January Meeting Minutes Reveal Persistent Inflation Concerns

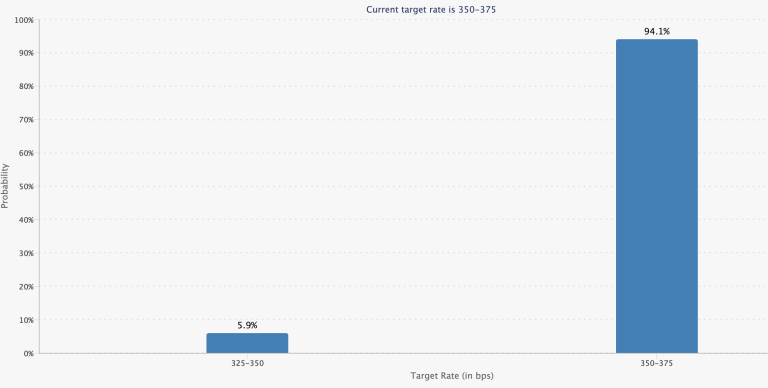

The Federal Reserve's latest policy meeting minutes have injected fresh uncertainty into cryptocurrency markets, challenging the prevailing narrative that interest rate cuts were imminent. While the central bank maintained its benchmark rate at the 3.5% to 3.75% range during January's Federal Open Market Committee meeting, the accompanying documentation revealed a more hawkish undercurrent than market participants had anticipated.

Several committee members expressed willingness to support additional rate hikes should inflation prove stubborn, a stance that diverges sharply from the market's recent pricing of multiple rate cuts throughout 2024. This hawkish tilt represents a significant recalibration of expectations that had built steadily since late last year.

Bitcoin's Rate Sensitivity Comes Into Focus

The implications for Bitcoin are substantial. The leading cryptocurrency has demonstrated increasing correlation with traditional liquidity conditions, thriving in environments where borrowing costs are low and capital is abundant. Low interest rates typically encourage risk-taking behavior, with investors more willing to allocate funds toward volatile assets like cryptocurrencies.

However, the prospect of sustained or increased rates challenges this dynamic. Higher borrowing costs tend to divert capital away from speculative investments toward yield-bearing instruments, potentially reducing crypto market inflows. Bitcoin's price action in recent sessions reflects this sensitivity, with the asset struggling to maintain momentum following the Fed's disclosure.

Market Participants Rethink Timeline Projections

Trading desks had largely priced in an aggressive easing cycle beginning as early as March. The meeting minutes have forced a reassessment, with probabilities for March rate cuts diminishing notably. Though a March move now appears unlikely, even a small probability of tightening carries outsized significance for a market that had become complacent about the trajectory of monetary policy.

The disconnect between market pricing and Fed communication highlights the challenges facing traders attempting to navigate the current economic landscape. Forward guidance has proven less reliable as the central bank emphasizes data dependence over predetermined paths.

Critical Inflation Data Takes Center Stage

All attention now turns to forthcoming inflation readings, particularly February's Consumer Price Index report. These numbers will likely determine whether the Fed's hawkish lean translates into actual policy action. Higher-than-expected inflation would strengthen the case for additional tightening, while softer readings could validate the market's original dovish expectations.

The relationship between inflation data and Fed policy has become the primary driver of crypto market direction, superseding industry-specific catalysts. Bitcoin's fate appears increasingly tethered to macroeconomic indicators and central bank responses.

Structural Linkage Between Crypto and Monetary Policy

The evolving situation underscores a fundamental reality: cryptocurrency markets no longer operate in isolation from traditional financial systems. The connection between Bitcoin and Federal Reserve policy has strengthened considerably as institutional participation has grown and correlations with risk assets have solidified.

This structural linkage means crypto investors must now monitor central bank communications with the same diligence as traditional market participants. The era of Bitcoin as a completely uncorrelated asset has given way to a new paradigm where monetary policy expectations directly influence digital asset valuations. Until inflation demonstrates sustained moderation, Bitcoin's price trajectory will likely remain hostage to the Fed's next move.