$FOGO @Fogo Official #fogo #FogoChain

I’ve been digging deeper into #Fogo lately, and the more I look at it, the clearer the positioning becomes.

Fogo isn’t trying to be a general-purpose chain for every possible use case. It’s being engineered for one specific environment: high-performance on-chain trading.

This is infrastructure built for participants who care about milliseconds.

Think about who actually benefits from that:

🔥Market makers managing tight spreads

🔥Perpetual futures traders operating with leverage

🔥High-frequency strategies reacting to price feeds

🔥Real-time auction mechanisms where latency changes outcomes

For these participants, speed isn’t marketing, it’s edge.

40ms Blocks Change Market Behavior

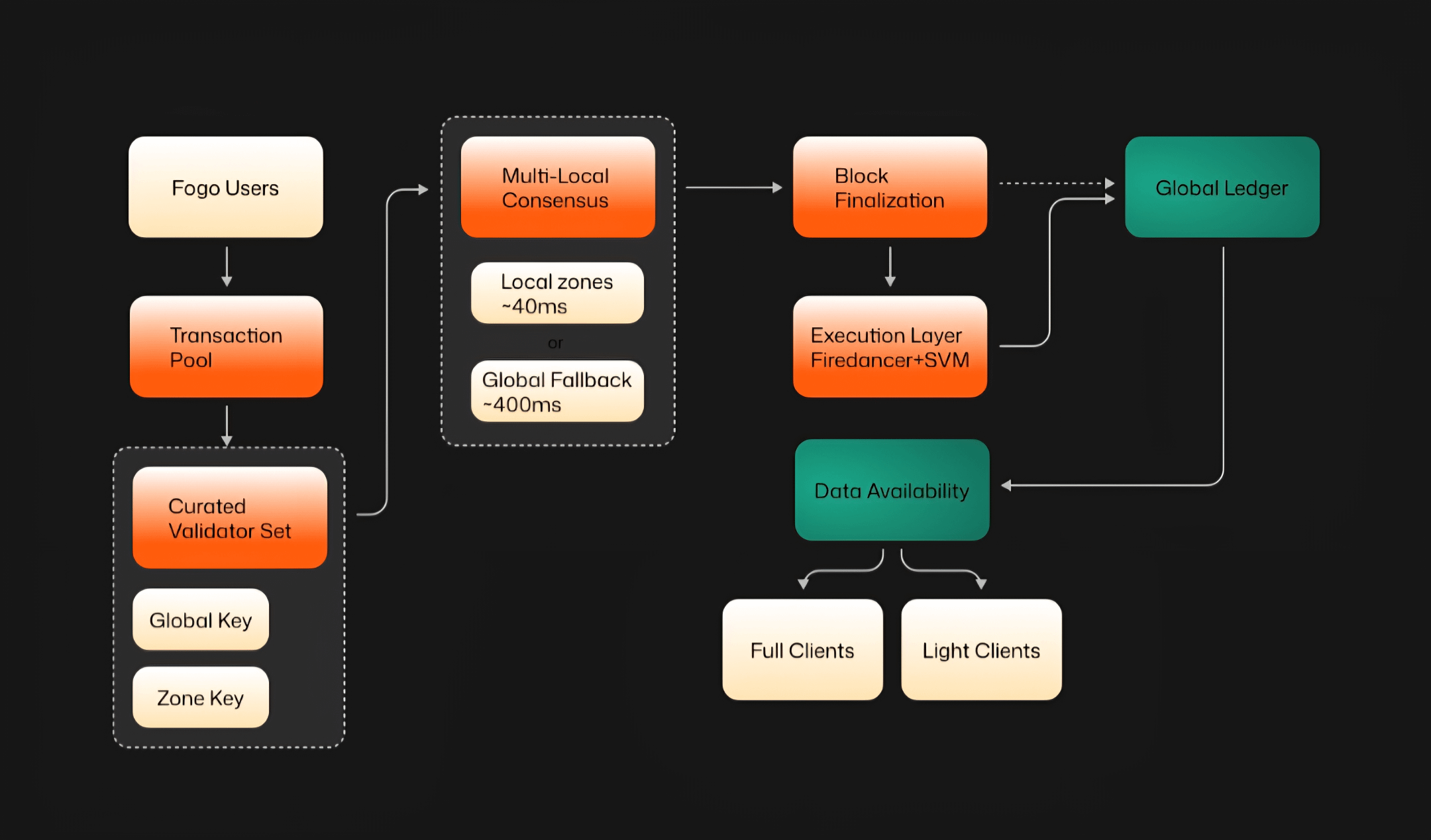

Fogo runs as an SVM-compatible Layer 1, meaning developers familiar with Solana tooling can build without starting from zero. But the real differentiator is latency.

With block times around 40 milliseconds and near-instant finality, the execution window tightens dramatically compared to traditional on-chain environments.

On slower networks, market makers face exposure between quote updates. Prices move. Arbitrageurs react. Makers compensate by widening spreads, reducing size, or paying priority fees. It’s defensive positioning.

Shrink that window to 40ms and the game shifts. Quotes can update more frequently. Exposure decreases. Spreads can tighten. The system becomes structurally more efficient.

That has second-order effects:

💪Better execution.

💪More competitive liquidity.

💪Improved capital efficiency.

💪Real-Time DeFi, Not Delayed Settlement

We talk a lot about “on-chain trading,” but in many cases it still feels detached from real-time markets. Delays compound. Confirmation times add friction. Execution risk grows.

Fogo’s thesis is simple: if decentralized markets want to compete with centralized venues, they must approach similar performance standards.

Not in theory, in practice.

Near-instant confirmation means traders can execute strategies without waiting through multiple block cycles. Funding rate arbitrage, liquidation protection, structured derivatives. All these mechanisms depend on precise timing.

When latency drops, entire categories of strategy become more viable.

Infrastructure Over Narrative

What stands out is that this isn’t built around social momentum. It’s built around throughput, execution quality, and validator optimization.

SVM compatibility lowers the barrier for developers. Performance-focused architecture attracts liquidity providers. If those two layers connect, ecosystem growth follows.

Of course, infrastructure alone doesn’t guarantee adoption. Liquidity needs to arrive. Applications need to deploy. Market makers need to route flow. That part takes time.

But when a chain is architected specifically for high-speed financial activity, it creates a clear target audience. Not everyone needs 40ms blocks. But the participants who do, really do.

My View

When I see a project focused on execution quality rather than abstract promises, it gets my attention.

If the next phase of the market rewards:

🔥Deep liquidity

🔥Efficient spreads

🔥High-throughput execution

🔥Real trading volume

Then networks optimized for those variables will stand out.

Fogo isn’t trying to win the loudest conversation. It’s trying to win the fastest one.