Let’s be real for a second.

Blockchain has been “about to go mainstream” for what… ten years now? Every cycle we hear the same thing. This time it’s different. This time adoption is here. And yet your cousin still doesn’t use crypto for anything except maybe sending USDT once in a while.

That gap between hype and reality? That’s the whole story.

Vanar steps right into that gap. And honestly, I respect that.

Vanar is a Layer 1 blockchain built with one very specific idea in mind: Web3 won’t scale through traders. It’ll scale through gamers, brands, entertainment platforms, and everyday users who don’t care about consensus algorithms but care a lot about experience.

That framing matters more than people think.

Because if you zoom out and look at how we got here, you start seeing why most blockchain projects struggle.

Bitcoin showed up in 2009 and changed money forever. Simple mission. Digital, decentralized cash. That’s it. It didn’t try to be a gaming engine or a brand engagement tool.

Then Ethereum showed up in 2015 and said, “Let’s make this programmable.” Smart contracts. dApps. Tokens. NFTs. Suddenly everyone wanted to build the future of everything on-chain.

And we did build a lot. But we also built complexity. Wallets. Gas fees. Network congestion. Bridges. Security hacks. You need a mini computer science degree just to move funds across chains sometimes. It’s a real headache.

People don’t talk about this enough.

Mainstream users don’t hate blockchain. They just don’t want friction. They don’t want to think about private keys. They don’t want to sign five transactions to buy a digital item. They want things to work.

That’s where Vanar’s pitch starts making sense.

Instead of building another finance-heavy ecosystem and hoping consumers eventually show up, Vanar focuses on industries that already operate digital economies at scale. Gaming. Entertainment. Brands. AI integrations. Even eco positioning.

Basically, they’re saying: people already live in digital worlds. Let’s just upgrade those worlds with blockchain underneath.

That’s a much smarter entry point than screaming about decentralization on Twitter.

One of Vanar’s core pieces is Virtua Metaverse. Now, I know what you’re thinking. “Metaverse? Didn’t that hype die in 2022?”

Yeah. The hype died. The idea didn’t.

People still spend absurd amounts of time online. Gaming worlds, social platforms, digital communities. The difference is ownership. In traditional systems, you don’t own anything. You license it. If a platform shuts down, your assets disappear. Gone.

Blockchain changes that. If it’s implemented properly.

Virtua aims to create a persistent digital environment where collectibles, NFTs, and interactive experiences actually live inside a usable ecosystem. Not just JPEG speculation. Not just marketplace flipping. A world you return to.

That matters. Because utility drives retention.

Then there’s VGN, the Vanar Games Network. And honestly, this is where things get interesting.

Web3 gaming has had a rough history. I’ve seen this before. Teams launch games built around token rewards instead of gameplay depth. Early users farm rewards. Token pumps. Token dumps. Users disappear.

It’s predictable.

If Vanar gets this right, the blockchain layer stays in the background. Invisible. Gamers play because the game is good. Period. Blockchain just handles ownership, maybe trading, maybe asset portability.

But here’s the truth: gamers don’t care about your Layer 1. They care about smooth gameplay and no lag.

So abstraction is everything. If users feel like they’re “using crypto,” you’ve already lost.

Now let’s talk about the VANRY token.

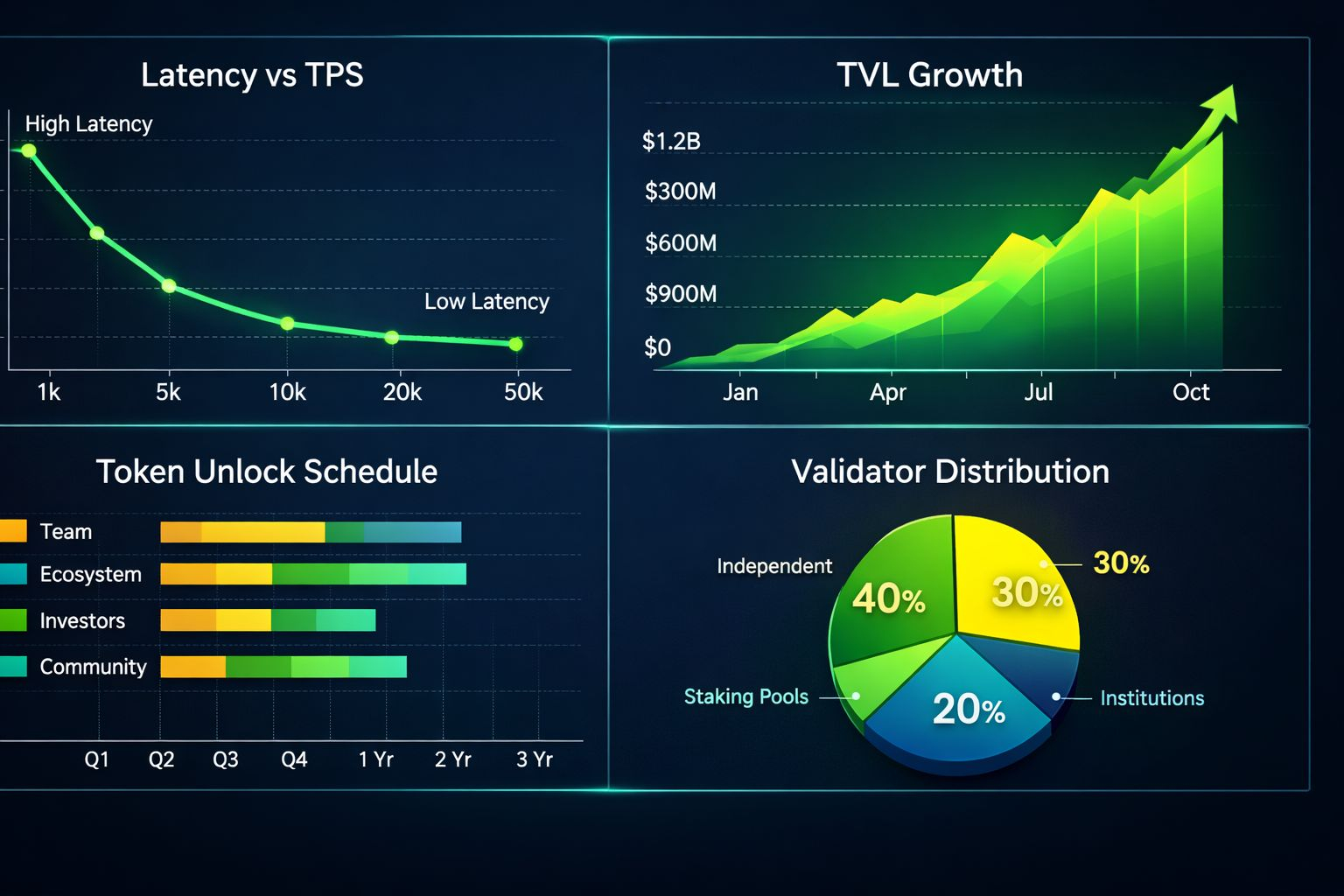

Every Layer 1 needs a native token. VANRY powers transactions, staking, governance, ecosystem incentives. Standard structure. Nothing unusual there.

But tokenomics can make or break a project.

I don’t care how impressive your tech stack is. If you flood the market with supply or design emissions poorly, you create constant sell pressure. That kills momentum and community trust. We’ve watched it happen again and again across multiple chains.

So the long-term health of VANRY depends on disciplined distribution and real utility demand. Not just speculative trading.

What I do like is the vertical integration strategy.

Vanar doesn’t just say “we’re a general-purpose L1.” They’re building around specific verticals. Virtua. VGN. Brand solutions. AI integrations. Eco narratives.

Some people might say that’s too broad. Maybe. Execution risk increases when you expand across multiple sectors. Gaming alone is complex. AI is another beast entirely.

But if they can align those verticals properly, it creates multiple demand streams feeding into the same infrastructure.

That’s powerful.

Now let’s address the elephant in the room. Competition.

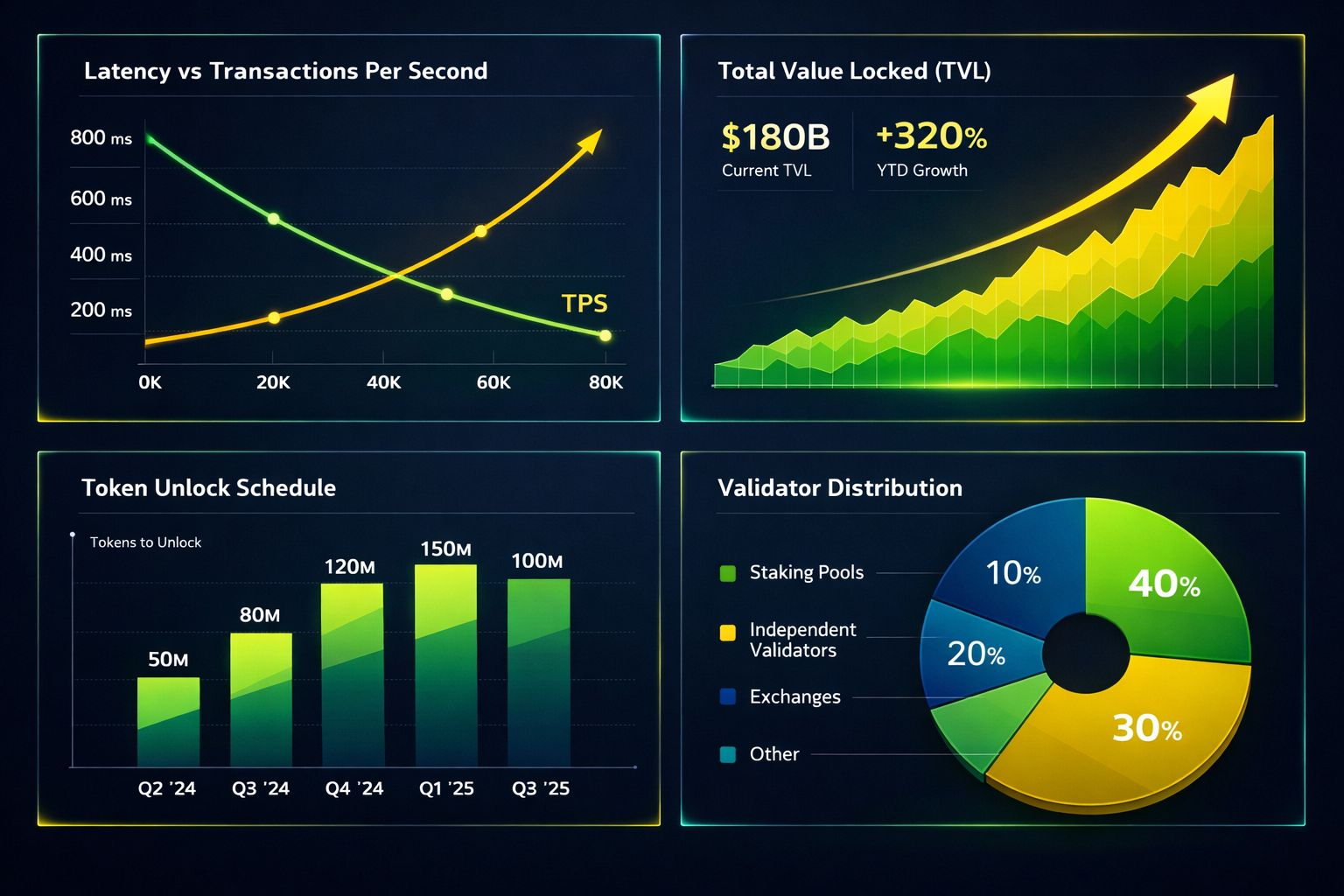

Layer 1 is crowded. Brutally crowded. Established ecosystems have liquidity, developers, partnerships, capital. You don’t just walk into that arena casually.

Vanar has to differentiate through user experience and industry partnerships, not just throughput metrics.

And speaking of AI integration… this part actually makes strategic sense.

AI dominates tech conversations right now. Models, automation, content generation, predictive systems. Blockchain can complement AI through verifiable data layers, ownership frameworks, and decentralized marketplaces.

Will that play out exactly as envisioned? Hard to say. But positioning at that intersection isn’t random. It’s calculated.

On the eco side, energy efficiency matters more than ever. Early blockchains faced heavy criticism for energy consumption. Modern Layer 1 designs tend to focus on more efficient consensus mechanisms. That helps with brand partnerships. No global company wants headlines about carbon-heavy infrastructure.

Still, none of this guarantees adoption.

Execution does.

The gaming industry generates over $180 billion annually. Billions of players already buy digital skins and items. If even a fraction of that market shifts toward blockchain-based ownership, the upside is massive.

But that shift won’t happen because of ideology. It’ll happen because the experience is better.

And that’s the real test for Vanar.

Can they make blockchain feel boring? Normal? Invisible?

If users log into a game, trade assets, interact with brands, and never once think about gas fees or wallets, that’s success.

If they have to jump through technical hoops, they’ll leave.

Simple.

There’s also regulatory uncertainty to think about. As blockchain merges with consumer markets, governments step in. Token classifications, compliance frameworks, digital asset laws. It’s messy. And it’s evolving.

Vanar will need strong legal navigation if they want enterprise and brand adoption at scale.

Here’s where I land.

I like the consumer-first framing. I think the industry needs more of that and less “look at our TPS chart.” I think gaming and entertainment are the most realistic gateways to mainstream Web3 adoption.

But ambition alone doesn’t build retention.

Vanar’s success depends on consistent execution, sustainable token design, real partnerships, and products that people actually enjoy using. Not for a week. For years.

If they pull it off, they won’t “change the world” overnight. They’ll do something more important.

They’ll make blockchain feel ordinary.

And honestly? That’s when this technology finally wins.