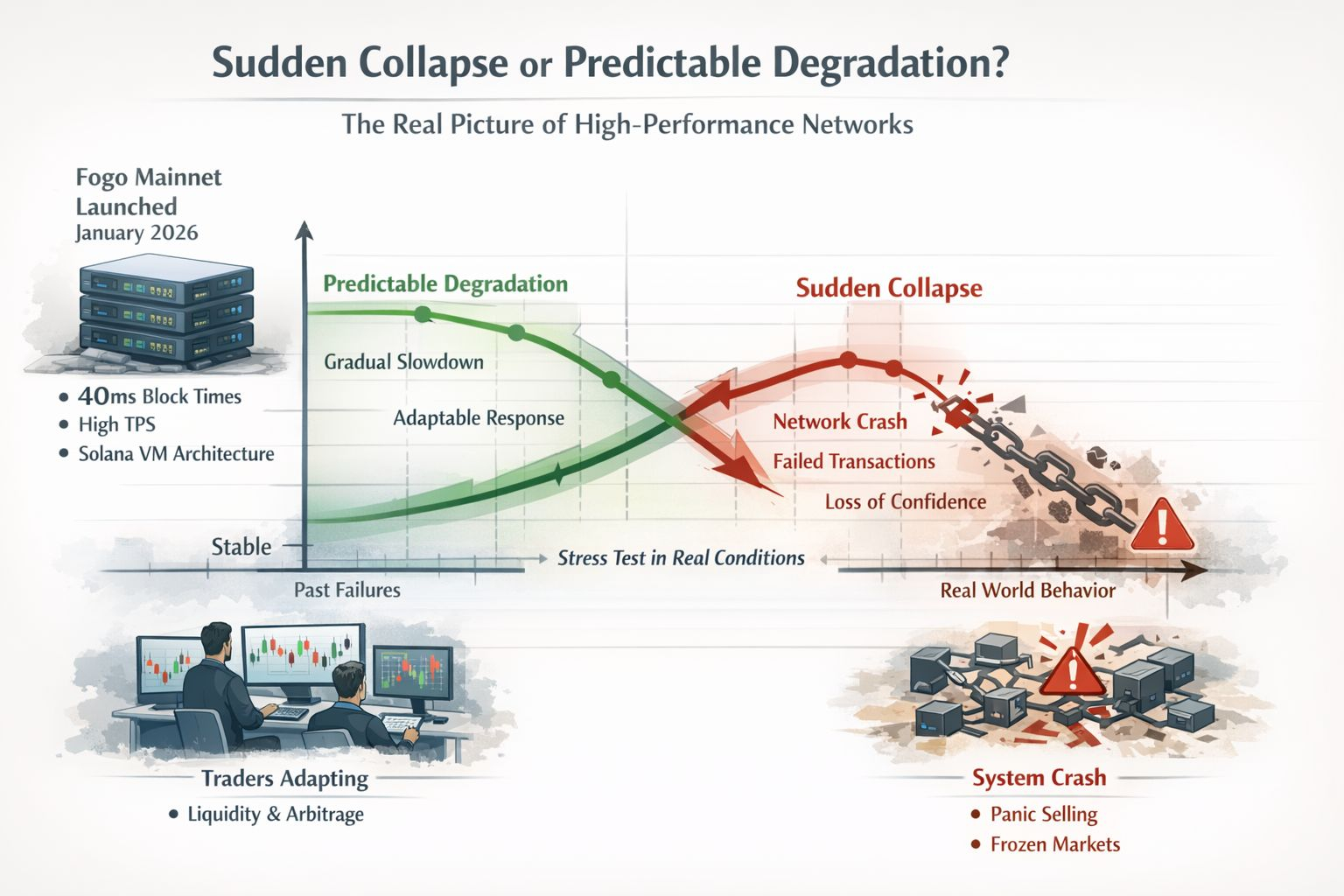

When Fogo launched its mainnet in January 2026 it brought a lot of talk about its specifications. Fogo is not another blockchain trying to do a lot of transactions per second. It is trying to build a network that works like financial systems but is still decentralized. This makes us ask a question: how does a high-performance blockchain really work when it is under a lot of stress?

In markets traders know that systems work differently when they are under pressure. A server can handle a lot of orders when things are normal. It can fail when there is a lot of demand. Blockchain networks are the same. They can look good in tests. We only really know how they work when people are actually using them. This is where we need to know if the network will degrade slowly or collapse suddenly.

Fogo says it can do 40-millisecond block times and a lot of transactions per second. These numbers come from its architecture, which is based on the Solana Virtual Machine, a custom validator client and a special consensus model. For developers and traders this is both a good and a bad thing. The good thing is that it can support markets that work like exchanges. The bad thing is that if the network is not strong it can fail when there is a lot of stress.

The network can be set up to handle a lot of transactions. If the validators or consensus mechanism are not good the system can pause or behave strangely. In blockchain terms this means the system can degrade slowly so traders can. It can collapse without warning. A collapse is bad because it causes confusion, failed transactions and a loss of confidence.

This is not a theory. In the past networks that said they could handle a lot of transactions but were not stable have failed. We learned that just because a network can do a lot of transactions does not mean it is stable. What matters is how the system responds to stress.

Fogo is trying to do things. By focusing on high-frequency trading it is reducing the things that can go wrong. It is also using a curated validator set and a single high-performance client to make the network more consistent. These decisions are meant to make the network respond to demand in a way rather than crashing.

Big numbers and plans are only part of the story. The real test is when real money and traders start using the network. We need to see how it works when there is liquidity, arbitrage and unpredictable trader behavior. Then can we see if the network will degrade slowly or collapse suddenly.

For traders this is a deal. If the network degrades slowly they can plan for it. Adjust their strategies.. If it collapses suddenly they will be caught off guard. This can disrupt the market not just individual traders.

In the weeks after Fogo launched we saw some activity and listings on exchanges. But we need to be careful. Just because the network is working now does not mean it will work when there is a lot of demand. The important thing is not how fast the network is when demand is low but how it works when demand is high.

The big picture is that people are not just looking for blockchains anymore. They want blockchains that work under real conditions, where the response is predictable and the failure modes are understood. Fogo is a test case for how the best blockchains will be judged in the future: not by how fast they are but, by how they work in the real world.@Fogo Official #fogo $FOGO