The crypto market is going through one of its most painful phases right now.

Bitcoin is trading around the $60,000 level, and fear is clearly visible across the market. Altcoins are bleeding heavily—some down 20%, 30%, even over 50% in a very short time. Social media is filled with panic, frustration, and people questioning whether this is the end of crypto.

But the truth is simple: this is not new.

Every Bitcoin cycle has a phase where the market looks completely broken. Prices fall sharply, retail investors panic, leveraged traders get liquidated, and altcoins suffer the most. Headlines scream “Crypto is dead.”

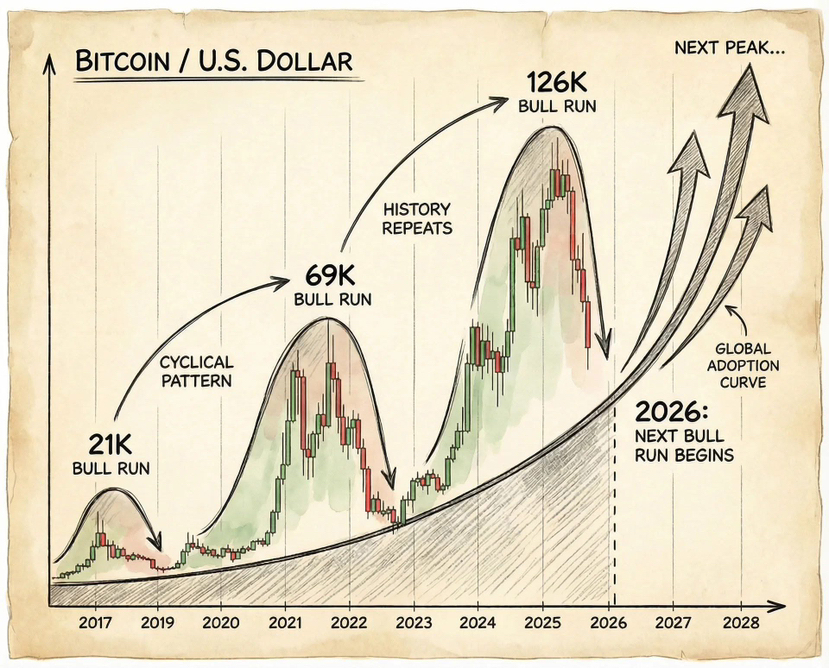

We have seen the same emotions in 2018, 2020, and 2022—and every time, Bitcoin survived and came back stronger.

When Bitcoin corrects, money moves away from risk. That is why altcoins bleed harder. This does not mean crypto is finished. It means weak projects are getting flushed out while strong narratives slowly build during accumulation.

Bitcoin at $60K feels scary today only because price came down from higher levels.

Zoom out. Just a few years ago, people dreamed of seeing Bitcoin at this price.

Markets do not move in straight lines. They move in cycles and waves.

Right now, the market is not testing technology. It is testing patience, discipline, and emotional control. Weak hands are shaking out, emotional traders are exiting, and over-leveraged positions are getting wiped.

This phase is painful, but it is also necessary. Every major expansion starts after maximum fear.

Despite the crash, the bigger picture remains strong. Institutional adoption is growing, ETFs are live, regulations are being discussed, and blockchain technology continues to improve. The foundation is not collapsing—the market is simply resetting.

A painful market does not mean the end of crypto. It means transition.

The real question is not: “Is Bitcoin dead?”

The real question is: “Can you stay patient when the market hurts?”

Because in crypto, history always rewards those who survive the painful phase before growth.