Let's discuss today about Vanar Chain regulation, why it's important, so let's gets started.

The friction in regulated finance isn’t a lack of transparency; it’s the scary exposure that comes with it. Think of a fund moving $50M to hedge a position or a company settling a sensitive acquisition. Usually this happens behind doors in banking.. In today’s Web3 world it’s like the whole world can see.

We’ve built systems where compliance feels like an invasive surgery. To prove you aren’t a criminal you have to stand naked in public. That’s the core problem. Most Layer 1 blockchains are public by default making privacy an exception. This approach is awkward because it creates targets for hackers and regulators. If you add privacy to a system you aren’t solving the problem; you’re just hiding the suspicious activity.

The Mechanism of Failure: Transparency as a Liability

The problem exists because we’ve treated privacy and compliance as a zero-sum game. If you have one you supposedly lose the other. This led to problems in L1 tokenomics. They paid validators with tokens because the actual use was limited by public data.

Dukan sabki khuli hai, par sauda parde mein hai,

Yahan roshni toh hai, magar chehra andhere mein hai.

The shop is open to all. The deal is behind the veil; there is light here but the face remains in the shadows.

When we look at infrastructure like Vanar we see an attempt to change through the "Usage-Driven Fuel" loop. Specifically the $VANRY AI Subscriptions suggest a shift toward a system where value comes from service, not movement. Starting in Q1 2026 premium access to layers like Neutron and Kayon requires $VANRY subscriptions.

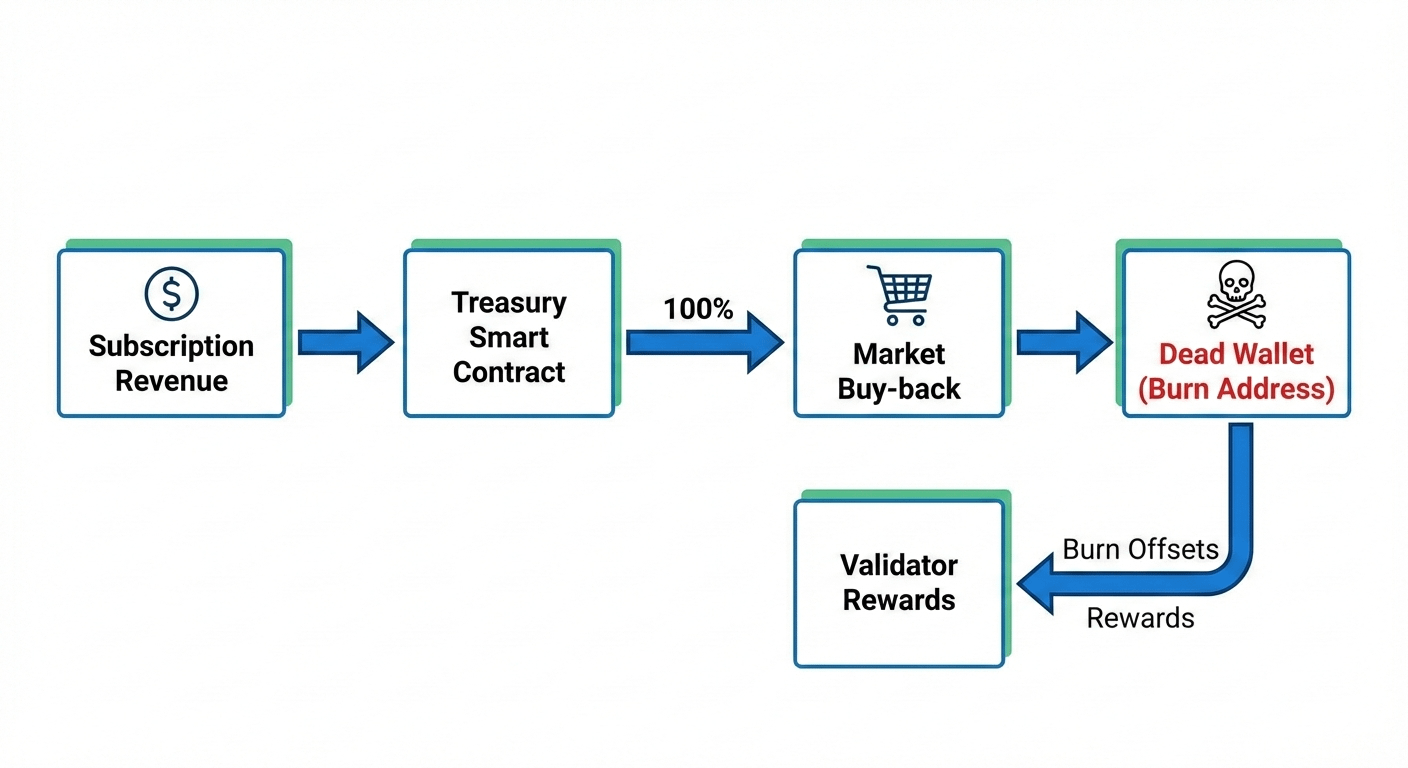

Unlike gas, which is purely transactional and often volatile a portion of this revenue is used to buy back and burn tokens. This creates a link between AI utility and scarcity. But for this to matter to a bank or a brand the "AI reasoning" cannot be public.

Analysis: Infrastructure vs. Hype

If we treat a blockchain as infrastructure, not hype we have to look at settlement and law. A regulated entity doesn’t care about "moon bags." They care about knowing a transaction actually ends and data sovereignty. They also need costs. They can’t have subscription fees skyrocketing just because a meme-coin launched on the network.

Vanar’s approach focuses on high-data areas like gaming, brands and AI. A brand launching a metaverse experience on Virtua handles user data that must comply with GDPR or CCPA. You cannot put that data on a ledger "by exception." It has to be private by design.

The Risk of the "Middle Ground"

The skepticism comes in when we look at execution. Many projects claim to be "enterprise-ready ". They fail because they try to please everyone. They offer a bit of privacy a bit of transparency and a lot of complexity.

Raaste sabhi bheed gum ho gaye,

Manzil wahi milti hai jo khud ko pehchante hain.

All paths got lost in the crowd; only those who know themselves find the destination.

The risk here is that the AI Subscription Burn becomes another subsidized gimmick. If the Neutron and Kayon layers don’t provide value that businesses are willing to pay for then the burn mechanism is just a slower version of inflation. The system only works if the utility is so high that the cost of the subscription is seen as necessary.

Comparing the Dynamics

In L1 gas models scarcity is driven by speculative transactional volume. This leads to volatility during network congestion. Furthermore token minting often outpaces burning leading to that problem where the supply overflows and value dilutes.

In the $VANRY model the driver is service utility. By using tiered access for AI layers the network attempts to offer predictable costs for developers. The token impact shifts from gas burning to a direct buy-back from actual revenue. This aligns the interests of the holders with the actual enterprise usage of the network.

The Grounded Takeaway

Who would actually use this? It won’t be the trader looking for a quick return. It will be the builder who needs a reasoning engine to automate compliance or the brand that needs a memory layer to track customer loyalty without exposing their database.

It might work because it aligns value with the actual work the network does. It will fail if the AI tools are mediocre or if the barrier to entry is too high. Privacy in finance isn’t about hiding secrets; it’s about protecting the system. If Vanar can prove its AI layers offer a private environment it moves from being a crypto project to being actual financial infrastructure.

Disclaimer: This post is for informational purposes only. It is not financial or investment advice. The cryptocurrency market is volatile. Always do your own research (DYOR) before investing.