Ethereum is standing at a pivotal moment.

After a brutal five-month correction that dragged price from the October 2025 highs down toward the $1,850–$1,930 range, one question dominates the conversation:

Is the bottom finally in?

📉 Market Structure & Elliott Wave Outlook

From a technical standpoint, Ethereum’s chart reflects a textbook corrective phase within a larger macro uptrend.

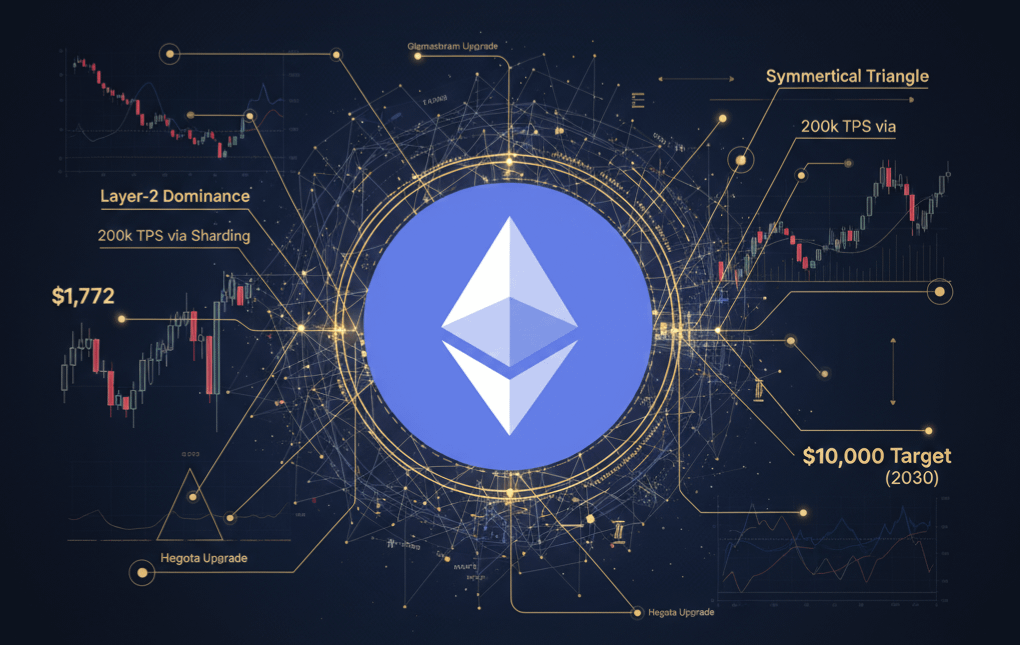

Wave 2 Correction: Many analysts interpret the current drawdown as a large-scale Wave 2 pullback inside a multi-year bullish impulse. While downside liquidity near $1,772 remains possible, momentum indicators are approaching historically oversold extremes.

The Golden Liquidity Zone: A major demand range between $1,792 and $2,206 has emerged. Deep retracements into this zone have historically preceded powerful V-shaped recoveries — particularly if the $1,890 region continues to hold.

Compression Before Expansion: Although MACD remains negative, higher-timeframe symmetrical triangle structure suggests volatility expansion is approaching. Periods of compression at macro support often precede decisive trend moves.

🚀 The Long-Term Thesis: Ethereum as Global Settlement Infrastructure

Ethereum in 2026 is no longer simply a transaction network — it is becoming financial infrastructure.

Layer-2 Dominance: With the majority of retail activity migrating to scaling solutions like Arbitrum and Base, Ethereum Layer 1 is evolving into a high-security settlement layer and capital coordination hub.

Scaling Roadmap: Upcoming upgrades aim to dramatically reduce Layer-2 costs and increase throughput through parallel execution and sharding — positioning the network for exponential growth in on-chain activity.

Institutional Adoption: With expanding ETF exposure and accelerating tokenization of real-world assets, long-term projections from major analysts place valuation targets between $5,000 and $10,000 by 2030.

🧠 Final Thought

A bottom is rarely a single candle — it’s a process.

Short-term volatility may still test lower liquidity pockets, but structurally, the convergence of institutional inflows, scaling innovation, and Ethereum’s evolution into a global settlement layer paints a compelling long-term picture.

In markets, fear creates opportunity especially when fundamentals strengthen beneath the surface.