I need you to stop scrolling and actually read this one.

On February 18, 2026, SEC Chairman Paul Atkins took the stage at ETHDenver alongside Commissioner Hester Peirce and said out loud, in public, on the record, what the crypto community has been waiting to hear for years. He laid out exactly how the SEC plans to regulate crypto going forward. Not with lawsuits. Not with ambiguity. With actual, clear, written rules.

This is the most important regulatory moment for crypto since Bitcoin was declared a commodity in 2014. And most people on Binance Square haven't read a single word of what was actually announced. So let me break it all down.

Why This Matters More Than Any Price Movement

Here's something most traders don't think about enough. Price follows regulation. Not the other way around. Every single major crypto bull run was preceded by regulatory clarity. When the SEC approved Bitcoin ETFs in early 2024, BTC ran from $42K to $73K in two months. When the GENIUS Act passed for stablecoins in 2025, the total stablecoin market cap doubled. When Japan legalized crypto as a payment method, their market exploded.

What Atkins announced at ETHDenver is bigger than any individual ETF approval. He announced the entire framework. The rule of law for crypto is coming. Not someday. Now. In the coming weeks and months, in his exact words.

For Binance users specifically, this matters because Binance was one of the exchanges the SEC sued under Gensler. That lawsuit is now in a completely different regulatory environment. The new SEC isn't looking to destroy exchanges. They're looking to build rules that let them operate legally.

The 7 Announcements: What Atkins Actually Said

Let me go through each announcement and explain what it means in plain language.

Number 1: Investment Contract Framework. This is the big one. The SEC is finally going to publish a clear framework explaining when a crypto asset is and isn't a security. Under Gensler, the SEC's approach was basically we'll tell you it's a security when we sue you for selling it. That's over. Atkins specifically mentioned they'll define how an investment contract is formed and, critically, how it can be terminated. That second part is huge. It means a token that started as a security through an ICO can potentially become a non-security as the project decentralizes. That's a game-changer for every project that did a token sale.

Number 2: Innovation Exemption. This one is fascinating. The SEC wants to create a legal sandbox where tokenized securities can be traded on decentralized platforms like automated market makers. Think about that. The SEC is actively considering letting tokenized versions of stocks trade on DeFi protocols. Atkins specifically said he wants to let market participants engage with decentralized applications on public, permissionless blockchains. That's a direct quote from the SEC Chairman. About DeFi. On the record.

Number 3: Capital Raising Rules. New rulemaking to create legal pathways for projects to raise money through token sales. Under Gensler, there was no legal way to do a token sale in the US without either registering as a security (which was basically impossible for crypto projects) or hoping you didn't get sued. Now the SEC is writing actual rules for how to do it legally.

Number 4: Wallet Clarity. This one directly affects anyone using Binance's Web3 wallet or any non-custodial wallet. The SEC is issuing no-action letters and exemptive orders to clarify that wallets and user interfaces don't need to register as broker-dealers under the Exchange Act. MetaMask, Trust Wallet, Phantom, and every other wallet developer can breathe easier.

Number 5: Broker Custody Rules. Brokers will be allowed to custody non-security crypto assets and payment stablecoins. This opens the door for traditional financial institutions to hold crypto for their clients. Think about what happens when every brokerage in America can offer crypto custody. The amount of capital that enters this market will be massive.

Number 6: Transfer Agent Modernization. The SEC is updating transfer agent rules to officially recognize blockchain-based recordkeeping. This sounds boring, but it's actually the infrastructure that enables tokenized securities to work at scale. Without this, tokenized stocks and bonds can't properly track ownership on-chain.

Number 7: SEC + CFTC Joint Rulemaking through Project Crypto. This might be the most significant long-term announcement. The SEC and CFTC have historically been in a turf war over who regulates what in crypto. Atkins announced they're now working together through a joint initiative called Project Crypto. Mike Selig, who Peirce originally brought to the SEC's Crypto Task Force, is now the CFTC Chairman. These two agencies are now coordinating instead of competing. Atkins called it unlike anything seen before.

The Before and After: Understanding How Big This Shift Is

To really grasp why this matters, you need to understand what crypto regulation looked like before.

Under Gary Gensler (2021-2025), the SEC brought over 100 enforcement actions against crypto companies. There were zero clear rules about what constituted a security in crypto. SAB 121 effectively blocked banks from offering crypto custody. The SEC sued Coinbase, Binance, Kraken, and dozens of smaller projects. Gensler publicly stated that everything except Bitcoin is likely a security. The entire regulatory approach was enforce first, maybe write rules later.

Under Atkins, the transformation has been dramatic. SAB 121 has been rescinded, banks can now custody crypto. The SEC issued guidance clarifying that staking, mining, and meme coins are not securities. They created a token taxonomy that categorizes different types of crypto assets. They approved generic listing standards for crypto ETPs, leading to ETFs for DOGE, SOL, and XRP. And now, with the ETHDenver announcements, they're building the full regulatory framework through formal rulemaking.

The Crypto Task Force has held roundtables, met with developers across the country, and published multiple guidance documents. They've issued no-action letters for specific projects, including tokenization and DePIN applications. This is what functional regulation looks like.

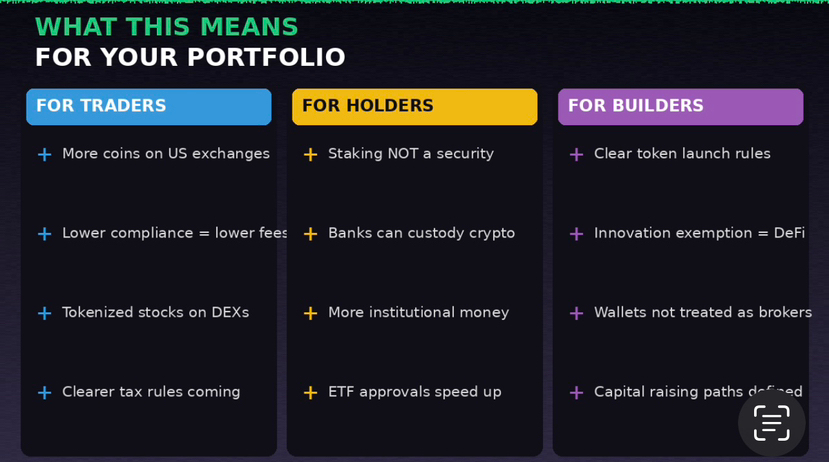

What This Means for Your Portfolio

If you're a trader, expect more tokens listed on US-regulated exchanges. When the investment contract framework is published, tokens currently in a regulatory gray zone will get clarity. Projects confirmed as non-securities will see massive US exchange listings. Lower compliance costs for exchanges will eventually translate to lower trading fees.

If you're a holder, the staking clarity is immediately relevant. The SEC has already declared that staking is not a securities activity. That means Binance and other platforms can offer staking products in the US without fear of enforcement action. Banks entering crypto custody means your assets have more institutional-grade storage options. And the pipeline of new ETF approvals is accelerating.

If you're a builder or developer, this is the most important news in years. Clear capital raising rules mean you can actually fundraise legally in the US. Wallet developers no longer face the threat of being classified as unregistered brokers. The innovation exemption could let you build DeFi protocols that interact with traditional securities.

The Timeline: When These Rules Drop

Right now (Q1 2026), the token taxonomy and initial investment contract framework guidance are already published. These are staff statements, not formal rules, but they give the market clear direction.

In Q1 to Q2 2026, expect the innovation exemption proposal. Atkins called this one of his top priorities. The Office of Information and Regulatory Affairs signaled in September 2025 that formal SEC rule proposals are coming in 2026.

Q2 2026 should bring the capital raising rulemaking proposal. This will define how crypto projects can legally raise funds through token distributions.

May 15, 2026 is a wildcard. That's when Powell's term as Fed Chair ends and Kevin Warsh takes over. While not directly SEC regulation, the Fed controls monetary policy and a new Chair could shift the macro environment for all risk assets.

Q3-Q4 2026 is when broker custody rules and transfer agent modernization should be finalized. These are the infrastructure pieces that enable traditional finance to fully participate in crypto.

Throughout 2026-2027, the SEC and CFTC will continue joint rulemaking. Congress is working on the market structure bill. The CLARITY Act passed the House, and the Senate Agriculture Committee advanced its version. Atkins testified that legislation is needed to make the rules future-proof.

The Honest Risk Assessment

Rules can be reversed. Atkins himself acknowledged this. Without legislation from Congress, everything the SEC does through rulemaking can be undone by a future administration. That's why the congressional bill matters.

The innovation exemption might be narrower than people hope. Peirce herself compared it to buying an abandoned storage unit, saying people expect gold bars inside. She cautioned it would be important but would not change the entire financial system overnight.

BTC is still at $68K in extreme fear territory. Regulatory clarity is bullish long-term, but it doesn't override macro factors in the short term. The FOMC minutes, PCE data, and the broader economic environment still dominate price action right now.

The Bottom Line

What happened at ETHDenver on February 18, 2026 will be remembered as a turning point. The SEC Chairman went to a crypto conference and announced seven specific regulatory initiatives. This isn't a press release. It's a regulatory roadmap published on SEC.gov as an official speech.

Short-term, the market will keep doing what markets do. BTC is in a correction. Fear is extreme. Don't FOMO based on regulation news alone.

Long-term, this is the most bullish regulatory environment crypto has ever had. When clear rules meet institutional capital, the result is massive market expansion. We're in the regulatory clarity phase. The institutional flood comes next.

#CryptoNews #StrategyBTCPurchase #SECChairman #WriteToEarnUpgrade #BTCVSGOLD