Bitcoin is now on track for its fifth consecutive weekly decline, and losing this level could open the floor for a fresh leg lower.

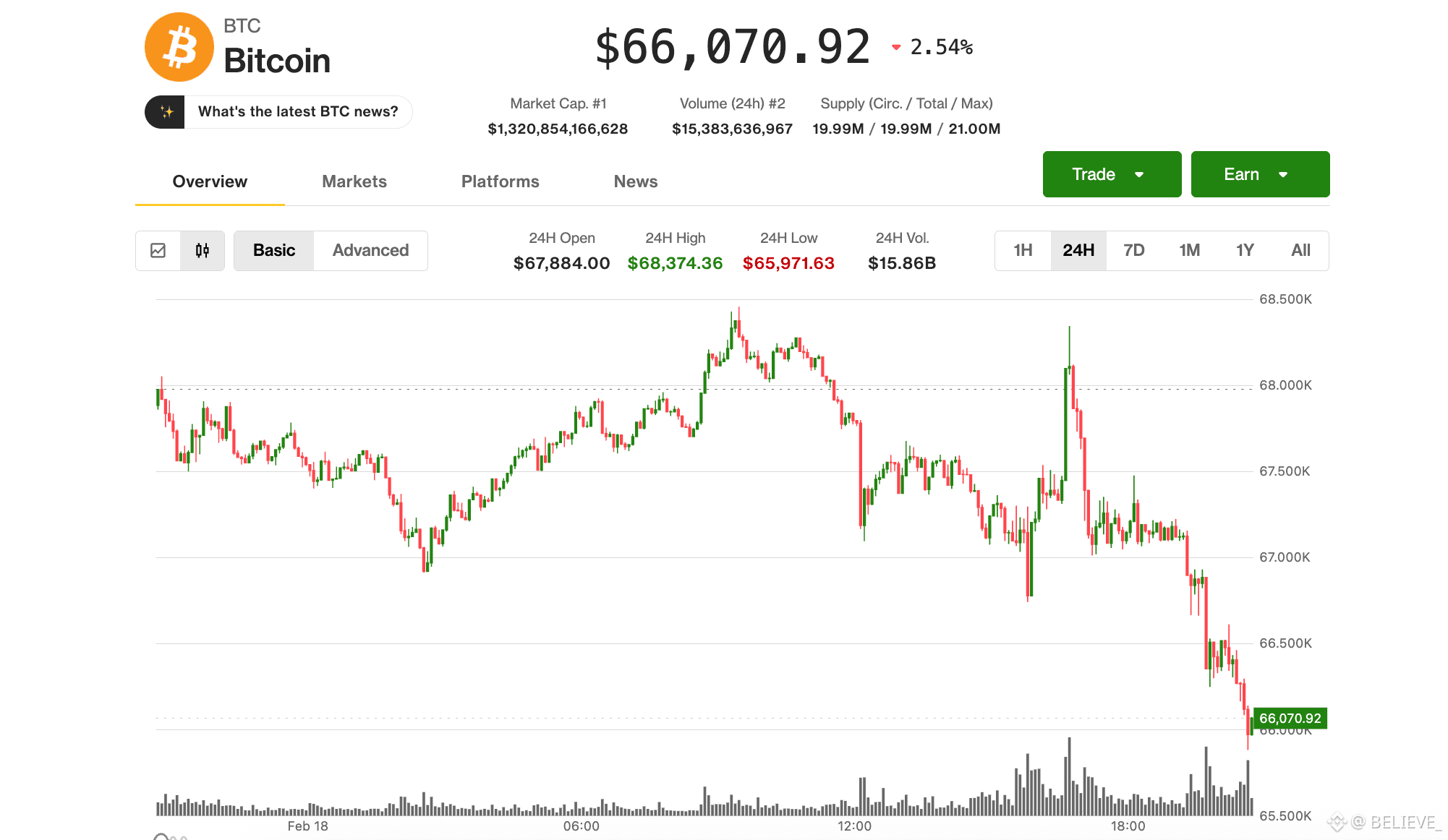

Bitcoin fell back to $66,000 on Wednesday afternoon, testing the lower end of its recent trading range.

Crypto-related stocks reversed early gains, with Coinbase swinging from a 3% morning rise to a 2% loss and Strategy slipping about 3%.

Surprisingly hawkish Fed minutes had the U.S.dollar strengthening, putting pressure on risk assets.

After chopping around early Wednesday, bitcoin BTC$66,943.64 rolled over during the U.S. afternoon and slid to session lows under $66,000, putting pressure back on the lower end of its recent range.

Having traded $68,500 overnight, BTC was down 2.5% over the past 24 hours and last trading at $66,200.

STORY CONTINUES BELOW

Don't miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newsletters

By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy.

Crypto stocks, which started the day on a stronger foot, followed suit, paring back their gains or snapping into declines across the board. Most notable was Coinbase (COIN), which turned its 3% morning advance into a 2% decline by the afternoon. Strategy (MSTR), he largest corporate holder of bitcoin, was down roughly 3% as the underlying asset weakened.

After a fast start to the session, U.S. stocks had given back much of their gains shortly before the close of trading. Not helping were surprisingly hawkish minutes from the January meeting of the Federal Reserve's Federal Open Market Committee (FOMC). As expected, most at the central bank agreed with the decision to pause rate cuts, but — in a twist — several suggested the Fed favor "two-sided" guidance at which the bank might opt to hike rates if inflation continues to remain sticky.

Already higher for the day, the U.S. dollar gathered even more strength, with the dollar index (DXY) — which measures the greenback against a basket of major foreign currencies — climbing to its strongest level in nearly two weeks. A firmer dollar often weighs on risk assets, and Wednesday’s crypto fade appeared to fit that pattern.

With today's slide, bitcoin is now staring at a fifth straight week of losses, its worst streak since the long 2022 bear market.

It also faces a key test at current levels. The $66,000 area held as support last week and helped fuel a bounce above $70,000. If that floor gives way decisively, traders will likely start eyeing the early February lows at $60,000 or a fresh leg lower.