Let me get straight to it. Here’s why I believe Vanar Chain actually works not just on paper,but where it counts:in real world performance, architecture,and staying power.In crypto,hype cycles come and go,but the projects that last always nail two things:execution and design.I don’t chase narratives.I care about what’s under the hood: architecture,incentives, and how the system holds up day after day.$VANRY

First,Vanar stands out because of its infrastructure discipline. A blockchain isn’t valuable just because it says it’s scalable.It has to stay stable when stress hits.That’s even more critical now,with AI pushing workloads in unpredictable ways.AI doesn’t trickle transactions in slowly it dumps activity in bursts.If your base layer can’t handle those spikes with steady fees and reliable finality,the whole stack turns fragile.What I see with Vanar is a real focus on reliability before rapid expansion.To me,that’s a sign of maturity,not just ambition.#vanar

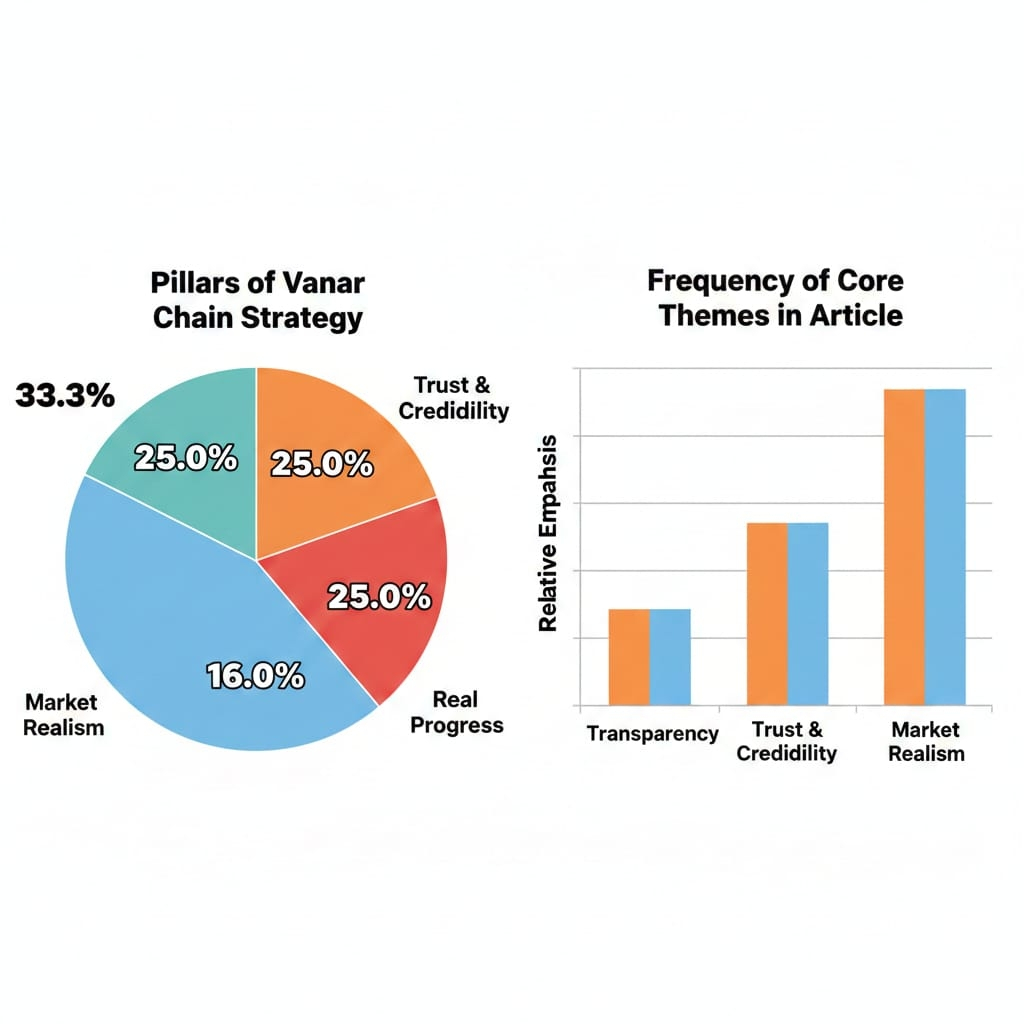

Execution is another big one.Plenty of projects launch with flashy incentives huge rewards,lots of noise, temporary surges in use.But as soon as emissions drop or liquidity dries up,users vanish.Sustainable networks don’t run on hype.They align incentives for validators,developers, and holders so people stick around for the long haul.Vanar’s approach favors steady, organic growth instead of chasing artificial spikes.In a market where capital is picky, that restraint pays off.

Now, about AI.Slapping “AI” on a roadmap doesn’t make a blockchain AI ready. Real AI integration demands data integrity, automation,secure execution,and predictable costs. AI native apps need a network that delivers deterministic results no wild swings in transaction fees,no sluggish finality.If the base layer wobbles, everything built on top suffers.Here,Vanar’s infrastructure first design gives it an edge over ecosystems that just market themselves well.The engineering comes first.

Economic coherence rounds out my view.A token isn’t just for speculation it has to anchor the network: staking,real fee capture, a supply model that matches adoption. When tokenomics drift away from actual usage,the foundation weakens.What I respect about Vanar is how its economic design ties directly to real network activity. That’s rare,and it shows.

Bottom line:Vanar Chain works because it values execution above buzz.Strong infrastructure,incentive alignment,and real AI readiness those are the ingredients that matter.If you’re evaluating any blockchain,skip the headlines.Look at the numbers,validator engagement,and how the economics line up with real use not just the announcements. Strategy grabs attention,but execution is what builds something that lasts.