The Ghost in the Machine: Why Speed is a Lie Without Secrecy

Greetings to people.

Trading at the speed of light doesn’t matter if your strategy is leaked to the world before the block even settles.

Imagine standing in a high stakes poker room where every other player can see your cards through a reflection in the window behind you. You might be the fastest dealer in the building, but you’ll still lose every hand.

Badi tezi se chalti hai ye duniya, magar hosh kisko hai?

Chirag bujhne se pehle, batado ki roshni kisko hai?

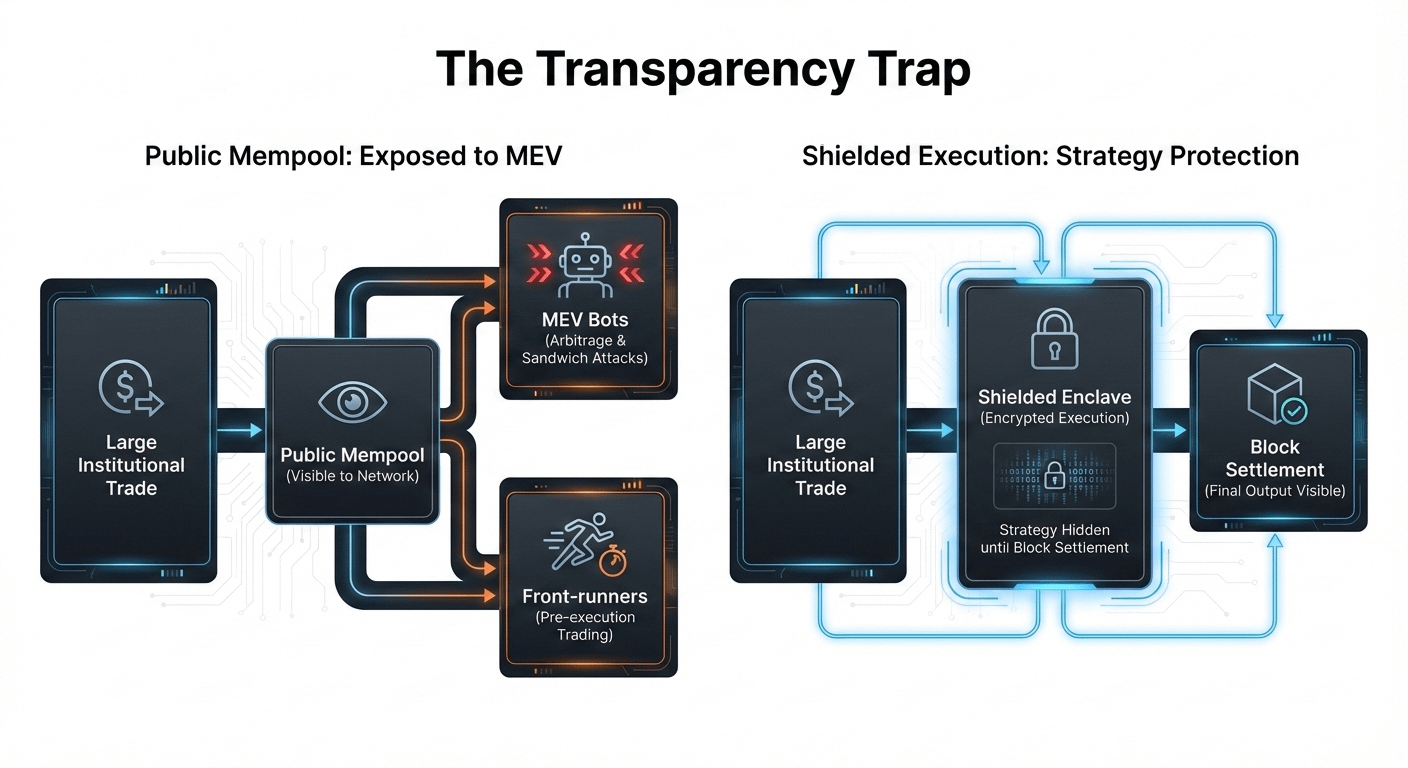

This is the "Transparency Trap" of modern blockchain. In the real world, when a fund manager moves capital, the mere visibility of that move shifts the market against them. On most chains, you are essentially playing poker with your cards facing the table. We’ve seen this failure before: high-speed chains that offer "transparency" but end up creating a playground for MEV bots and front-runners who pick apart every trade before the ink is dry.

The Core Problem: The Transparency Trap

The industry has long treated privacy as a "plugin" something you add later if you’re doing something sensitive. But for regulated finance, transparency is a double-edged sword. If an institution must disclose its entire balance sheet and every pending move to the public just to use a decentralized ledger, the system is fundamentally broken for them.

The current "privacy by exception" models like mixers or opt-in shielded pools feel awkward because they flag the user. In the eyes of a regulator, if you are the only person in the room wearing a mask, you are the suspect. In the eyes of the market, if you are the only person hiding your trade, you are the signal.

Mechanism Analysis: FOGO’s Regional High Speed Engine

FOGO attempts to solve this by moveing away from the "one size fits all" global validator model. It’s not just a chain; it's a high density liquidity layer built on the Solana Virtual Machine (SVM).

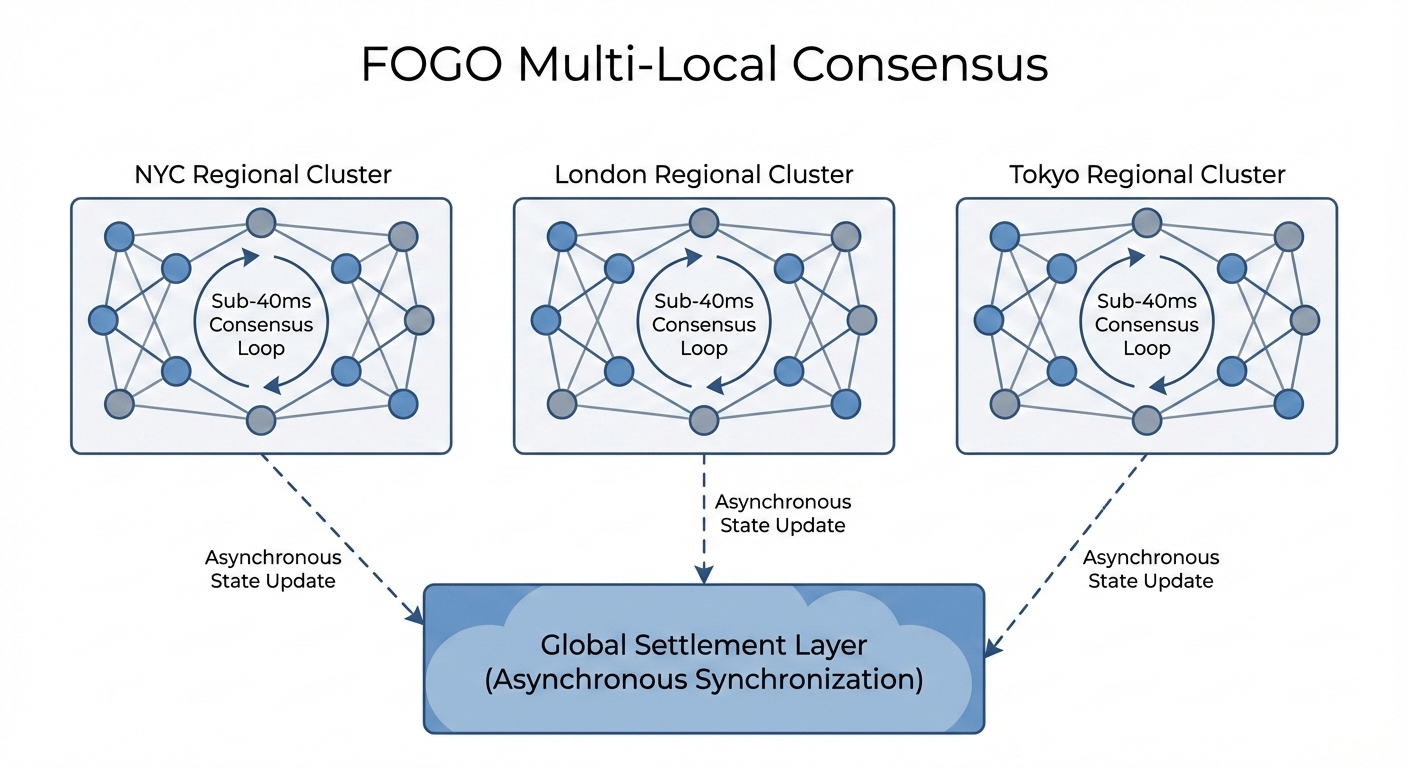

Regional Clusters: FOGO uses a Multi Local Consensus. Validators are grouped geographically. If you are trading in a high density financial hub, your transaction reaches consensus within a local cluster first.

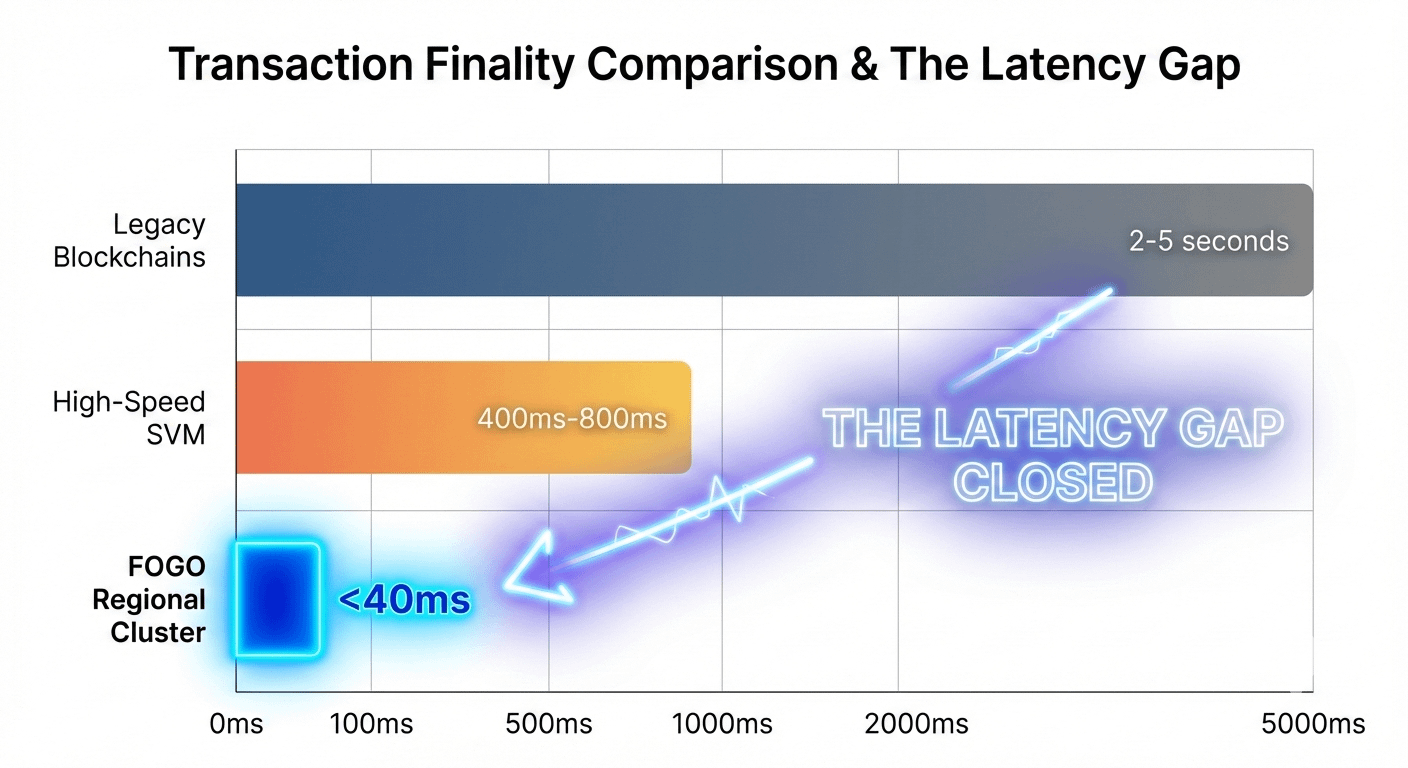

The 40ms Target: By utilizeing a pure Firedancer implementation, the goal is 40 millisecond block times. This isn't just for "hype" it’s to match the internal speeds of top tier Binance engines.

Enshrined Primitives: Unlike general-purpose chains, FOGO builds the limit order book and oracles directly into the protocol. This removes the "middleman" latency of third party smart contracts.

Evidence & Data: The Latency Gap

In finance, a 10 millisecond delay is an eternity. Current "fast" chains still hover around 400ms to 800ms for finality. FOGO’s pursuit of sub-50ms execution is an attempt to close the gap where professional market makers currently loose money to "stale" prices. When the mechanism is regional, the physical distance of light through fiber optics becomes the only limit.

Koshish bohot ki raftar pakadne ki is zamane ne,

Magar rasta wahi mila jo likha tha purane ne.

Failure Modes & Risks

The risk of such extreme speed is Regional Fragility. If a specific geographic cluster goes offline due to a localized internet outage, the "Multi-Local" advantage could become a bottleneck.

Gammma Ray Errors: There is a known risk in high-frequency systems where "soft" errors in hardware can lead to inconsistant states if the consensus isn't robust enough.

Governance Centralization: To maintain 40ms speeds, the hardware requirements for validators are massive. This naturally limits who can run a node, potentialy leading to a "club" of elite validators rather than a truly permissionless network.

Market Implications: Privacy as Infrastructure

Regulated finance doesn't need privacy to hide; it needs privacy to function. Privacy by design means the system assumes confidentiality is the default state. If FOGO can pair its 40ms execution with "Sessions" a way to authorize trades without constant pop up signatures it moves the experience away from "crypto" and toward "finance."

Visual System Diagram: The Regional Flow

User Entry Point: Transaction enters via the nearest Regional Validator Cluster (RVC).

Local Consensus: Regional nodes achieve sub-40ms agreement on the transaction order.

Asynchronous Global Sync: The regional "state" is then propagated to the global network for long term settlement.

Enshrined Oracle Feed: Native price data is injected directly into the execution layer, bypassing the need for external call-backs.

The Grounded Takeaway

Who actually uses this? Not the person buying a meme coin for $20. This is for the market maker who needs to hedge 1,000 ETH without being front run by a bot that saw their transaction in the mempool. It’s for the institution that needs to settle a trade in a way that satisfies banking secrecy laws without sacrificing the auditability of the blockchain.

Manzil milegi, bhatak kar hi sahi,

Gumrah toh woh hain jo ghar se nikle hi nahi.

It might work because it acknowledges that physics (latency) and human behavior (the need for secrecy) cannot be "coded away" they must be designed around.

Disclaimer: This post is for informational purposes only. It is not financial or investment advice. The cryptocurrency market is volatile. Always do your own research (DYOR) before investing.