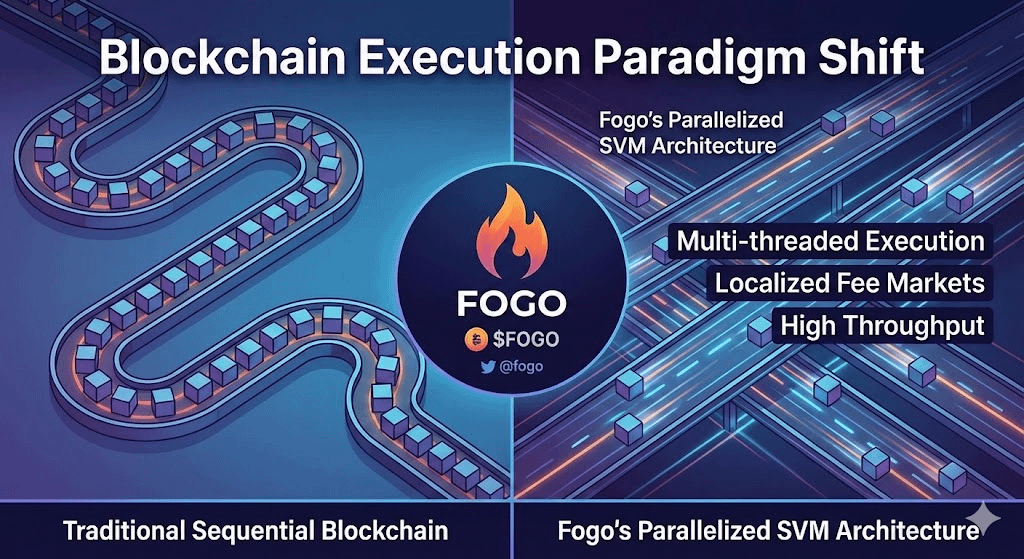

The past one decade has seen the blockchain industry in a cycles architectural trap namely in the way state transitions are implemented. Early distributed ledgers focused on strong consensus and indefatigable security, but essentially compromised on computational performance. Sequential processing standard, which is mostly popularized by early smart contract platforms, requires all transactions to be handled one at a time, whether the transactions share the underlying code or not, and whether the transactions are completely disconnected or not. This single thread model will inevitably cause extensive state bloat, erratic fee markets and poor network reliability under high network demand conditions. This failure in the system is critical on a large scale. Global financial infrastructure and high frequency on chain apps simply cannot operate on settlement layers which exhibit failure, non deterministically, when loaded to peak loads. What is needed is the shift to standardized, high throughput settings that are more focused on parallel processing and deterministic results instead of isolated, monolithic experiments of execution.

In direct response to this execution constraint, the infrastructure project @Fogo Official is an extremely practical way of designing a network. Instead of trying to build a proprietary virtual machine up to the knees, the network uses the Solana Virtual Machine as a foundation of implementation. It is a decisive design decision, which indicates an underlying industry change towards infrastructure realism. The construction of a new Layer 1 is no longer a matter of maximizing the theoretical novelty; but of creating strong, battle-proven execution layers that can be subject to heavy use. The protocol avoids the decades of incompatibility, which are typically linked to auditing new smart contract languages and stabilizing underlying node software, by using a familiar standard. The strategic positioning in this case is evident. The network will attempt to obtain the throughput benefits of a parallelized architecture, but create an independent sovereign state, where pure execution efficiency is sought instead of re-inventing the basic computational wheel.

At the technical level, the incorporation of this particular virtual machine enables the network to attack systemically the constraints of sequential processing. The architecture already encourages localized fee markets and running multiple transactions in parallel since it explicitly requests transactions to specify in advance what portions of the network state they will read or write. This micro level attribute is transformed into colossal system level efficiencies. Transactions which are not overlapping by state are executed on different threads in parallel, utilizing the hardware resources of the validator set as much as possible. Given the macro- industries point of view, this architecture basically changes the distributed systems throughput scaling. The network has a very synchronized and coherent global state rather than the complex, latency-inducing workarounds, such as execution sharing or asynchronous rollup settlements. This cohesiveness is essential to the applications that need absolute atomic composability, in which sophisticated financial operations can be performed with no cross-chain bridging or finality delays.

To maintain this degree of technical functionality, an extremely disciplined economic framework is needed, and here is where the native token, $FOGO , creates behavioral consonance. In a high throughput network, the physical validator hardware is highly demanded. Thus, any incentive design based on conventional incentive-based inflationary blocks will not work; it should be able to reflect the actual price of accessing states or continued compute usage. The token is the key economic bandwidth that impose this discipline. The validators should also be adequately paid to use the heavily investment capital to have enterprise-wide servers that can handle thousands of concurrent threads. At the same time, the fee structures should be able to rationally discourage spam and to encourage state bloat without making the costs unaffordable to serious market participants. The localized fee market dynamics means that when there is a spike in the demand of a single type of decentralized application under the pressure of stress conditions, the operation costs of the rest of the network are not artificially inflated. This localized pricing system gives a strong market structure, so that behavior by the validators is consistent with long-term sustainability of the network and not short-term rent-seeking.

These underlying design choices have far reaching ecosystem implications that go beyond the speed of transactions, and are fundamentally changing the playing field of builders and capital allocators. Using a fully optimized and standardized virtual machine the network instantly leverages an available and high-quality base of developers that already understand parallel computing concepts and Rust as a programming language. This helps to avoid the disintegration of key developer tooling and also speeds up the delivery of developed applications that are mature, with heavy auditing. In the case of liquidity architecture, the low-latency execution environment is structurally transformative. It allows the development of on-chain order books with very high efficient capital requirements and state of the art decentralized exchanges that are very comparable to the performance of a traditional centralized financial infrastructure. By using block times in milliseconds instead of seconds it is possible to have market makers offer smaller spreads and deeper liquidity, knowing that their trades will be settled in a consistent manner. As a result, the network is a desirable execution layer of financial primitives at an institutional grade, and a system is created in which composability is constrained by developer creativity instead of infrastructural rot.

Nevertheless, objective infrastructure analysis is forced to accept the structural tradeoffs of this particular architectural direction. The unavoidable centralization vectors on the physical hardware layer are a result of the pursuit of maximum throughput by means of parallel execution. Since the network entails the use of exceptionally powerful and expensive enterprise-grade hardware to maintain the pace with the very rapid state transitions, the barrier to entry of independent, retail-level node operators is much more significant than in less demanding legacy networks. This economic fact necessarily restricts the geographical / entity density of the validator set, with a focus on hardware performance, rather than ideology decentralization. Moreover, the network also ties its technological path in a way by relying on an external standard of execution, which makes the network tied to a larger ecosystem of virtual machine development. There have to be a well-managed control of any upstream architectural inflexibilities, fundamentals of core vulnerabilities, or necessary protocol improvements such that it does not impinge on the autonomous sovereignty and security of the local network space.

Finally, the development of this type of infrastructure is an indicator of a maturation stage in blockchain development, a structural shift in the direction of the isolated limitations of the early single-threaded systems. The protocol is designed to ensure practical scalability and instant, concrete utility of builders by strategically decoupling the environment of execution of new consensus experiments. Parallel processing and localized markets of fees and economic discipline form the basis that can support applications at scale, complex and high frequency. While the hardware demands present a clear tradeoff regarding global node distribution, the architectural choices reflect a necessary compromise to achieve true institutional readiness. This methodology establishes a compelling framework for the future of distributed networks, demonstrating that long-term utility is generated not through speculative technical novelty, but through the rigorous application of proven, high-performance computing standards to decentralized state machines.