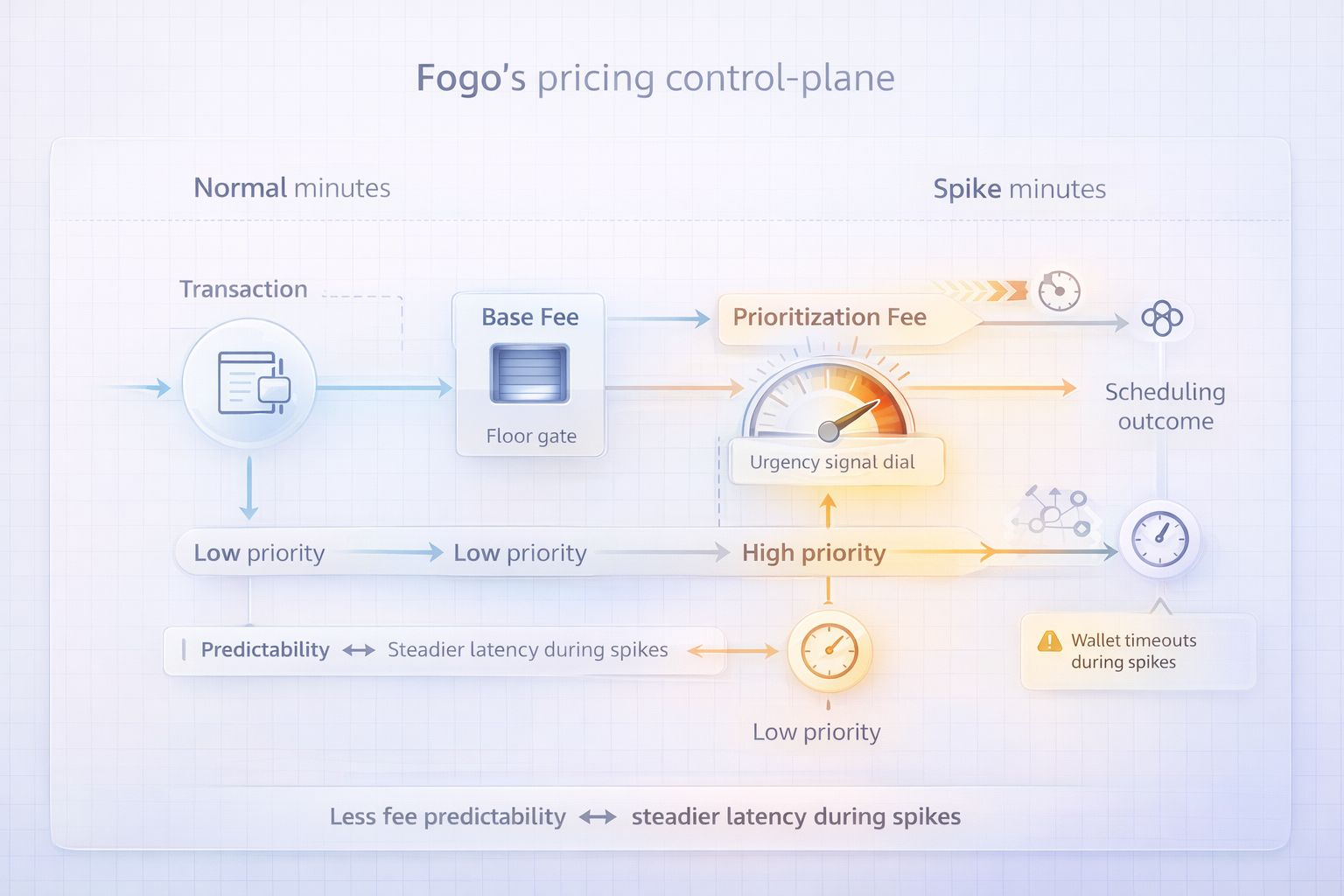

I remember a night when the market felt loud and impatient, and my wallet was timing out fast enough that a slow confirmation became a retry. I was watching a simple swap go from “tap and done” to “tap and wait.” I did not change the app. I did not change the amount. The only thing that changed was the crowd. In that moment, two words mattered more than any promise about speed: Base Fee and Prioritization Fee. When the chain is calm, they feel like small settings. When the chain is hot, they act like a pricing control-plane that decides whether you get a confirmation before a timeout turns your action into another attempt.

The mispriced belief is that tips are just optional speed-ups. Pay a little extra and your transaction moves faster. If you do not pay, you just wait a bit longer. That belief is comforting because it makes congestion feel like a personal preference. I do not think it is true in the minutes that actually break trust. In those minutes, tips stop being a luxury because timeouts trigger retries and retries add load. Under stress, the tip is part of how the system stays coherent.

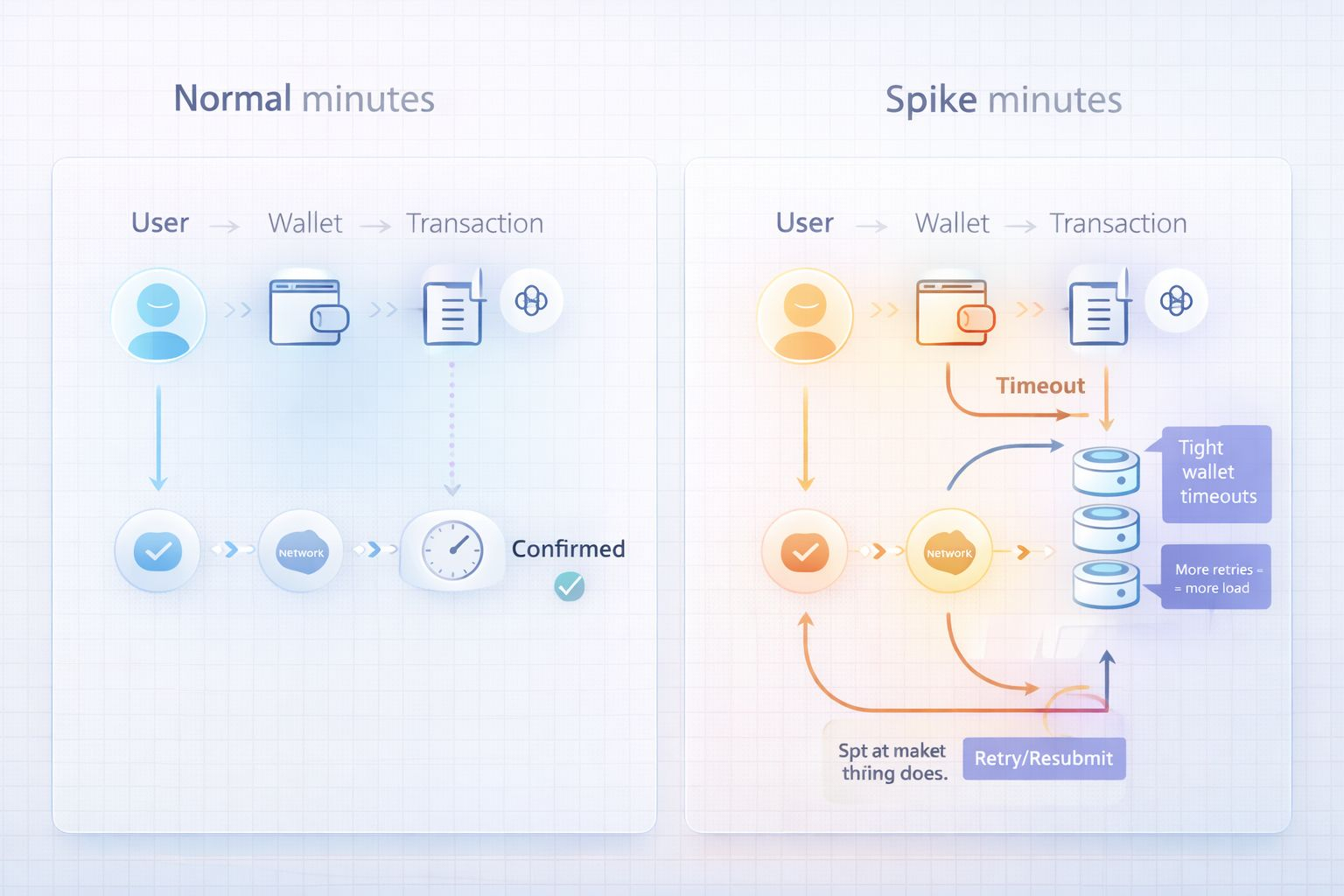

The constraint is simple and brutal. During a congestion spike, many wallets and apps run on tight timeouts. If a confirmation does not arrive quickly enough, the user taps again, the bot resubmits, or the app retries in the background. These retries are not “bad users.” They are a normal response to uncertainty. But they create extra load at the worst time. So I treat pricing as a control-plane: it can either shorten uncertainty or stretch it into repeated submissions that make everything slower.

In this lens, Base Fee is the floor. It makes every transaction pay something. Prioritization Fee is the signal. It lets users and apps say, “this one matters now.” The trade-off is explicit: you lose fee predictability because the total cost can swing with demand. In return, you try to protect latency stability, especially in the tail where p95 lives. That tail is where user experience is decided. Averages do not calm people when their own action is stuck.

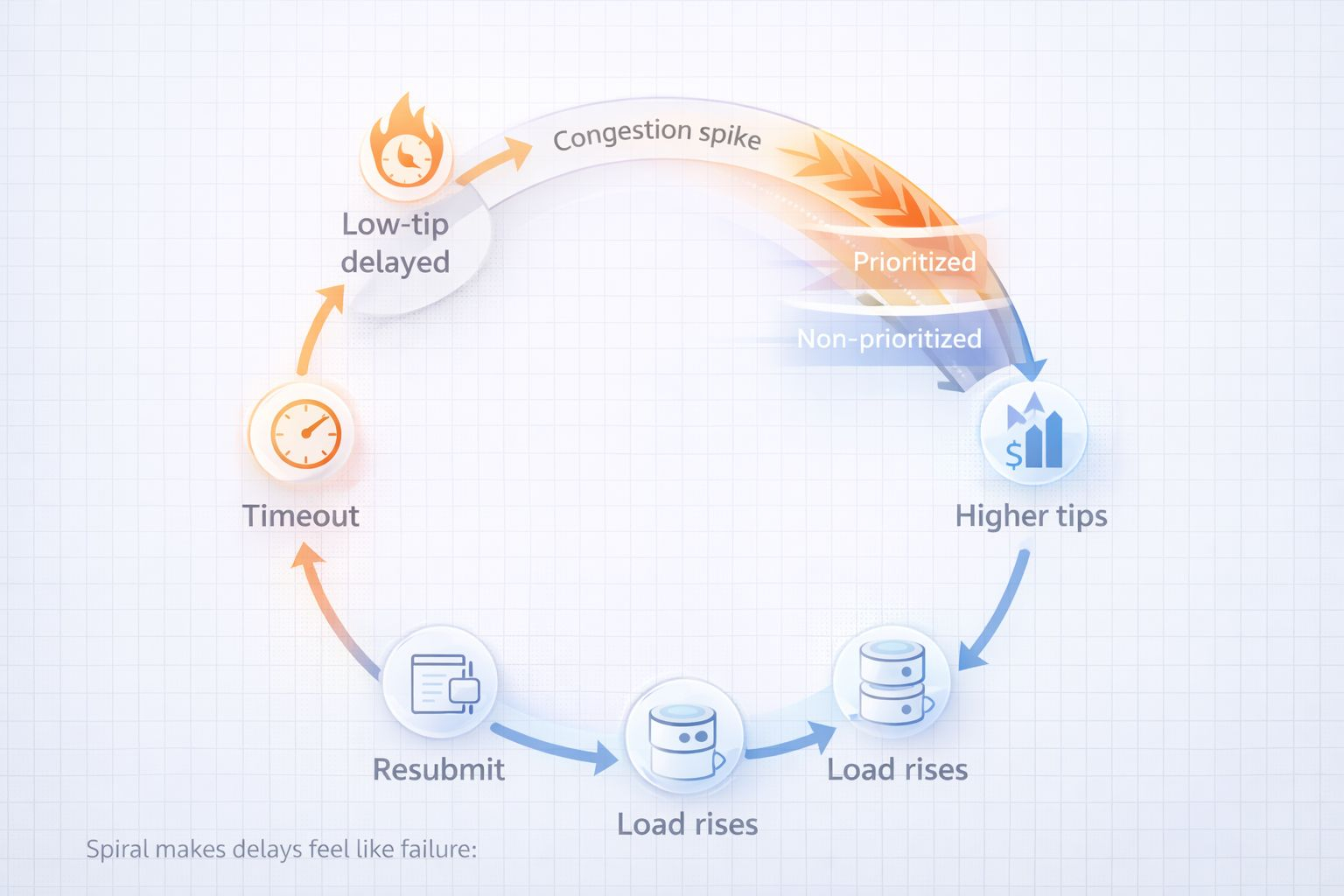

What surprised me when I started watching fee behavior closely was how quickly the system can flip from “crowded” to “self-amplifying.” At first, you see small differences. A few transactions include higher prioritization. A few do not. Then the spike hits and something changes. Low-tip transactions stop looking like “slower.” They start looking like “not happening.” The user does not know that. The user only knows that nothing is confirmed. So they try again. That is how a tip-bidding spiral begins. Not because everyone is greedy, but because everyone is trying to avoid being the one who times out.

This is why I do not like the phrase “optional speed-up,” because it underplays what is happening in the worst minutes. A low or missing tip can trigger a repeat attempt that adds load and slows confirmations further, which pushes more people to add prioritization, which widens the gap between prioritized and non-prioritized traffic. The gap then creates even more retries from the non-prioritized side. That cascade can become a bigger driver of pain than the raw level of demand.

The useful thing about this angle is that it leaves a hard trail. You can see it in the tip-to-base histogram, where the shape shifts at spike onset as tips rise relative to the base. In a calm period, that histogram often looks boring. Tips are small, sometimes zero, and the base fee dominates. When a spike begins, the right side can get fatter fast. More transactions carry meaningful prioritization. The median ratio of tip to base moves. That shift is the proof-surface. It tells you the chain is no longer in a simple “wait your turn” state. It is in a state where priority signaling is carrying a lot of the scheduling load.

If you are new to this, you do not need to memorize charts. You just need to internalize one idea. Fees are not only payment. Fees are behavior. When the system gives a way to signal urgency, people will use it. When they use it, the system behaves differently. In a spike, that difference is not subtle. It changes who sees a confirmation before a timeout. And that changes how many resubmits the system has to absorb.

I have felt the emotional version of this on the user side. A stuck action is not just slow. It feels like loss of control. You start watching the clock. You start thinking about what could go wrong. You start worrying about the price you will actually get. That is why latency stability matters more than headline speed. It is the difference between “the chain is busy” and “the chain is unreliable.” Pricing is one of the few levers that can push the experience back toward reliability when demand is peaking.

From a builder’s view, this suggests a different habit. Instead of treating prioritization as a last-second hack, treat it as part of your reliability plan. If your users will time out quickly, you are operating under a tight constraint. In that world, the safer path is often to include a small, consistent prioritization so you do not fall off the cliff where “cheap” becomes “repeat.” The cost of resubmitting is not only money. It is also extra load and more uncertainty for everyone.

At the same time, you cannot pretend there is no downside. If everyone learns to tip more, the fee experience becomes less predictable. Users will ask why the same action costs different amounts on different minutes. That is real friction. But the alternative is worse in the moments that matter. If the system keeps costs predictable by discouraging prioritization, it risks pushing more traffic into timeouts and retries. That can increase failure rates and tail latency. This trade is not moral. It is operational.

The reason I like the tip-to-base histogram as a proof-surface is that it keeps the conversation honest. You do not need to trust a narrative. You can watch the shift at spike onset and then check the outcome. You can track whether p95 confirmation latency tightens as the priority signal strengthens, or whether it stays wide. You can see whether tipping buys stability, or whether it only buys hope.

When I hear someone say “just add a tip and you will be fine,” I now translate it into a more serious claim. They are saying the pricing control-plane can absorb a spike without turning it into a resubmit cascade. Sometimes it can. Sometimes it cannot. The difference is measurable. That is the point of falsifiers. They stop us from arguing about vibes.

For builders, the practical implication is to treat Base Fee as the baseline and Prioritization Fee as the stability dial during spikes, and to tune for fewer timeouts rather than for the lowest possible cost on calm minutes.

If the median tip/base ratio rises at spike onset while p95 confirmation latency in spikes does not tighten, then Base Fee and Prioritization Fee are not delivering latency stability through the pricing control-plane.