Abstract

This research report evaluates @Fogo Official as a performance-optimized SVM Layer-1 blockchain designed specifically for real-time financial applications. Unlike general-purpose chains that pursue broad composability narratives, Fogo appears structurally oriented toward high-frequency trading environments, low-latency execution, and institutional-grade reliability. This paper analyzes architecture, validator topology, ecosystem formation, economic design, competitive positioning, and long-term risk factors.

⸻

1. Investment Thesis

Fogo’s core thesis can be summarized in three pillars:

1. Latency is alpha — execution speed directly impacts profitability in DeFi.

2. Infrastructure precedes liquidity — robust architecture attracts serious builders.

3. Performance differentiation creates specialization — not every chain should be general-purpose.

If Fogo successfully captures performance-sensitive applications (derivatives, perp DEXs, market makers, MEV-aware systems), it could occupy a specialized niche within the broader SVM ecosystem.

2. Technical Architecture Analysis

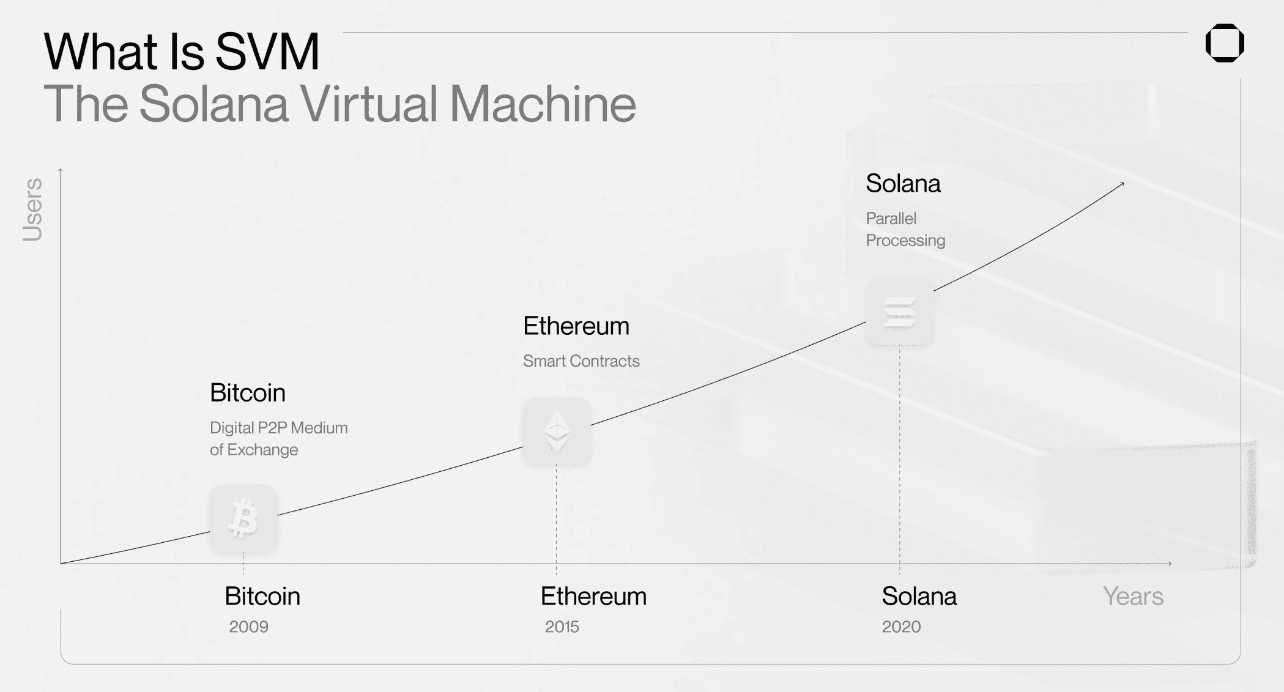

2.1 SVM Compatibility

Fogo is fully compatible with the Solana Virtual Machine (SVM). This reduces developer switching costs and enables:

• Contract portability

• Familiar tooling

• Faster ecosystem bootstrapping

• Reduced audit friction

Strategically, SVM compatibility lowers the barrier for migration while allowing Fogo to differentiate on execution environment and validator strategy.

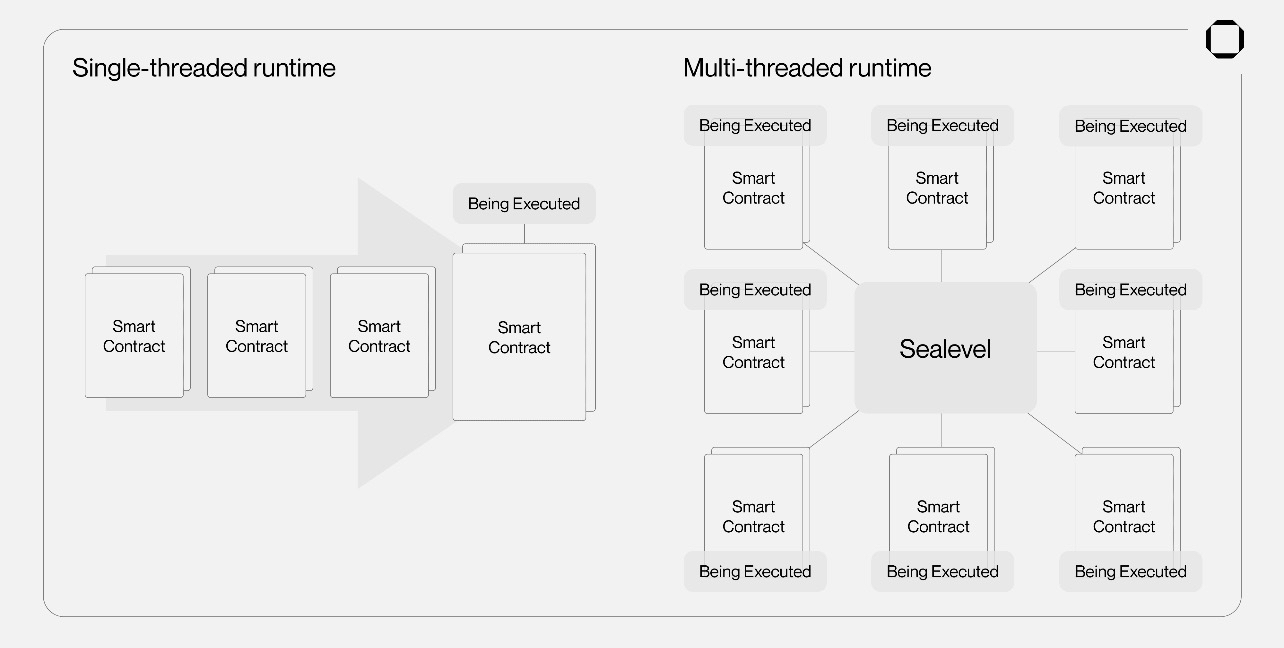

2.2 Firedancer-Based Client

Fogo utilizes a customized Firedancer-based execution client. Firedancer is known for:

• Parallelized transaction processing

• Hardware-efficient design

• High throughput capability

• Deterministic performance optimization

This indicates Fogo is targeting consistent latency under stress, not merely peak benchmark numbers.

In trading systems, variance in latency is often more damaging than average latency. Stability may therefore be a stronger long-term differentiator than theoretical TPS.

2.3 Validator Architecture & Latency Engineering

One of the most distinctive features is validator colocation strategy:

• Initial validator sets deployed in high-performance data centers.

• Proximity to exchange infrastructure reduces round-trip latency.

• Backup nodes deployed geographically for redundancy.

This approach prioritizes:

• Execution predictability

• Network reliability

• Professional trading alignment

Trade-off: Early-stage decentralization may be constrained compared to globally distributed validator models. However, this may be a deliberate performance-first phase strategy.

3. Ecosystem Structure Evaluation

The Fogo ecosystem forms across several coordinated layers:

3.1 Trading Layer

• Perpetual markets

• Hybrid orderbook + AMM DEXs

• Derivatives infrastructure

This is typically the primary liquidity driver on performance chains.

3.2 Capital Efficiency Layer

• Lending protocols

• Leverage systems

• Liquid staking mechanisms

These allow capital to circulate rather than remain idle, increasing TVL efficiency.

3.3 Infrastructure Layer

• RPC optimization

• Indexing services

• Data analytics providers

This is critical for developer retention and uptime under heavy usage.

3.4 Access Layer

• Wallet integrations

• Cross-chain bridging

Reduces user friction and supports liquidity inflows.

Observation: The ecosystem is forming horizontally rather than sequentially. That suggests coordinated growth rather than organic randomness.

⸻

4. Economic Design & $FOGO Utility

The native $FOGO token underpins network economics:

• Gas utility (with possible session sponsorship models)

• Staking incentives

• Validator security alignment

• Ecosystem incentive distribution

The key question for long-term value capture is:

Does increased trading volume translate into measurable token demand?

If fee flow, staking demand, and ecosystem growth reinforce each other, $FOGO could become structurally tied to network activity rather than speculative cycles alone.

⸻

5. Competitive Landscape

Fogo competes within three overlapping arenas:

1. High-performance SVM chains

2. Derivatives-focused L1 ecosystems

3. Latency-optimized trading infrastructure networks

Differentiation appears to rely on:

• Validator colocation strategy

• Firedancer optimization

• Trading-first positioning

The challenge will be defending this niche against:

• Core Solana upgrades

• App-specific rollups

• Centralized exchange hybrid models

⸻

6. Strengths & Risks

Strengths

• Clear specialization narrative

• Performance-centric architecture

• Developer portability (SVM)

• Early ecosystem layering

• Institutional trading alignment

Risks

• Early validator concentration perception

• Liquidity fragmentation risk

• Competition from Solana mainnet improvements

• Dependency on trading narrative strength

• Market cycle sensitivity

7. Long-Term Outlook

If the market continues moving toward:

• On-chain derivatives

• Institutional DeFi

• Low-latency execution

• MEV-aware trading systems

Then performance-optimized networks like Fogo may benefit disproportionately.

However, success depends on:

• Sustained liquidity growth

• Developer retention

• Clear token value capture mechanics

• Progressive decentralization roadmap

Final Assessment

Fogo is not attempting to be “another Layer-1.”

It is positioning itself as a specialized execution environment for real-time finance.

If it succeeds, it could become:

• A performance extension of the SVM ecosystem

• A hub for derivatives-centric DeFi

• A liquidity-dense micro-financial network

At its current stage, Fogo represents exposure to an early infrastructure thesis — one that depends less on hype and more on execution quality.