The building sounds different at this hour. Air vents and distant elevators. No voices. No laughter. Just one pool of light on this floor, and I’m sitting in the middle of it, staring at a dashboard we all pretend to trust during the day.

I know its tricks. It’s pretty. The numbers line up in neat rows. Colors are soothing. But no one really believes it when things get tight. It’s the kind of dashboard that was “temporary” three releases ago and somehow became the main thing people stare at.

Tonight there’s a small mismatch in one corner.

Not a big red siren. Just a number that’s off by a little. Too small to justify waking anyone up. Too big to ignore. Right in that cruel middle where it might be a rounding issue, or it might be the first sign that something is quietly breaking.

That’s how the incident report starts.

Time. System. What changed since yesterday. What I see on-chain versus what the dashboard claims. It’s boring, but I’ve learned you either write this stuff down early or you get eaten alive by your own memory later. By morning, details blur. Fear fills the gaps. People remember different things. The only defense is to pin the facts to the page before the story starts mutating.

I pull logs. Compare node views. Check the last deploy. Confirm the indexer isn’t lagging. Look at latency. Check if a single validator is out of sync. Refresh again, even though I know that’s not real work. It’s just a nervous tick with a progress bar.

The mismatch stays exactly where it is.

This is where all the big words fall apart. “Trustless.” “Transparent.” “Secure by default.” It’s easy to repeat those when you’re talking to a room full of believers. It’s harder when you’re the one who has to answer for a number that doesn’t make sense and there are people on the other side of that number who expect payroll, invoices paid, client funds safe.

Once money becomes salaries and contracts, slogans stop helping.

We say “public” a lot in this space, like it’s a spell. Public chain. Public ledger. Public state. The assumption is that if everyone can see it, it must be truthful. But that’s not how it works. Public just means “anyone can look.” It doesn’t mean “this is correct” or “this is fair” or “this won’t be used against you.”

Public is a spotlight. Provable is a standard.

You can publish garbage. You can publish partial truth. You can publish something mathematically correct that still misleads if it’s stripped of context. None of that becomes good just because it’s visible.

At , privacy also stops being a buzzword. It feels more like a duty.

A client’s exposure isn’t a fun data point. A firm’s strategy isn’t content. Salaries aren’t gossip you toss on-chain for the vibe. In a lot of cases, you are legally required not to expose these things. In others, it’s just basic decency. Real life doesn’t split cleanly into “secret” and “public.” It’s more “who can see this, when, and why.”

Auditability, on the other hand, is non-negotiable. If you can’t show what happened when the right person asks, you don’t have a system. You have a shrug.

A lot of projects try to solve both by just making everything transparent. Dump all state on-chain. Let the world sort it out. It feels pure. It also ignores the fact that public data will be used. Traders will infer positioning. Competitors will infer strategy. Employees will infer pay gaps. Observers have no duty of care. They don’t sign risk statements. They don’t face your clients. They just act.

That’s where the “sealed folder” image comes from for me.

Think about a real audit room. You don’t plaster every contract and payroll sheet on the walls. Records sit in folders. Some of those folders are sealed. When an auditor or regulator comes in with the right authority, you take the folder out, unseal it, and put it on the table. You show them what they are entitled to see. You might show underlying evidence. You don’t empty the entire cabinet onto the street in the name of “openness.”

A sealed folder isn’t about hiding everything. It’s about sharing the right things, with the right people, at the right time.

Vanar’s whole “AI-native Layer 1” idea only matters if it takes those realities seriously. “The Chain That Thinks” sounds poetic, maybe even silly. I don’t want a thinking foundation. I don’t want mood swings at the base layer. Settlement should be the most boring part of the whole stack.

It should just work. Every time. No cleverness. No surprises.

If anything is allowed to “think” in this system, it should sit above settlement, in well-defined execution environments. Places where you can run more complex logic, including AI assistants or policy engines, without touching the core guarantees underneath. If something odd happens there, you can contain it. Roll it back. Patch it. Learn from it. The foundation stays solid.

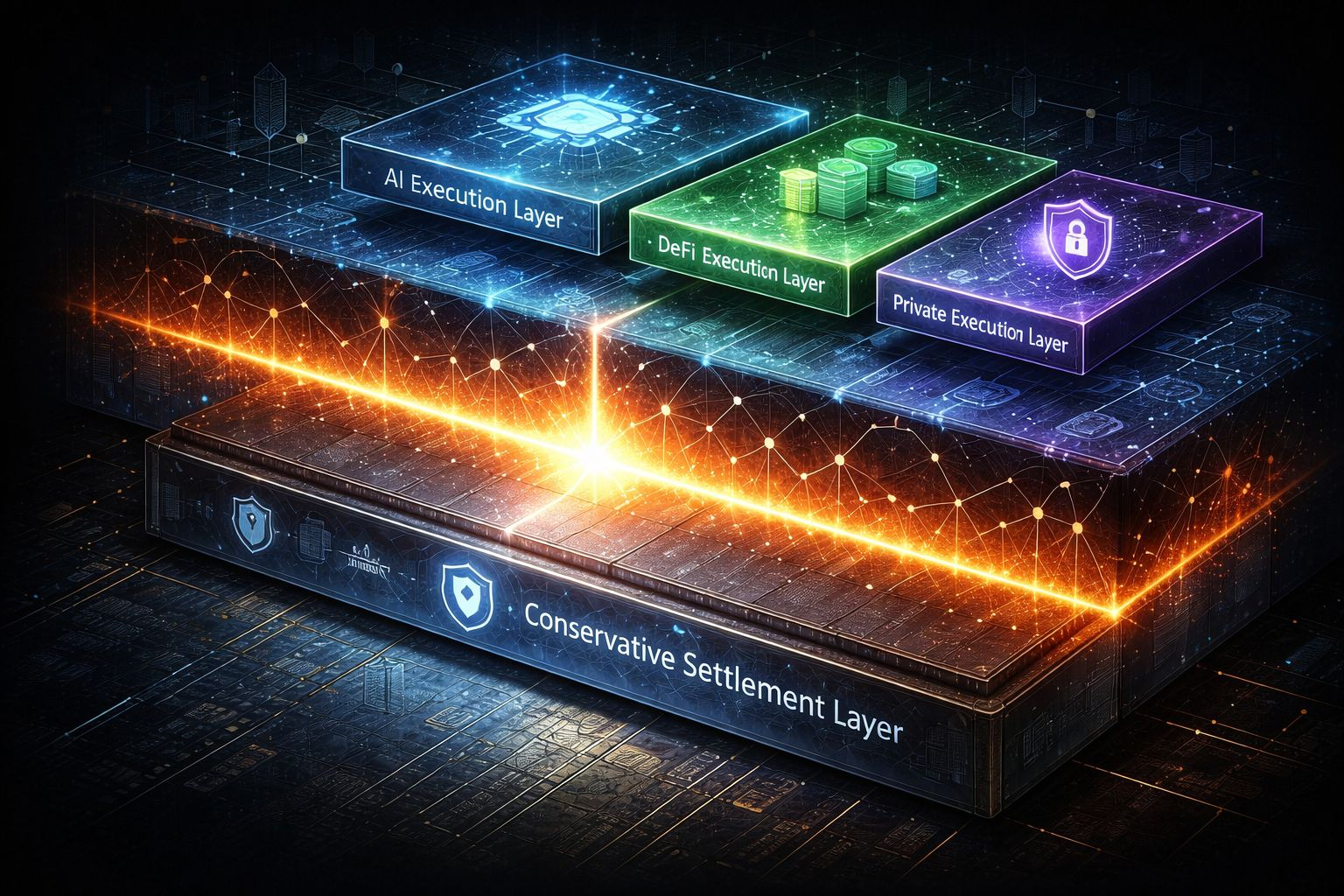

That’s why Vanar’s architecture is built as modular execution environments on top of a conservative settlement layer. The bottom is plain: finalization, verification, predictable rules. Above that, different execution layers for different needs. Some might be optimized for DeFi, some for AI-heavy workflows, some for privacy-heavy operations.

The separation is not an academic point. It’s a firebreak.

The AI part only makes sense in that context. You want intelligence in how workflows route, how policies are enforced, how alerts fire, how complex conditions are checked. But you always want to know where that “thinking” ends. You need clear boundaries: this part can suggest and adapt, that part must be stable and boring.

Then there’s Phoenix private transactions.

If you strip away the branding, Phoenix is about one core idea: confidentiality with enforcement. The network still checks the rules. Balances aren’t violated. Double spends don’t slip through. Constraints are respected. But the sensitive details are not shouted to the entire world.

It’s not “just trust us, it’s private.” It’s “the chain has cryptographic proof the transaction is valid, without exposing the raw data to everyone.”

In sealed-folder terms, you’re not throwing the contract wording, client identifiers, and payout details on a public wall. You’re stamping the folder with a verifiable mark: this meets the rules. The auditor, when needed and authorized, can open the folder. The general public just sees the stamp.

That’s very different from just hiding. Hidden data alone proves nothing. Private, proven data is a different category.

It matters for real reasons. Indiscriminate transparency can very easily cause harm. If the entire market can see a big client rotating out of one asset into another, someone will trade against that flow. If they see how your treasury moves, they can make guesses about your runway. If they see every salary, they can use it as a wedge inside your team. That’s not theory. That’s just how people behave around open information.

So instead of “everything public” or “everything opaque,” you start thinking in terms of permissions, proofs, and access.

The architecture supports that. Conservative settlement underneath. Modular execution on top. Phoenix giving you private transactions that can still be enforced. Selective disclosure for compliance. Public where it needs to be public. Controlled where it needs to be controlled.

EVM compatibility sits in this picture as a kind of reality check. Not a trophy. A way to avoid needless surprises. If your execution environment looks and feels like EVM, a lot of battle-tested tools and patterns carry over. Auditors have seen similar code before. Developers know the edge cases. You don’t start from zero. You still have to be careful, but you’re not inventing an alien machine and asking everyone to trust it on day one.

Less originality, more predictability. At , that sounds like a gift.

Then there’s the token, $VANRY. It’s easy to talk about tokens like they’re lottery tickets. But in a staking design that’s meant for grown-ups, they’re more like bonds. You lock value because you are taking on responsibility. If you validate or secure the network, your stake is the skin in the game that says, “I understand that if I mess this up, something real happens to me.”

That’s very different from “number go up.”

The rough parts don’t go away, though. The sharp edges are still there. Bridges and migrations are where all the neat diagrams meet human error.

Moving from ERC-20 or BEP-20 versions of a token to a native asset on Vanar isn’t just flipping a switch. It’s a whole set of assumptions changing. Different trust model. Different recovery paths. Different monitoring. Different attack surface. The bridge in the middle is the narrow path where one slip can hurt a lot of people at once.

You can do most things right and still get burned by one missed checklist item. One misconfigured address. One admin key in the wrong hands. One device compromised. One employee who thought, “I’ll write this down here just for now.”

Key management is not glamorous, but it’s where reality lives. Who holds the keys. What happens if they leave. How recovery works. Who can revoke access, and how fast. Whether procedures exist only in a wiki no one reads or in muscle memory.

Human error is not rare. It is the default.

People say trust “erodes” over time, like a gentle slope. That’s not how it feels in operations. Trust doesn’t degrade politely—it snaps. One event. One unexplained loss. One “we can’t fully account for this.” That’s all it takes for a client, or a regulator, or your own team to look at the system differently, maybe forever.

Tonight, the mismatch finally gives up its secret. It isn’t corruption. It isn’t theft. It’s a boring edge case between two components that disagree, for a short window, on when something is final. Settlement says “done.” The indexer says “almost.” The dashboard shows “now-ish.” There’s a race, and the numbers wobble before snapping into place.

Still dangerous, because these are the cracks that bad actors love. Still fixable, because we saw it. I update the report: root cause, impact, mitigation, follow-ups. Add another line to the long list of ways the system can trip itself.

By the time I’m done, the incident write-up has turned into something else in my head. A reminder of what this whole “AI-native Layer 1” thing is actually for.

Not for pretty phrases. Not for hype. For dealing with the real world.

A world where you must prove things, but you can’t expose everything. Where privacy is often an obligation, not an excuse. Where regulators will show up and ask for evidence. Where auditors will want a trail. Where clients don’t care about whitepapers. They care that their balances are correct and their sensitive data isn’t dumped into a mempool for sport.

In that world, Vanar’s stack makes sense only if it can handle all of this:

Settlement that stays boring. Execution layers that can change and grow without dragging the base down. Phoenix private transactions that give confidentiality with enforcement. A sealed-folder style of selective disclosure for audits and regulators. EVM compatibility to lower the surprise factor. $VANRY staking framed as responsibility, not a slot machine. Bridges and migrations treated as high-risk crossings, not routine traffic. Key management treated as a core function, not a chore.

It’s not a perfect system. There are no perfect systems.

But there are more and less adult ones.

The adult world, the one this chain has to live in, comes down to two rooms.

The first is the audit room. Someone sits across from you, asks, “What happened here?” and you need to open the right sealed folder. You show them proofs, logs, and, when appropriate, underlying data. You can do it without revealing everyone’s positions and salaries to the internet.

The second is the room where someone signs under real risk. A CFO. A partner. A founder. They sign off on using this chain because they believe the permissions are real, controls exist, revocation and recovery are possible, and compliance is something the system helps them with, not something it makes harder.

If Vanar can earn those signatures, quietly, repeatedly, then “The Chain That Thinks” won’t be about being flashy.

It will be about a network that understands the distinction between public and provable, between secrecy and confidentiality, between hype and the moment where a small discrepancy appears, and the only thing that matters is whether the stack beneath your cursor was built for grown-ups.