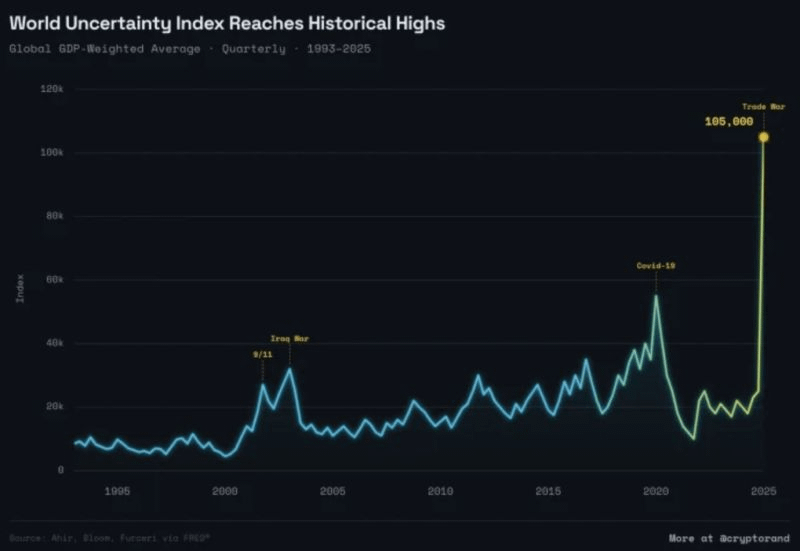

We’re not just living through normal market volatility.

The world is in a historic phase of uncertainty one that, in intensity, surpasses major crises like the pandemic, the 2008 financial collapse, and even the aftermath of 9/11.

Today’s indicators don’t lie. The global economy faces overlapping pressures:

fierce trade wars,

escalating geopolitical tensions,

and major central banks shifting policies as they try to balance recession risks against persistent inflation.

This sharp rise in uncertainty isn’t driven by a single factor.

It’s a full-blown storm forming on the horizon.

Conflicts are no longer confined to borders.

They now disrupt supply chains, impact energy prices, and cast doubt over the future of globalization itself.

When uncertainty spikes to these levels, major economic decisions get postponed and markets enter a state of excessive caution.

How should individual investors navigate the noise?

In times like these, the golden rule is:

“Don’t chase mirages protect yourself with real assets.”

Focus on quality:

Look for companies with strong cash flows and low debt businesses that can withstand prolonged turbulence.

Redefine safety:

Gold is no longer just ornamental; it has become a portfolio necessity, serving as a hedge against eroding trust in fiat currencies and traditional financial systems.

Geographic and sector diversification:

Don’t place all your bets in one basket, especially amid volatile international trade policies.

Emotional discipline:

Most importantly, don’t make decisions based on sensational headlines.

Uncertainty creates opportunity but only for those with patience and clarity of vision.

Bitcoin increasingly enters this conversation as a modern form of “real asset” not tied to corporate earnings, sovereign debt, or central bank policy.

In a low-visibility zone where trust in institutions, currencies, and global coordination weakens, Bitcoin offers fixed supply, neutrality, and portability across borders.

It does not replace gold or quality equities, but it complements them as a hedge against systemic uncertainty and monetary expansion. In an era of blurred visibility, mathematical scarcity becomes a strategic anchor.

History teaches us that peaks in fear indicators often mark the beginning of market resets.

What matters isn’t where the world stands today but how well you protect your financial position for tomorrow.

Share your view:

In this foggy environment, which asset do you believe is the most resilient?

This article is for information and education only and is not investment advice. Crypto assets are volatile and high risk. Do your own research.

📌 Follow @Bluechip for unfiltered crypto intelligence, feel free to bookmark & share.