Blockchain networks often presuppose that open infrastructure is automatically created to generate flourishing ecosystems. Practically it is clear that liquidity is usually delivered prior to utility and speculative capital is usually delivered prior to routine application utilization. The outcome is not the concentration but the fragmentation: disjointed builders, weak user interaction, and cyclic growth trends. Its structural constraint is not scalability but ecosystem gravity.

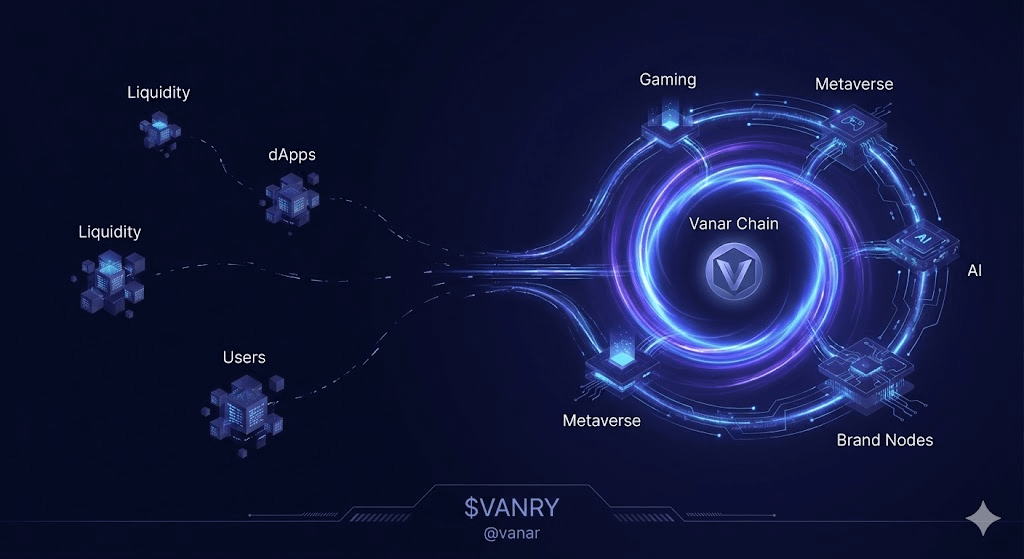

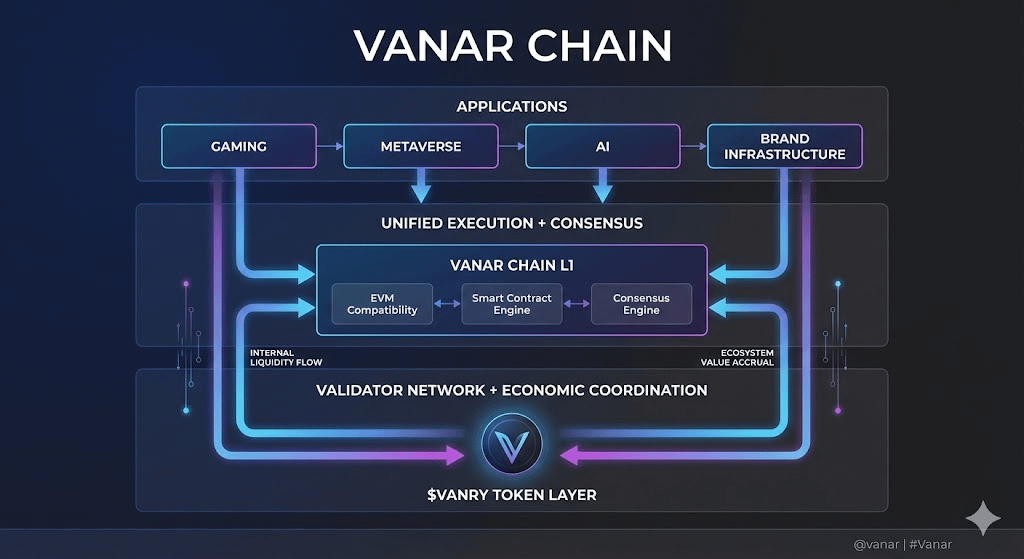

@Vanarchain mitigates this limitation by considering the formation of ecosystems as an architectural practice as opposed to a market by-product. The network combines various consumer-facing verticals of a coordinated Layer 1 environment, as opposed to passive composability. The goal is to expand economic concentration within a single sphere of execution.

Vanar features gaming infrastructure, metaverse platforms, AI-powered integrations, and brand activation systems at the feature levels. This vertical alignment meaning at the system level minimizes the cold-start risk of an ecosystem. The developers are not released into closed pools of liquidity but are constructed on a common economic surface in which identity, assets and transactions are executed to work to the same state assumptions. At the industry level, this strategy questions the notion that fragmentation is a cost well worth opening up.

This density thesis is reflected in the inclusion of such platforms as Virtua Metaverse and the VGN games network. These are not peripheral applications and structural liquidity anchors. Asset velocity can be achieved without the use of cross-chain bridges when the gaming activity, digital ownership and brand interaction are taking place within the same execution environment. This concentration minimizes leakage and increases capital efficiency.

Technically the density of ecosystem is based on predictability of execution. In case transaction costs vary erratically or the coordination of the validators fails under load, then consumer facing applications are worse. Consolidated Layer 1 architecture reduces the complexity of coordination through the synchronization of consensus and execution on a single framework. Although modular stacks are used to externalize scaling, they add governance and dependency layers. The integrated design of Vanar focuses on the responsibility, but minimizes systemic dependency.

The token layer, denoted by $VANRY , acts as the backbone of this coordinated space, the economic one. Fragments have a tendency to move through loosely linked domains, which enhances speculative migration. In a denser ecosystem, token demand is diffused structurally into application in the form of gaming, interaction with digital assets, and branded experiences. There is an important behavioral implication: a validator incentive and the involvement of the user support the continuity of the ecosystem, as opposed to the arbitrage in the short term.

There is an increase in the ecosystem gravity when capital, users, and developers are under a common infrastructure constraint. Liquidity fills up and not out. The process of coordination of upgrades takes place within a reduced governance envelope. With time this can enhance the capital retention and minimize the reflexive volatility generated by the cross-layer liquidity exits.

Density, however, has tradeoffs of its own. Prioritization is necessary in coordinated ecosystem development and this might restrict purely experimental deployments. Modular ecosystems may be attractive to builders of very specialized execution environments. Also, having a high density infrastructure requires continuous performance increase and disciplined governance.

A structural proposal made by Vanar: not only composability, but economic concentration. Through vertical integration and execution coherence coupled with token coordination that are made possible by use of $VANRY , @Vanarchain tries to make ecosystem formation more of a managed infrastructure outcome than an emergent phenomenon. In a scenario characterized by diffusion, the strategic leverage could be attributed to networks that develop gravity.