Vanar’s Big Bet: AI Agents, Real Payments, and a New Kind of On-Chain Infrastructure

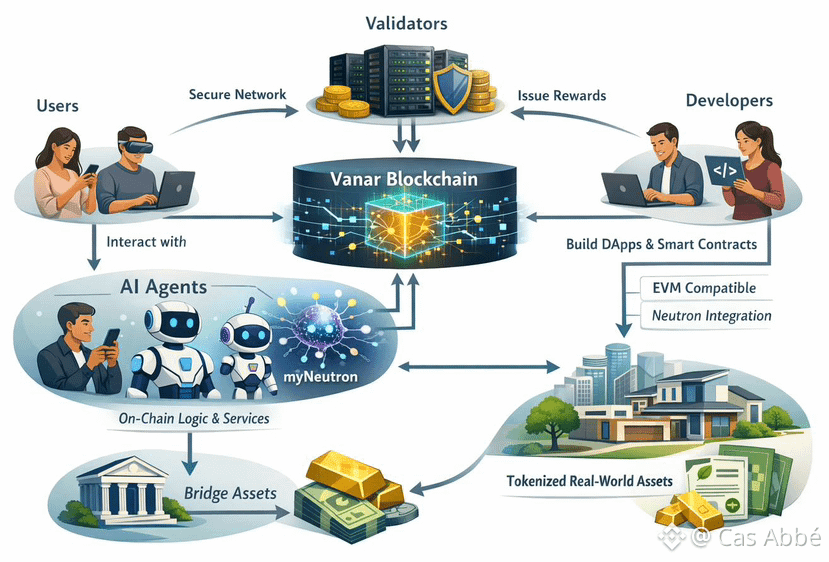

Vanar is trying to build something that feels less like a “crypto project” and more like a working foundation for real-world finance and AI-powered apps. The clearest, confirmed signal is where they’ve been putting their energy: payments that actually run in production, stablecoins that move like money should, and infrastructure meant to support AI agents and tokenized real-world assets without falling apart when things get operationally messy.

A major proof point came at Abu Dhabi Finance Week 2025. Vanar showed up alongside Worldpay, and the focus wasn’t hype. The discussion centered on the hard parts that decide whether stablecoins and tokenized assets can move beyond pilots and demos. They highlighted the real machinery behind payments: how customers get onboarded safely, how disputes are handled, how treasury teams manage flows, and how value converts back and forth between traditional rails and digital ones. In other words, it wasn’t just “tokenization is coming.” It was: what needs to be true for it to work day after day, with institutional-grade expectations.

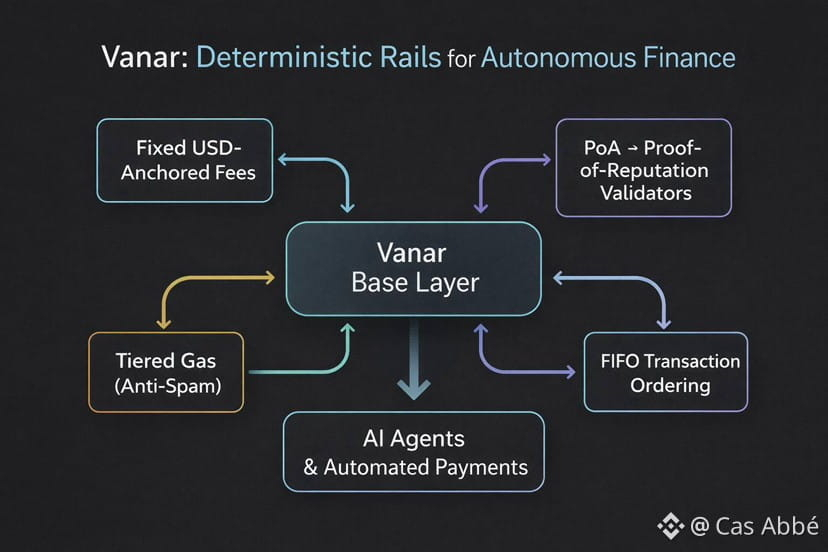

Not long before that, Vanar made another concrete move: bringing in senior payments leadership. Saiprasad Raut joined as Head of Payments Infrastructure, and the way the role was described matters. The job isn’t framed as “partnerships” or “community.” It’s framed around building payment plumbing—stablecoin settlement, tokenized value movement, and what they call “intelligent” or “agentic” payments. Put simply, Vanar is pointing toward a future where software doesn’t just help you pay, it actively handles pieces of the workflow for you: routing decisions, compliance checks, treasury logic, and the repetitive steps that slow down financial operations. Some reporting also noted deeper operational alignment with Worldpay, including a claim that Worldpay became an official validator on Vanar Chain earlier that year, which—if accurate—would suggest more than just a one-off stage appearance.

On the product side, Vanar’s public messaging keeps pushing the idea of an AI-native “stack,” not just a base blockchain. Their own site describes multiple layers built to work together. Vanar Chain sits at the bottom, and above it are components presented as building blocks for AI systems and real-world infrastructure. One of the most talked-about pieces is Neutron, which was publicly introduced around the Token2049 Dubai period through the Vanar Vision event and later coverage. Neutron is described as an on-chain compression and storage approach, with bold claims about putting complete files “directly on-chain.” That’s a big promise, and while the reporting repeats it, the key confirmed point is simpler: Neutron was publicly presented as a core part of Vanar’s direction, and it’s being positioned as the memory layer for how data-heavy AI and ownership systems might run in a more verifiable way.

Taken together, the picture is fairly consistent. Vanar is telling the market it’s building infrastructure for AI agents and tokenized real-world systems, but its most visible momentum is around payments and settlement—where the real tests are operational reliability, compliance, and making digital value behave like something enterprises can actually use. And importantly, there’s a sign of discipline in how the “confirmed” story is being handled. Some secondary sources have floated a very specific “AI-native infrastructure launched Jan 19, 2026” claim, but without a primary Vanar announcement backing that exact launch framing and date, it’s smart not to treat it as verified. What is verified is already substantial: a high-profile payments narrative with Worldpay, a senior hire aimed at building serious payment infrastructure, and a product stack that’s being marketed as purpose-built for AI-era applications and tokenized real-world value.