I’m Dr_MD_07, and I want to dig into why Vanar Chain stands out and why I keep coming back to implementation risk as the real make-or-break factor for blockchain adoption. I’ve spent years analyzing infrastructure projects. These days, with AI and modular blockchains shaking up the scene, the stakes are even higher.

Here’s the thing: implementation risk quietly kills off even the most technically impressive networks. I’ve watched protocols with jaw-dropping throughput numbers get sidelined because actually plugging them in is a headache too complicated, too unpredictable, or just financially unstable. Enterprises crave stability. Crypto-native builders need systems that fit together easily. If integration feels risky or scattered, adoption stalls. High TPS doesn’t matter if nobody wants to touch the stack.

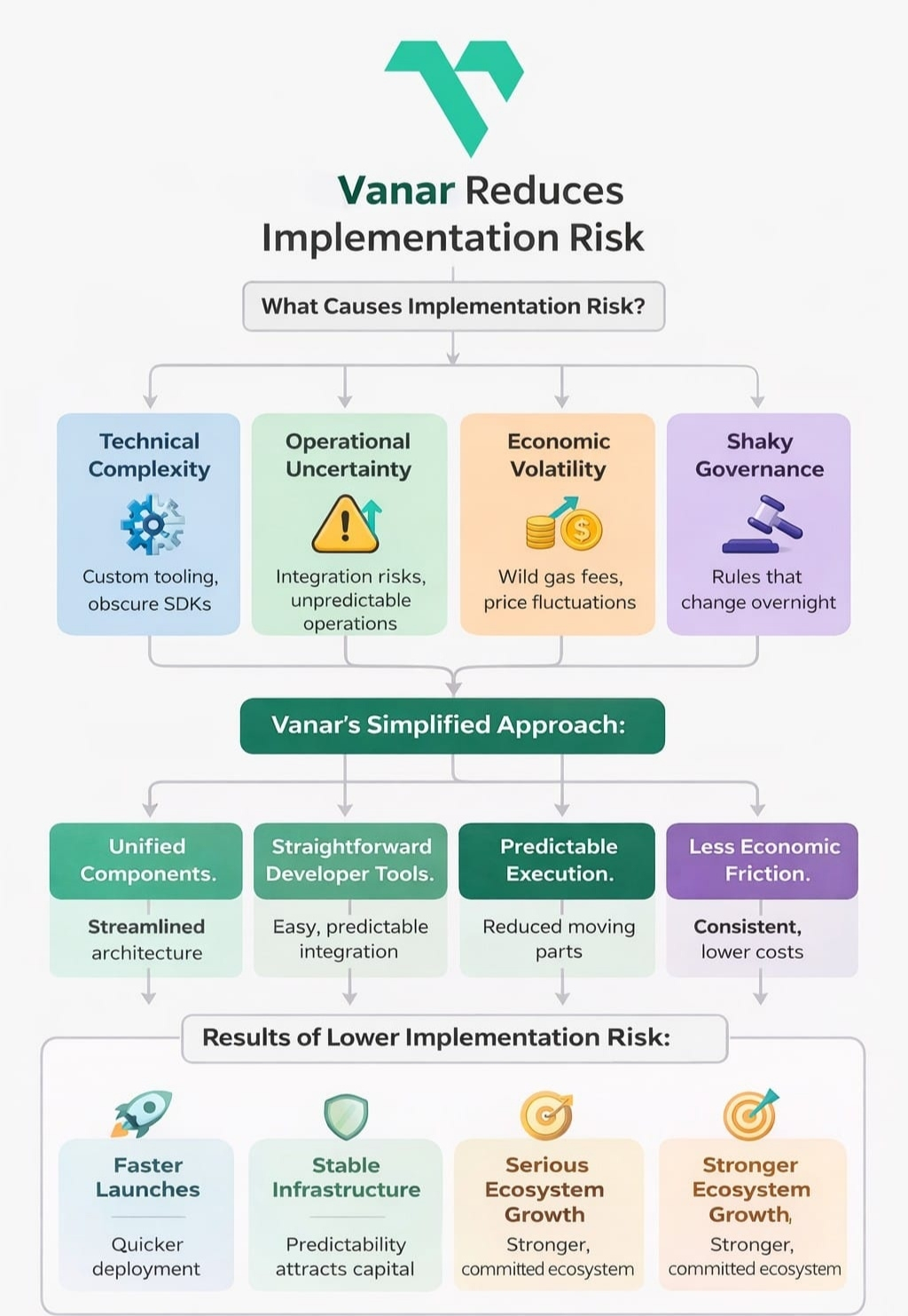

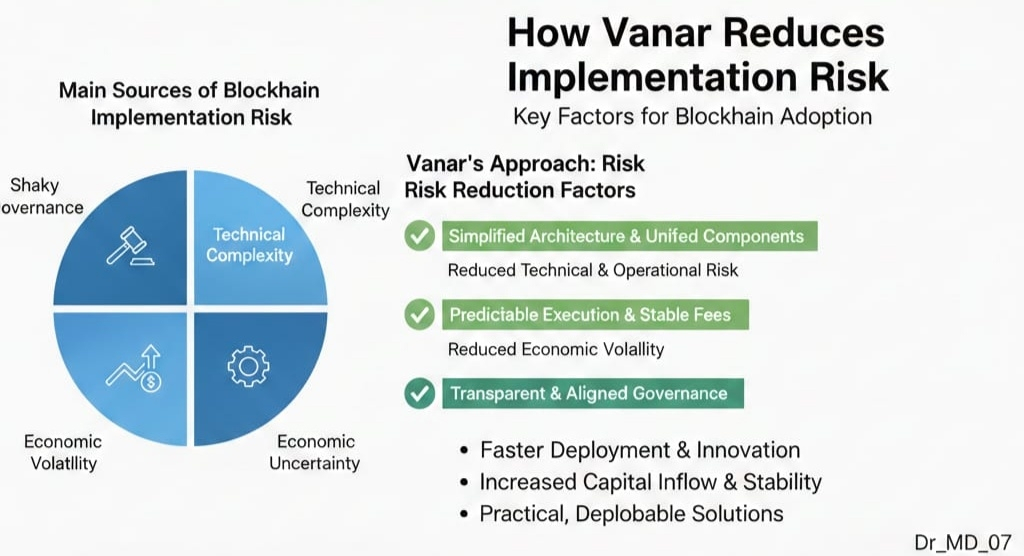

Whenever I look at Vanar, I zero in on how it smooths out integration pain points. Most implementation risk boils down to four culprits: technical complexity, operational uncertainty, economic volatility, and shaky governance. Developers and enterprises get spooked by custom tooling, obscure SDKs, wild gas fees, or rules that change overnight.

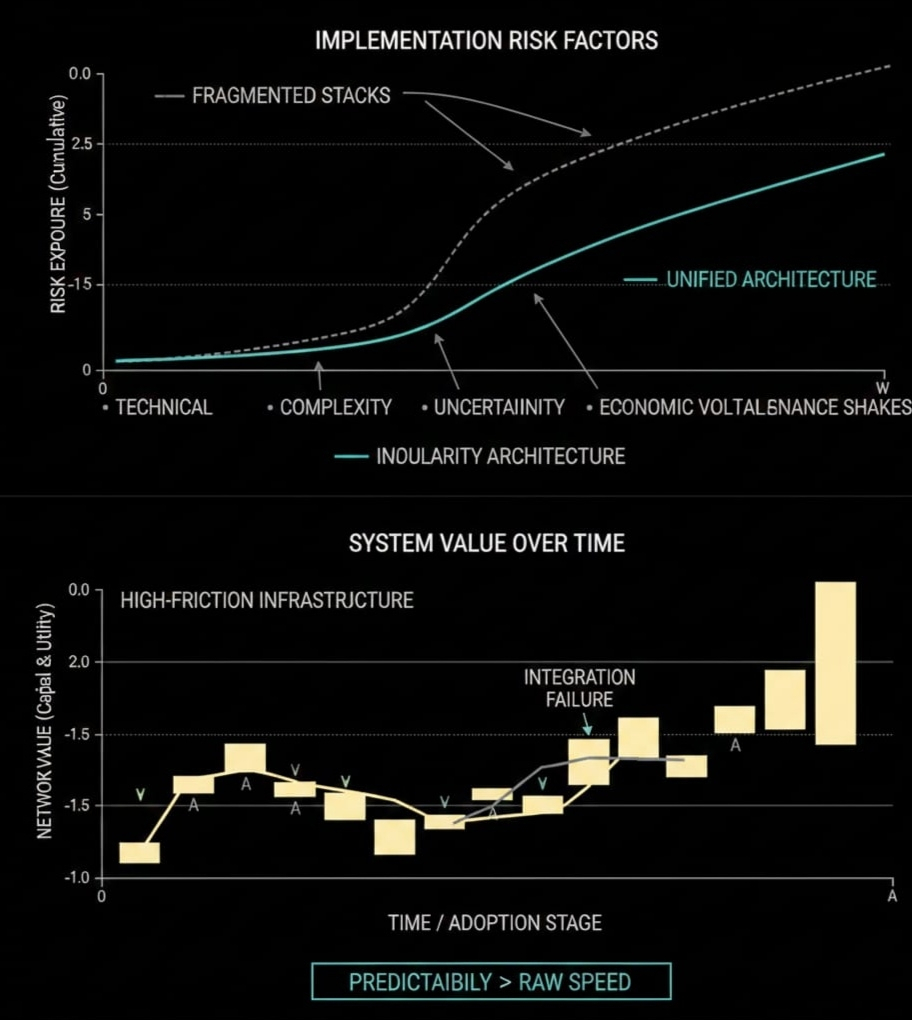

In today’s modular blockchain world, builders have to stitch together data availability layers, settlement, execution, bridges, and restaking. Every extra piece adds risk—more moving parts, more things that can break, more teams to coordinate. This kind of fragmentation isn’t just annoying; it’s a hidden cost that slows progress and erodes confidence.

Vanar takes a different approach: simplify the architecture. The network leans on unified components, straightforward developer tools, less cross-layer juggling, and predictable execution. The result? Fewer moving parts to manage like vertical integration in classic tech stacks. When you cut down on integration points, you cut down on surprises.

This simplicity matters. Smaller contract surfaces, fewer oracles, less latency chaos. You also get clearer lines of responsibility. In fragmented stacks, nobody wants to own the problem when things go sideways. With consolidated infrastructure, it’s easier to see what broke and fix it fast.

Then there’s the economic angle. Lowering implementation risk frees up capital and time. Builders spend less energy wrangling infrastructure and more on actual products. Enterprises can integrate faster, which means better returns. In my experience, predictability always beats raw speed. When infrastructure feels stable, serious capital sticks around.

All of this gets even more important with AI in the mix. AI-powered apps demand steady throughput, trustworthy data, and scalable compute. Right now, a lot of AI + blockchain projects stumble because their infrastructure is cobbled together from layers that weren’t built for heavy, nonstop workloads. If Vanar can deliver seamless integration and steady performance, that’s a serious advantage.

Of course, there are trade-offs. Relying too much on a single stack can raise centralization red flags. Governance needs to stay transparent, and incentives have to line up. Reducing implementation risk only works if you keep decentralization real. The sweet spot is making things usable without sacrificing resilience.

For builders, slashing implementation risk means faster launches and less operational drag. For investors, low-friction infrastructure signals a stickier, more committed ecosystem. And for traders, it’s smarter to watch developer activity and transaction stability than to get caught up in flashy announcements.

Bottom line: I don’t think the future of blockchain belongs to whoever posts the biggest TPS numbers. It belongs to networks that cut down uncertainty. Vanar’s real strength is in making blockchain feel practical something you can deploy, not just tinker with. When integration is predictable, capital moves in. Over time, it’s predictability not hype that grows true network value.