As of February 2026, Ethereum (ETH) remains the undisputed leader in the smart contract and decentralized application (dApp) space. While the market has experienced significant volatility over the past year, the network's underlying fundamentals and technological roadmap continue to solidify its position as the primary settlement layer for global finance.

Technological Evolution: The Fusaka Era

The most significant recent milestone for the network was the Fusaka Hard Fork, implemented on December 3, 2025. This upgrade marked a major leap in Ethereum's scalability strategy. Building on the "blobs" introduced in the 2024 Dencun upgrade, Fusaka focused on:

PeerDAS Implementation: Streamlining data availability sampling to reduce storage requirements for validators while increasing throughput.

L2 Optimization: Further reducing transaction costs for Layer 2 scaling solutions like Arbitrum, Optimism, and Base, making micro-transactions more viable than ever.

Enhanced Throughput: An increase in the gas limit per block, allowing for higher transaction volume directly on Layer 1.

Market Dynamics and Institutional Adoption

The year 2025 saw a massive surge in institutional interest, largely driven by the continued maturation of Spot Ethereum ETFs (approved in mid-2024). By late 2025, these funds had reached over \$25 billion in assets under management.

Furthermore, the "Real World Asset" (RWA) narrative has become a reality on Ethereum. From US Treasuries to corporate bonds, trillions of dollars in traditional assets are being tokenized, with Ethereum serving as the primary host due to its security and established liquidity.

Price Performance (Feb 2025 – Feb 2026)

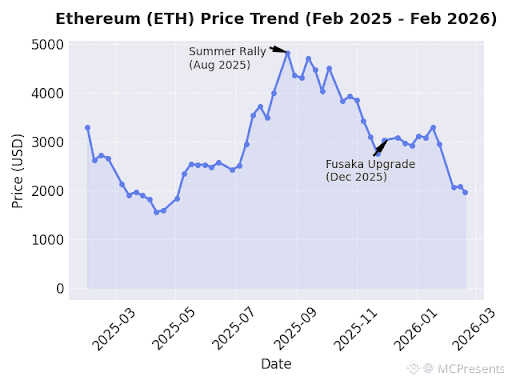

The past 12 months have been a rollercoaster for ETH investors. After a strong summer rally in 2025 that saw prices peak near \$4,800, the market entered a corrective phase in early 2026.

As of February 19, 2026, ETH is trading around \$1,969. Despite this recent pullback, analysts remain optimistic, with institutions like Standard Chartered projecting a recovery toward the \$4,000–\$7,000 range by year-end, citing the network's dominance in the stablecoin and DeFi sectors.

Ethereum (ETH) 1-Year Price Trend

The following chart illustrates the price movement of Ethereum over the last year, highlighting key events like the 2025 Summer Rally and the Fusaka Upgrade.

The Road Ahead

Ethereum's journey from a "world computer" to a specialized "settlement layer" is nearly complete. With the focus now shifting toward quantum resistance and further decentralized throughput, the network is well-positioned to handle the next wave of mainstream adoption. For investors and developers alike, Ethereum represents not just a cryptocurrency, but the foundational infrastructure of the future web.