Bitcoin may still be holding strong, but not everyone is buying right now. Short-term traders (STHs) are stepping back, but te long-term holders (LTHs) are staying right where they are.

STHs are getting anxious

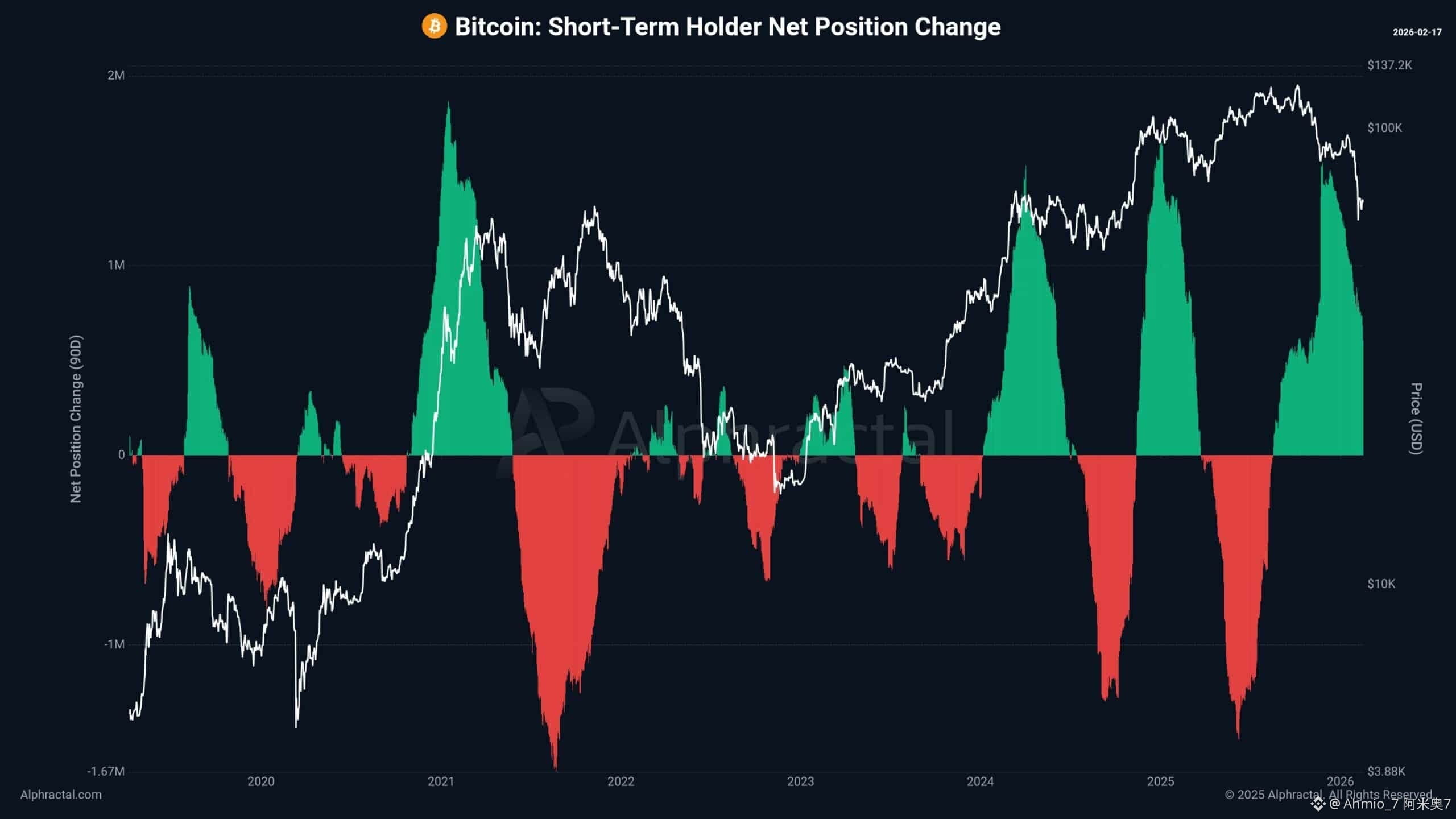

Recent data per Alphractal showed that the STH Net Position Change was in positive territory, so there was meaningful buying taking place. However, the size of these inflows has dropped compared to earlier spikes.

The STH engine slowdown matters because they often cause strong moves up. When their demand fades, Bitcoin [BTC] can go into sideways movement or just more chaos.

The STH engine slowdown matters because they often cause strong moves up. When their demand fades, Bitcoin [BTC] can go into sideways movement or just more chaos.

It’s not any more of a crash than there already is, but it does say that the market is stepping into a more cautious time period.

Meanwhile, LTHs are very calm

Instead of reacting to short-term price swings, they’re holding their positions.

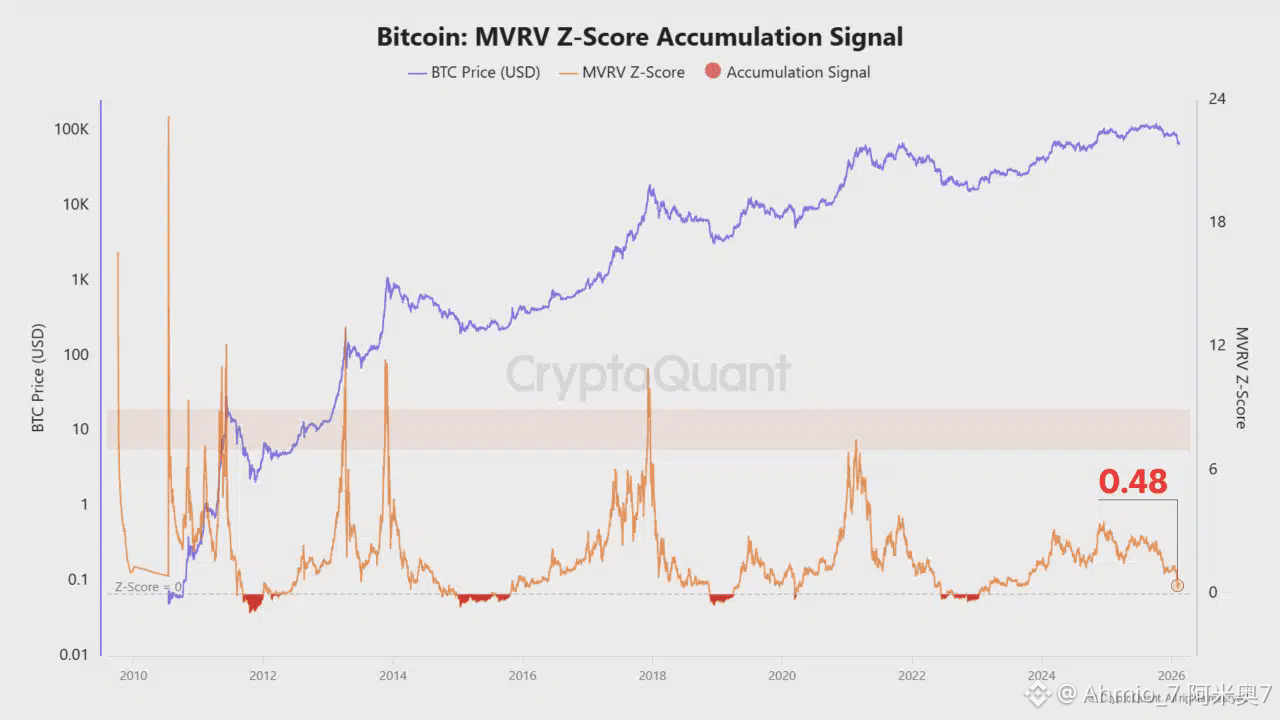

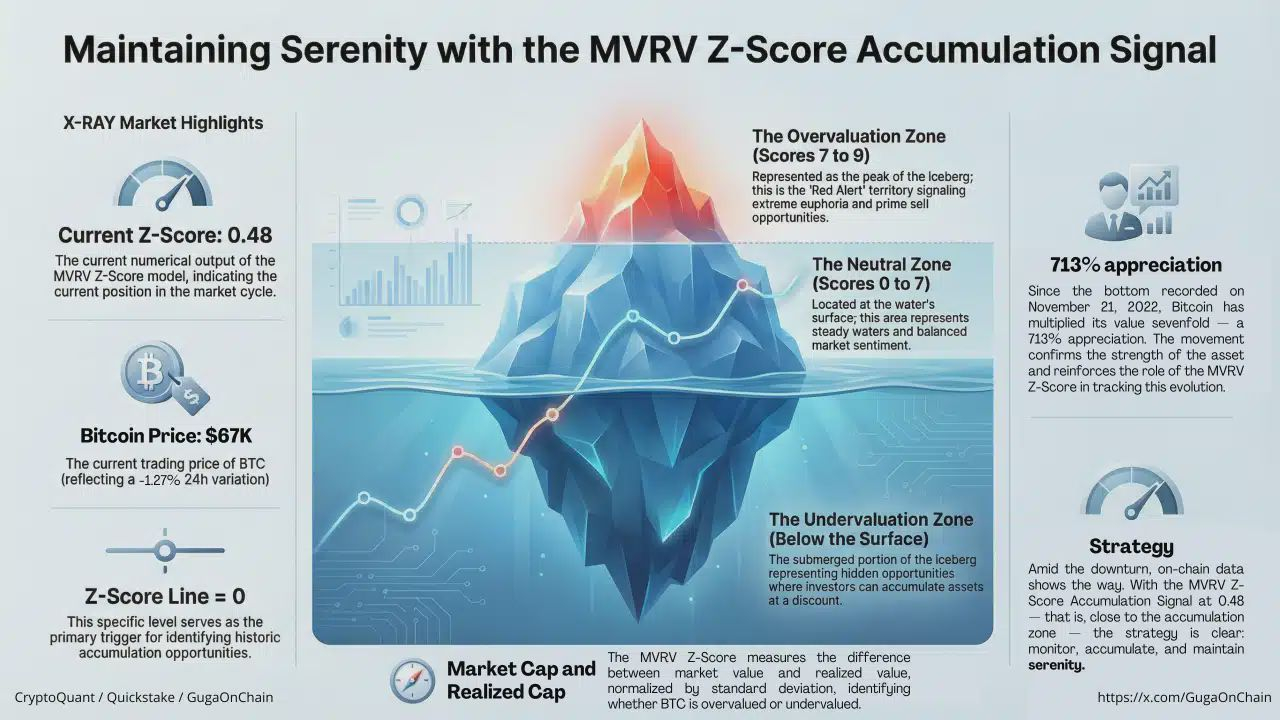

According to a recent report by GugaOnChain, Bitcoin’s MVRV Z-Score Accumulation Signal was at 0.48 at press time. This level is close to what is considered a buying zone.

According to a recent report by GugaOnChain, Bitcoin’s MVRV Z-Score Accumulation Signal was at 0.48 at press time. This level is close to what is considered a buying zone.

It happens when experienced investors build positions during uncertain times.

Confidence in BTC is intact as it stands. While STHs may hesitate, the older guns seem willing to wait!

Confidence in BTC is intact as it stands. While STHs may hesitate, the older guns seem willing to wait!

Content to wait and watch

This divide between both brackets of holders has showed up on the price chart.

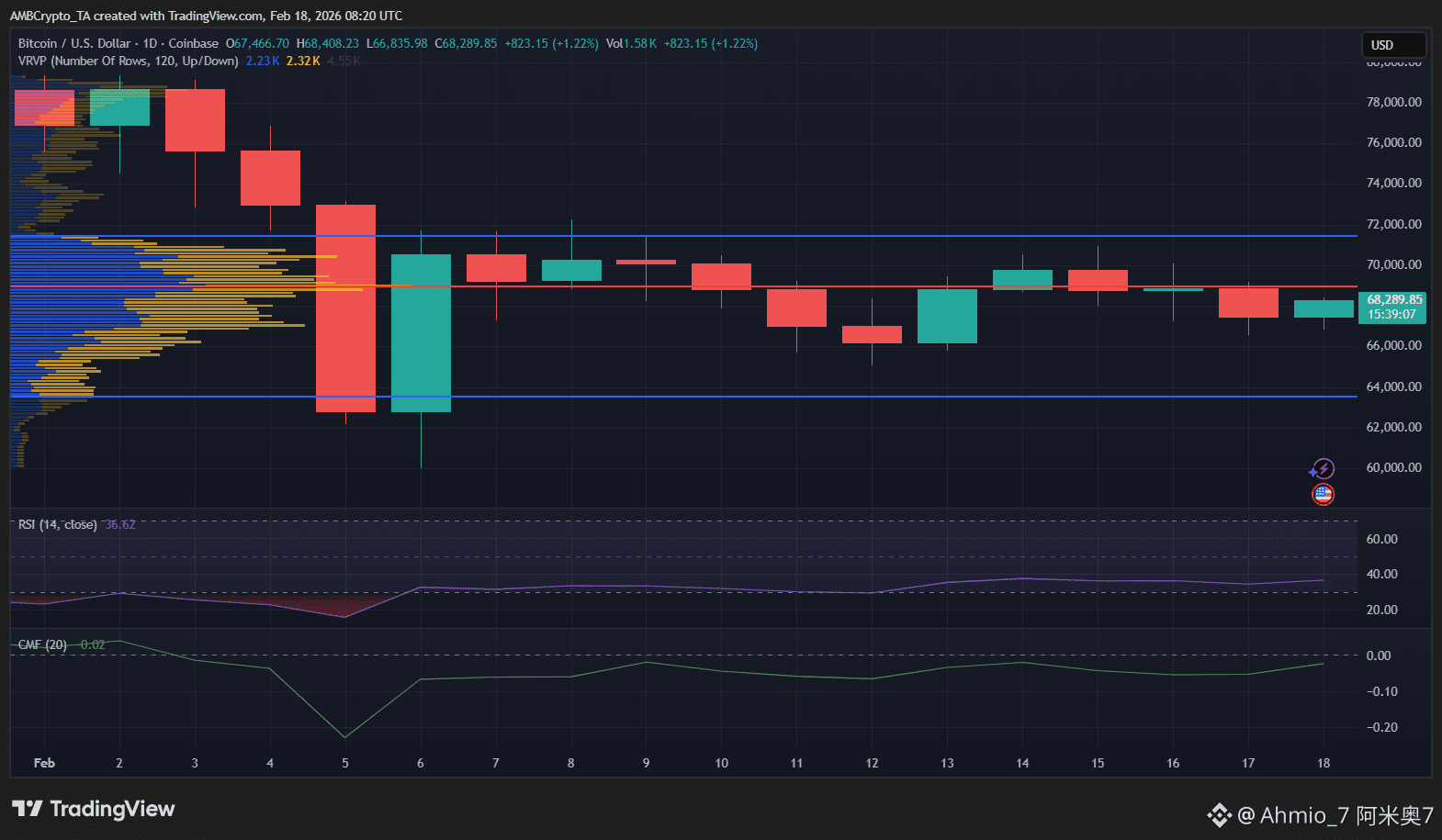

At the time of writing, Bitcoin was trading near $68,200, above a strong support zone around $64K. This was while facing resistance near the $71K level.

Price moved in a tight range, so the market is hesitant.

When STHs slow their buying, Bitcoin often loses pace and struggles to go higher. On the other hand, LTH confidence helps prevent deeper drops.

For a major move to happen, STHs will have to step back with strength.

Final Summary

LTHs are preventing a deeper crash despite weaker STH demand.

A breakout above $71K resistance will depend on STHs returning stronger.