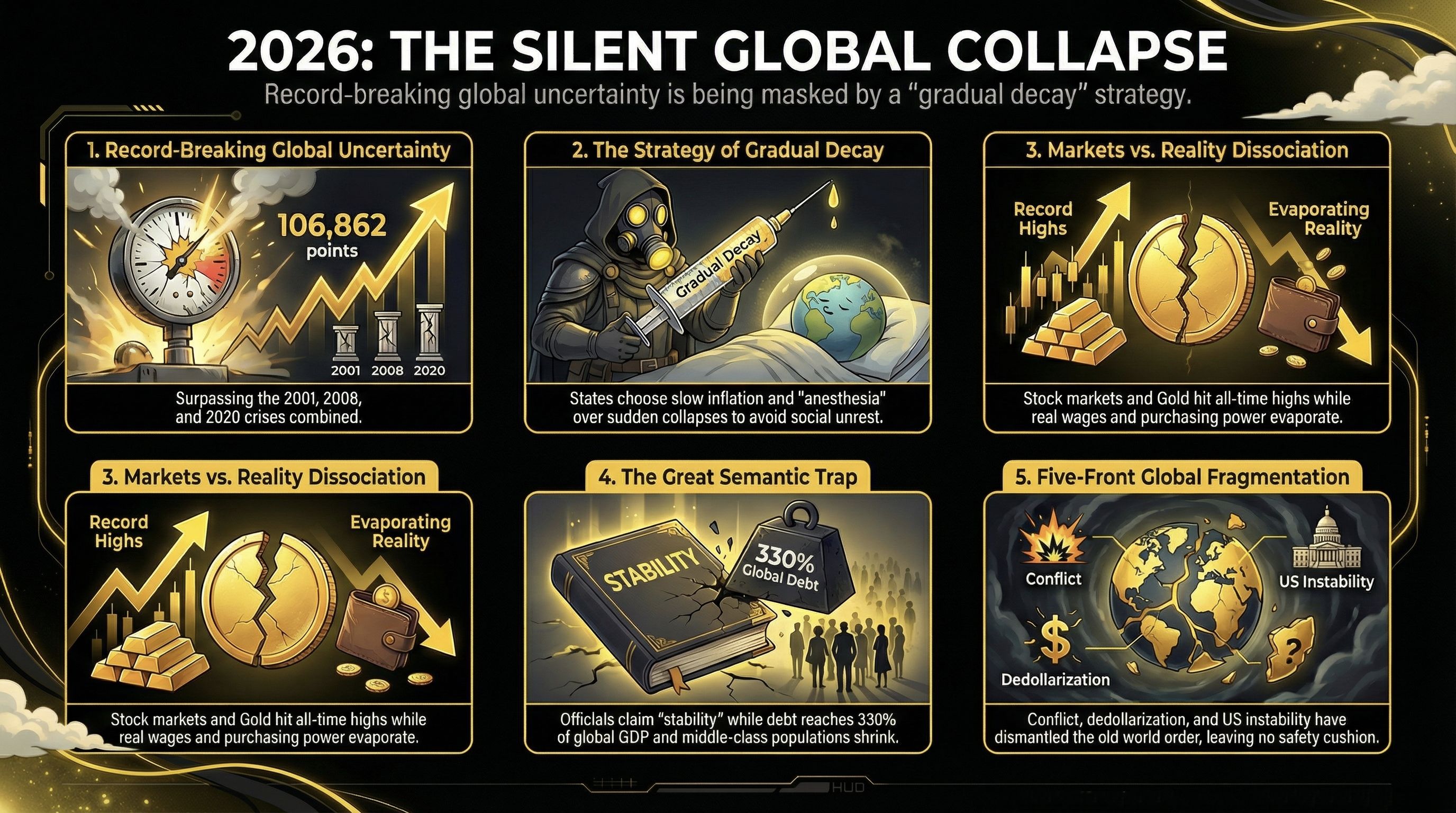

As of February 18, 2026, the global economy has entered a state of unprecedented macro-prudential risk. The Global Uncertainty Index, a sophisticated metric developed by economists at the IMF and Stanford University, has reached a staggering 106,862 points. This figure does not merely represent a spike in market nervousness; it marks the highest level of economic unpredictability ever recorded, surpassing the cumulative volatility of the 2001 terror attacks, the 2008 financial collapse, and the 2020 global pandemic combined.

Despite this, a profound "Great Dissociation" persists. While the Global Uncertainty Index signals a fundamental structural break in the world's economic architecture, the Nasdaq and S&P 500 continue to hover near record highs. This dissonance suggests that traditional market signals are no longer operating in a vacuum of fundamental value, but are instead being buoyed by specific policy choices that mask underlying decay. To navigate this environment, strategic participants must look beyond official narratives of "stability" and understand the mechanics of the anesthesia currently being administered to the global financial system.

2. Deciphering the Uncertainty Index: Beyond Sentiment

For institutional stability and long-term capital allocation, the failure of traditional economic modeling is a critical concern. When professional analysts can no longer project future outcomes using standard econometric tools, the resulting paralysis leads to a strategic migration of capital toward non-traditional hedges. The Global Uncertainty Index is not a measure of public sentiment, but a quantitative frequency analysis of the term "uncertainty" in professional reports across 143 countries. When the experts tasked with modeling the future effectively admit they cannot do so, the "So What?" is clear: the inability to forecast leads to a total cessation of productive corporate investment and a flight toward "safe haven" assets.

To grasp the severity of the 2026 data, one must compare it against historical benchmarks of systemic shock:

2001 (Post-9/11): A localized geopolitical shock that disrupted global trade.

2008 (Lehman Brothers): A collapse of the global credit and banking architecture.

2020 (Global Pandemic): A total, albeit temporary, cessation of global production.

The current index level indicates that we are not facing a single, identifiable shock, but rather a convergence of systemic stresses that the existing global order is unequipped to manage. As official channels maintain a rhetoric of control, the data suggests a reality where the "rules of the game" have fundamentally shifted.

3. The Semantic Trap: Redefining Crisis in the Modern Era

To maintain social order during periods of structural decline, states frequently employ a "Semantic Trap." By strategically redefining "crisis," governments can manage public perception, using the word "stability" as a placeholder for the gradual sacrifice of public welfare to prevent systemic explosion. The catalysts for the internal decay we observe in 2026 can be traced back to the early 2020s, specifically the 2022 global real wage decline—the first of the 21st century—and the Eurozone inflation spike of 8.4% when interest rates were still near zero.

This period initiated the "Invisible Tax," a process where inflation erodes liquid savings and erodes purchasing power without a formal tax declaration. The scale of this structural prioritization is evident in the current global debt-to-GDP ratio: 313 trillion USD, representing 330% of total global production. A case study in this decay is the United Kingdom, where debt interest spending reached 111 billion GBP—nearly double the entire primary and secondary education budget. This prioritization of debt service over human capital creates a "termite effect": the internal decay of social infrastructure that remains invisible to stock market tickers but effectively hollows out the economy from within.

4. Strategic Impoverishment: The Choice of Gradual Erosion

Modern crisis management has evolved from the "sudden collapse" models of the past toward a strategy of "administered anesthesia." Central banks and governments now actively fear deflation, as falling prices would increase the real weight of the 313 trillion USD global debt mountain, making it impossible to service. Consequently, the policy choice has shifted toward "kicking the can forward"—using liquidity injections, debt expansion, and subsidies to prevent a "Lehman Brothers moment."

This strategy avoids concentrated social unrest but results in the "Strategic Impoverishment" of the middle class. OECD data confirms this trend, showing that the middle-income population in developed nations has shrunk from 64% to 61%. This is not an accident; it is the price of maintaining the current financial architecture.

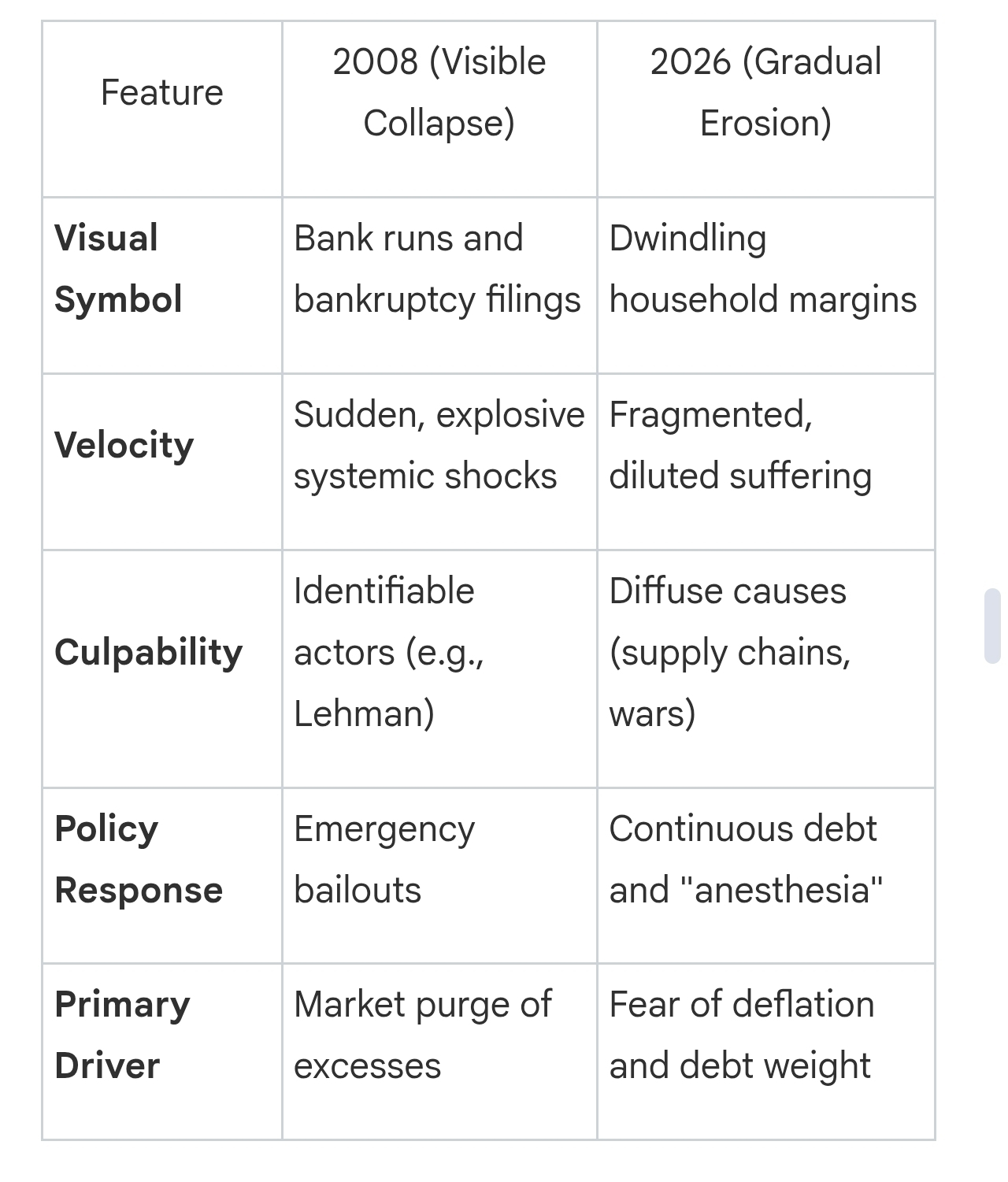

Crisis Management Evolution: 2008 vs. 2026

5. The Convergence of Five Global Fractures

The complexity of the 2026 environment stems from the lack of a single "epicenter." Instead, we are navigating five simultaneous fractures that are reordering the global landscape:

Prolonged Geopolitical Conflict: Ongoing wars in Ukraine and the Middle East have created permanent frictions in supply chains and energy costs.

De-dollarization & BRICS Expansion: The acceleration of bilateral trade agreements outside the dollar system is weakening the primary reserve currency's hegemony.

Institutional Decay: The multilateral institutions established in 1945 are increasingly ineffective at managing 21st-century economic disputes.

U.S. Institutional Volatility: High domestic political uncertainty in the U.S. and pressure on Federal Reserve independence have turned the "guarantor of order" into a source of global risk.

Global Stagnation: Growth rates of 2.7% globally (and as low as 0.9% in Japan) leave no "cushion" to absorb further shocks.

For professionals navigating these liquidity shifts, Binance Academy serves as essential infrastructure for monitoring the mechanics of de-dollarization. Utilizing Binance market tools to track macro trends allows users to identify how liquidity is fragmenting across these five fractures in real-time.

6. Asset Protection in a High-Uncertainty Environment

As global institutions fracture and the "administered anesthesia" continues, investors are losing faith in "paper" promises, leading to a flight toward hard assets. We are seeing a widening gap between holders of real assets and those dependent on fixed wages or liquid savings. The surge of gold to $5,000 per ounce and the housing crisis—where 38% of the median American household income is now consumed by mortgage payments, the highest since 1984—are clear symptoms of this dissociation.

In an environment characterized by the "Invisible Tax," "paper" stability is a liability. Strategic asset protection now requires a move toward asymmetric hedges that can withstand the "termite effect" of currency debasement.

Practical Takeaways for Professionals:

Assess Macro-Prudential Risk: Evaluate your exposure to fiat-linked instruments versus assets with intrinsic scarcity.

Prioritize Hard Assets: Use "hard assets" to protect long-term purchasing power against the eroding effects of inflationary debt management.

Maintain a "Do Your Own Research" (DYOR) Mindset: In an era of failing models and semantic traps, individual analysis and skepticism of official narratives are the primary tools for capital preservation.

7. Conclusion: Beyond the Anesthesia

The current global landscape is not "broken" in the traditional sense; it is undergoing a documented, gradual process of restructuring. While the "administered anesthesia" of central banks may prevent a sudden explosion, it cannot halt the structural decay. Awareness of this "Great Dissociation" is the first step toward effective participation in the current market cycle.

The record-high uncertainty reflects a world becoming more honest about its own contradictions. Rather than seeking a return to the "certainty" of the past, professionals must focus on active risk management and educational empowerment. We invite you to utilize Binance educational tools as your primary infrastructure for navigating this volatility and deepening your understanding of risk management in an age of fragmentation. In an era of historic uncertainty, clarity of analysis is the only true hedge.