When I look at the market today, with the Fear & Greed Index parked at 25 , I see most people making the same mistake. They're still searching for the next "Ethereum Killer" based on TPS and validator numbers. I've been around in this industry long enough to know that infrastructure that actually works quietly will outperform hype that loudly screams.

That's why I've been diving deep into Vanar Chain ($VANRY). It's not trying to kill anyone. It's building the invisible infrastructure for something much bigger: the convergence of AI and enterprise adoption. And from what I'm seeing on-chain, Q4 could be the quarter when this story breaks.

What Caught My Attention: The "Stack" That Actually Thinks

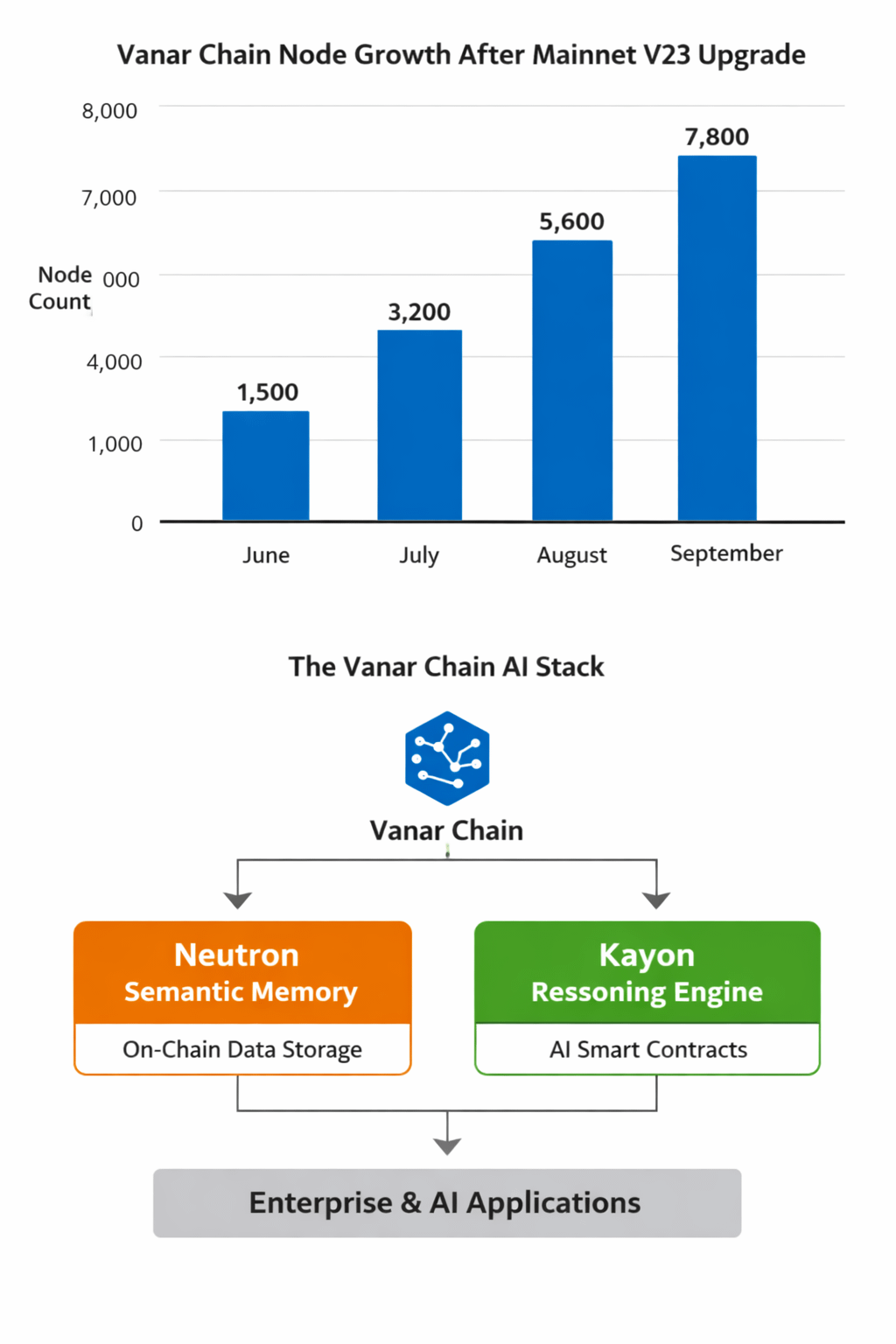

Most L1s are just talking about AI integration as a buzzword to add to a press release. Vanar Chain was built from the ground up with AI integration in mind. What caught my attention is their two-layer architecture:

Neutron (Semantic Memory) is a solution to a problem I’ve griped about for years the “Storage Illusion.” You understand how most NFTs or files aren’t actually on-chain? They’re just pointers that can break. #Vanar uses AI compression to lock data in place on the ledger. During the AWS outages that froze Binance recently, I realized how brittle our current infrastructure is. Neutron is more than just a clever solution it’s a necessity.

Kayon (The Reasoning Engine) is where things get really exciting. This allows smart contracts to actually comprehend the data they’re processing. I’ve tried enough DeFi projects to know that current automation is little more than “if this, then that” programming. Kayon allows for true autonomous agents that can validate invoices or close trades based on semantic context. That’s not a feature bump that’s a shift in paradigm.

The Metric That Made Me Take a Second Look

Frankly, the price performance of $VANRY over 90 days (-54%) isn’t exactly pretty on a chart. However, I’ve learned to look beyond that. What did catch my attention was the node count explosion following the Mainnet V23 upgrades . When long-term holders begin to deploy infrastructure, they’re not looking to sell out next quarter.

More importantly, I've been tracking the Neutron transaction volume. Each transaction burns $VANRY. If Q4 delivers the enterprise partnerships I've heard about (leveraging existing Google Cloud and Nvidia partnerships), we could see daily burns outpace new issuance. That's the kind of supply shock that occurs quietly while retail is distracted.

Why I'm Watching Q4 Closely

Three things are on my radar:

1. Axon launch (late 2026) for automated workflows this puts Vanar on a high-frequency economy

2. Subscription model requiring $VANRY for premium AI tools this shifts token utility from gas to productivity

3. Enterprise pipeline fixed $0.0005 fees with sub-3-second blocks make this the "predictable cost" chain brands actually want to build on

My Take

Vanar isn't trying to win the TVL game. It's building the infrastructure for the "Intelligence Economy" that hasn't yet arrived. When it does—when AI agents need cheap, permanent memory to transact I want to be on the chain that was built for them from day one.

That's why I'm accumulating quietly while the market panics. The silent surge is often the only one that matters.