Abu Dhabi just made a quiet but massive Bitcoin bet.

Sovereign linked investors disclosed more than $1.04B in U.S. spot Bitcoin ETFs at the end of 2025. Mubadala Investment Company alone reported over 12.7M shares of BlackRock spot Bitcoin ETF, worth about $630.7M.

Source: SEC

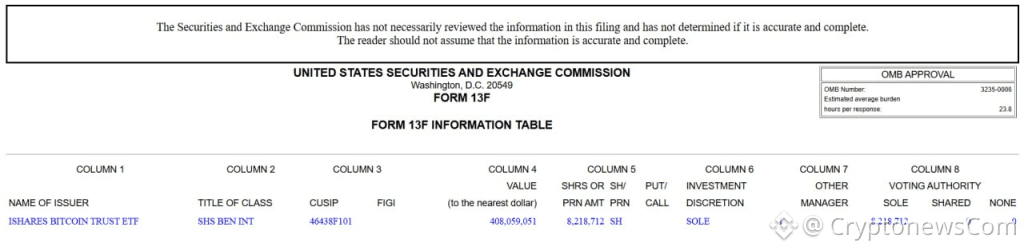

Source: SEC

Al Warda Investments added another 8.2M shares, valued near $408.1M. Combined, that is roughly 20.9M shares tied to one of the largest Bitcoin ETF issuers in the world.

This is not retail speculation. It is state backed capital allocating at scale.

The filings come as Bitcoin ETFs recorded $104.87M in daily net outflows and short term selling pressure returned. Spot Bitcoin has been hovering near the mid $60,000 range while broader sentiment remains fragile.

Yet these positions reflect holdings as of Dec. 31. That suggests a longer term allocation strategy rather than tactical trading.

Bitcoin Price Prediction: Are Governments Keeping Price At This Level To Accumulate?

Bitcoin is still compressing between clear levels.

On the chart, price bounced hard from the $60K–$64K demand zone and is now ranging just under the $70K–$71K resistance band.

That area keeps capping upside. A clean break and hold above $71K would shift short term structure and open the path toward $80K, then $90K.

The downside is simple. $64K is the key floor. Lose it, and $60K comes back into play fast.

Now, zoom out and connect it slightly to the ETF story. While price is chopping and sentiment feels fragile, sovereign-sized allocations are quietly building in the background.

If structure keeps improving and $71K eventually flips into support, price could start catching up to that longer-term positioning. For now, it is a battle between range resistance and a base trying to form above $64K.

While Governments Accumulate, Bitcoin Hyper Could Activate Capital

State-backed money can afford patience. They allocate. They wait. They hold through volatility.

Retail does not always move that way.

Bitcoin Hyper ($HYPER) is built for participants who want more than slow range compression. This Bitcoin-focused Layer-2, powered by Solana technology, adds speed, lower fees, and real on-chain utility while preserving Bitcoin’s core security.

It keeps the brand strength of Bitcoin but unlocks actual activity on top of it. Payments. Staking. Scalable execution.

Momentum is already visible. The Bitcoin Hyper presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next increase. Staking rewards currently reach up to 37%.

If Bitcoin eventually breaks $71K, great. If it keeps chopping while institutions accumulate, Bitcoin Hyper could be positioned to move regardless.

Visit the Official Bitcoin Hyper Website Here

The post Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know? appeared first on Cryptonews.