Every cycle we hear the same promises. Faster chain. Cheaper fees. “Enterprise ready.” Most of it blends together after a while. Vanar Chain didn’t hit me that way. When I started looking into it, it felt like they were trying to fix a deeper issue in crypto  not just how fast blocks move, but how blockchains think.

not just how fast blocks move, but how blockchains think.

Vanar Chain is a Layer-1 built around AI from the start. Not AI as a marketing add-on, but something baked into how the network handles data and logic. The idea is simple: blockchains shouldn’t just store information, they should understand it. That’s a big shift from how most chains work today.

What’s interesting is where Vanar comes from. It started under the name Virtua, focused more on entertainment and digital collectibles. Then came the rebrand, the mainnet, and the VANRY token. That wasn’t just a name change. It was a full pivot toward building serious infrastructure for AI, gaming, finance, and real-world assets. You can feel that difference in how the project talks and builds now.

At the tech level, Vanar is what they call AI-native. Instead of smart contracts blindly executing rules, the chain introduces tools that help apps reason over data. Neutron turns large files into compressed, searchable data units. Kayon adds an AI reasoning layer that lets applications actually work with information onchain. That means less dependence on offchain servers, oracles, and duct-taped solutions.

Why does that matter? Because suddenly you’re not limited to basic token transfers. You can build systems that understand documents, automate workflows, handle compliance logic, or power more advanced gaming and payment apps. That’s where things start to feel real, not theoretical.

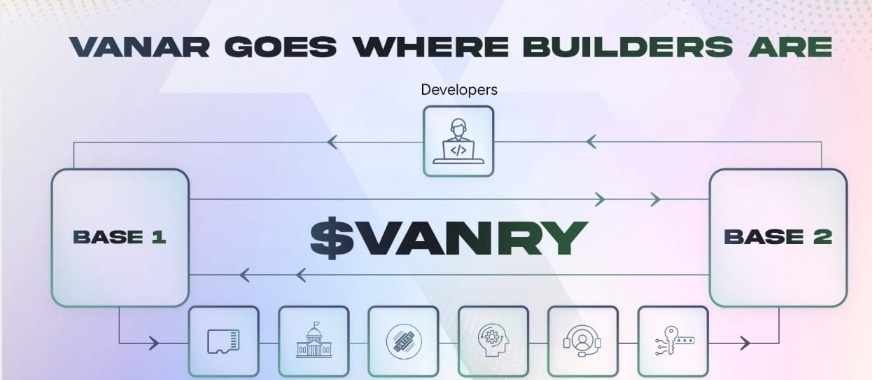

The chain itself is fast, low-cost, and EVM compatible. That part matters more than people admit. Developers don’t want to relearn everything from scratch. With Vanar, Ethereum tools already work, but you also get access to this AI-focused stack on top. Lower friction usually means higher adoption.

Then there’s VANRY. It’s the fuel for everything — gas fees, staking, validators, and eventually governance. The tokenomics are one of the more underrated parts here. Total supply is capped at 2.4 billion, and there were no founder or insider allocations. Most tokens go toward validators and ecosystem growth. That’s not common, and it sends a clear message about who the network is really for.

From a market perspective, VANRY behaves like what it is: an early Layer-1 token. Volatile, still discovering its value, no wild hype cycles yet. Liquidity is improving slowly, and price action feels organic rather than manufactured. That’s usually how real infrastructure projects start.

The team stays relatively quiet, but they’re not disconnected. Integrations with programs like NVIDIA Inception and community platforms like Galxe show they’re building relationships where it actually matters. Less noise, more shipping.

Looking forward, the roadmap is ambitious but grounded. More AI tooling, subscription-based services like Neutron, deeper real-world asset support, and even things like quantum-resistant security. The goal seems clear: make Vanar useful enough that people need it, not just speculate on it.

Is it risky? Of course. AI + blockchain at scale isn’t easy, and adoption is the real test. But if Vanar can turn this tech into tools people actually use, it won’t just be another chain in the list. It could end up being one of the smarter foundations Web3 is built on.@Vanarchain #Vanar $VANRY