On the third day of Lunar New Year I spent the afternoon doing something very traditional, sitting with the older members of my family and playing Mahjong for hours. What started as casual entertainment unexpectedly turned into one of those moments where a simple game explains something much bigger.

One of my distant cousins joined the table. He is the classic science and engineering personality. Everything he does follows logic, probability tables, and calculated decisions. He never chases risky tiles, never bluffs, and never deviates from statistical safety.

And yet he lost more than anyone else at the table.

At first it looked strange. On paper he played perfectly. Every move followed probability. Every discard was technically correct. But slowly it became obvious what was happening. He was playing the rules, while everyone else was playing the people.

He could not recognize when another player was building a big hand. He could not sense when someone was baiting the table. He could not adjust when momentum changed. He stayed loyal to the fixed logic of his hand while the game itself kept evolving.

At one point I told him something that came out almost instinctively: the rules stay the same, but the game never does. If you only calculate and never reason, you become predictable. And predictable players lose.

Right after saying that, a thought hit me unexpectedly.

That description sounds exactly like today’s blockchain.

For years we have praised smart contracts because they follow rules perfectly. Code is law. If the signature is valid, execution happens. No hesitation, no interpretation, no judgment.

But that strength is also the weakness.

A contract cannot understand intent. It cannot recognize when a flash loan attack is draining liquidity. It cannot tell whether a transaction comes from a phishing setup or a legitimate user. It executes flawlessly even when execution itself becomes harmful.

The system has perfect obedience but zero awareness.

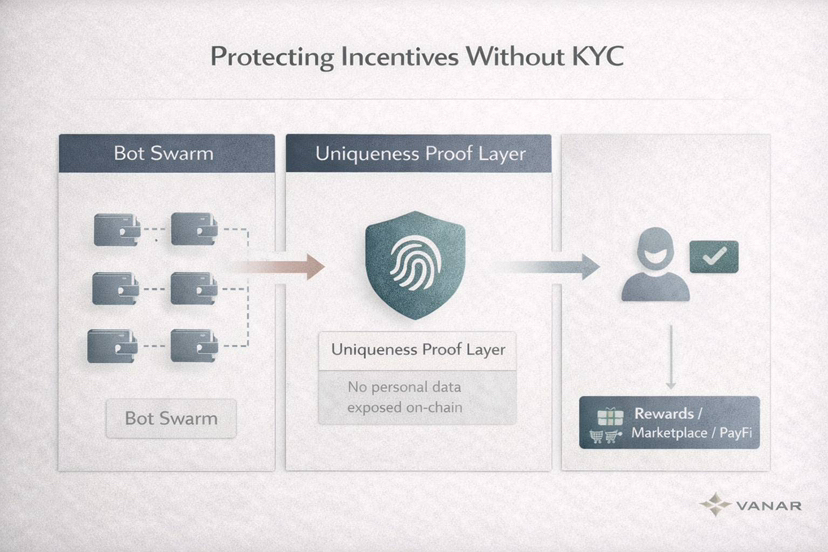

That is why DeFi exploits keep repeating. That is why MEV strategies extract value from ordinary users again and again. The contracts are not broken in a technical sense. They are simply blind to context.

While thinking about this frustration, I looked into the Kayon release announced by @Vanarchain, and suddenly the Mahjong table analogy felt even stronger.

It looks like someone is finally trying to upgrade the rigid player.

Giving contracts situational awareness

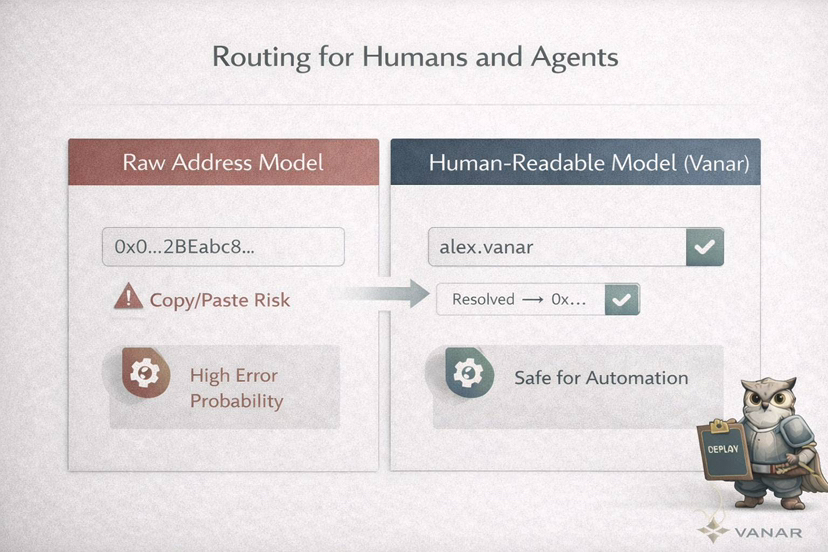

The core idea behind Kayon is reasoning directly connected to on chain execution. In simple language, it tries to give contracts the ability to observe conditions before acting instead of blindly following instructions.

Instead of executing a transaction the moment conditions match, the system can evaluate surrounding signals.

Is network activity behaving abnormally right now

Are gas fees suddenly spiking in a way that suggests manipulation

Does the caller’s historical pattern resemble exploit behavior

Could this transaction create abnormal liquidity risk

If something feels inconsistent with normal behavior, execution does not have to proceed automatically. Additional verification can be required or the action can be rejected entirely.

That changes the philosophy of blockchain more than people might realize.

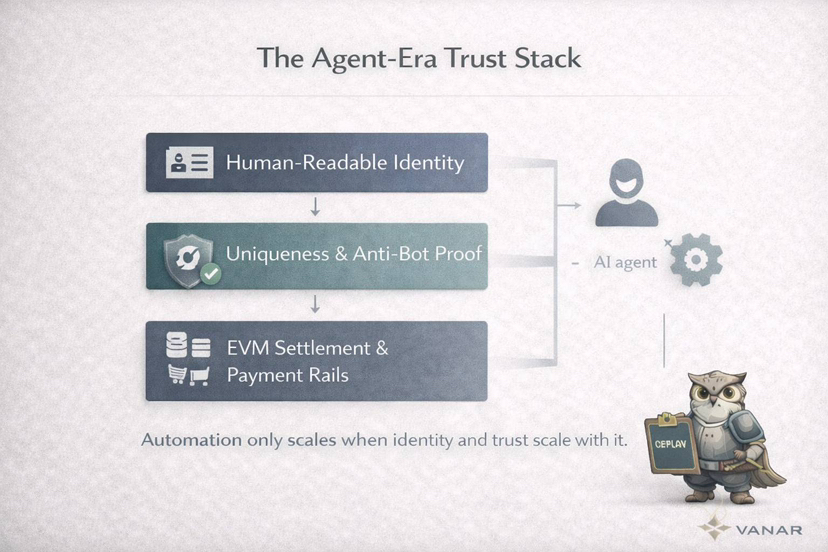

Until now automation meant doing exactly what the code says without questioning anything. Kayon introduces the idea of autonomy, where execution includes judgment.

The contract stops being a mechanical script and starts behaving more like an experienced participant in the system.

In Mahjong terms, it finally learns to read the table.

Why this matters as capital moves on chain

As we move deeper into 2026, the conversation around blockchain is changing. Real world assets and institutional capital are entering the space more seriously. When organizations manage large pools of money, security expectations change completely.

No institution wants to entrust large amounts of capital to something that cannot recognize obvious risk patterns. Perfect execution alone is not enough. They need systems that understand context, risk exposure, and abnormal behavior.

Traditional finance relies heavily on monitoring layers, compliance checks, and intelligent safeguards. Blockchain removed intermediaries but also removed judgment.

What projects like Vanar appear to be exploring is how to reintroduce intelligent risk awareness without reintroducing centralized control.

Instead of a human custodian watching every action, the infrastructure itself becomes capable of evaluating situations.

That is a very different vision from earlier generations of public chains that focused purely on speed and deterministic execution.

From automation to adaptive systems

If this direction succeeds, blockchain evolves from a passive execution environment into an adaptive system. Contracts do not simply react to inputs. They interpret environments.

This does not mean abandoning determinism or security. It means expanding execution to include risk signals, historical patterns, and contextual reasoning before final action occurs.

Just like at the Mahjong table, knowing the rules remains important. But winning requires understanding the flow of the game.

Right now market prices move up and down every day, and many people focus only on short term volatility. But sometimes those quiet periods are simply giving participants time to notice deeper structural changes.

The real question becomes whether the future belongs to rigid systems that execute blindly or to systems that can adapt while remaining transparent.

The game is still early. The table is still full. And sometimes the biggest mistake is leaving before understanding how the rules themselves are evolving.