Liquidations are not merely risk controls, they are timing-critical events where milliseconds define fairness. On FOGO, liquidation logic is engineered as a precision instrument rather than a reactive safeguard.

FOGO’s architecture transforms liquidation from a race condition into a deterministic process.

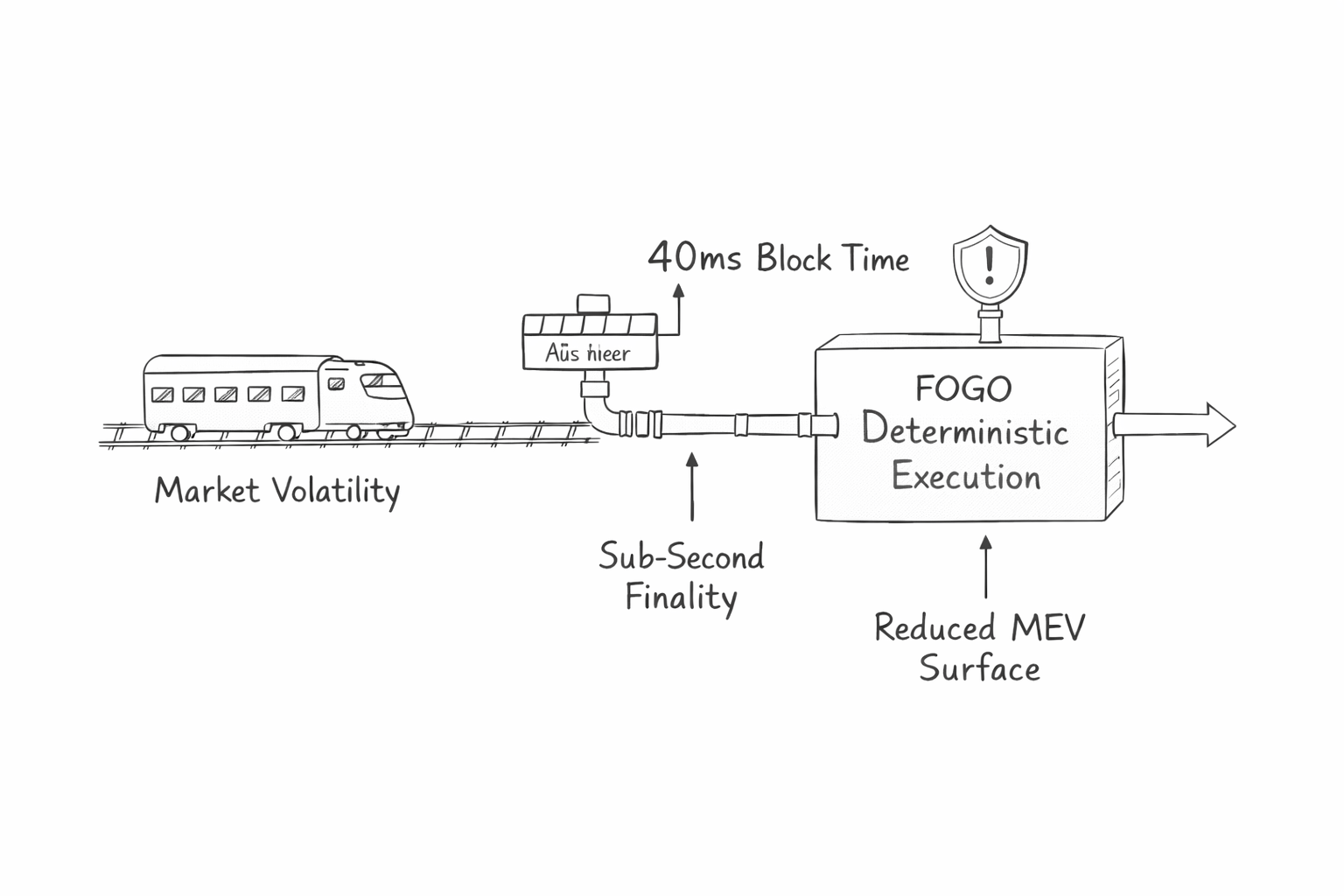

At block times approaching 40 milliseconds and near-instant finality, FOGO enables real-time liquidation execution with consistency. In volatile derivatives markets, latency is not just inefficiency; it is systemic risk. Delayed liquidations create cascading imbalances, widening spreads and amplifying liquidation spirals. FOGO’s high-throughput execution minimizes this window of instability.

Deterministic Timing as Infrastructure

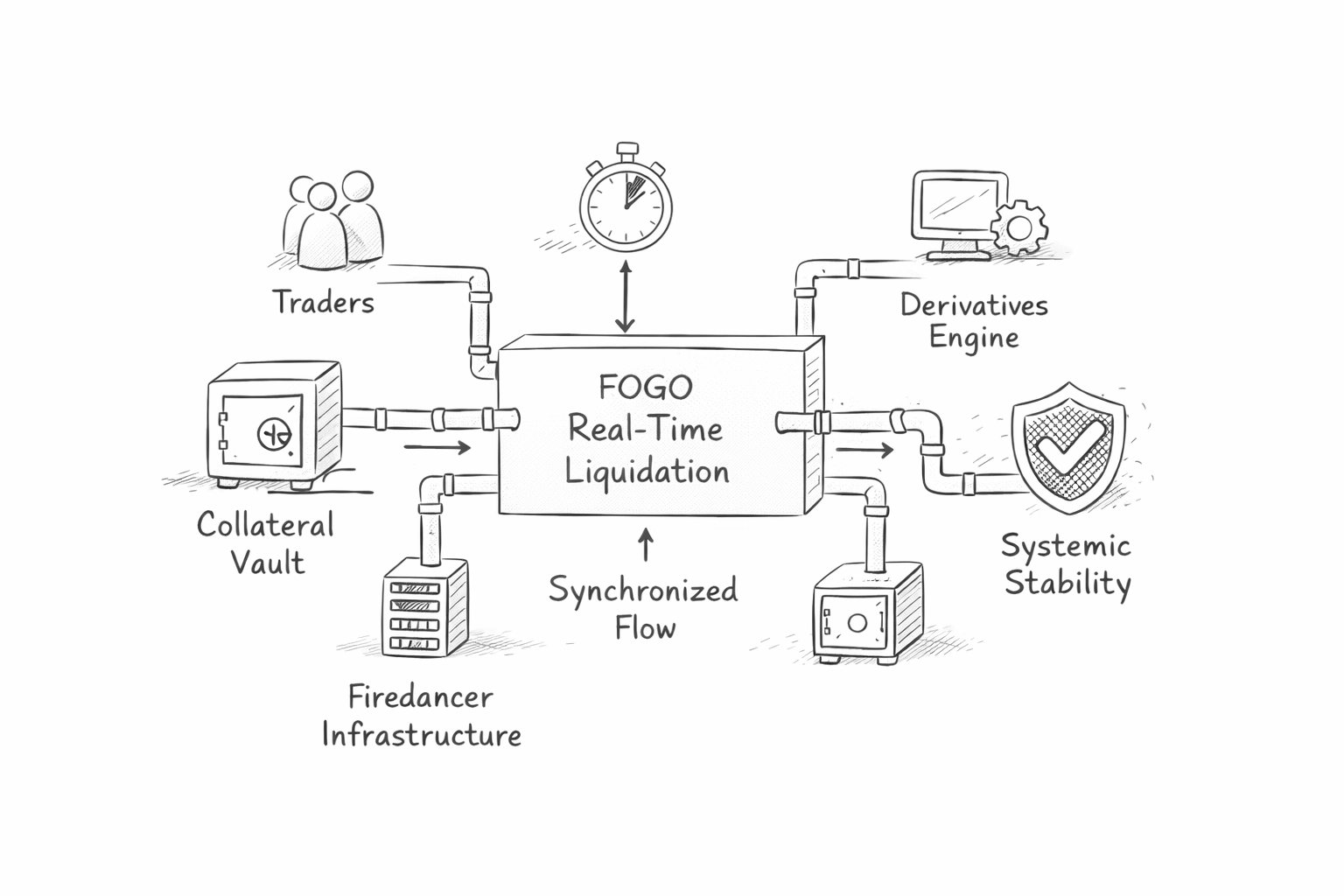

FOGO leverages the Firedancer client, originally developed by Jump Crypto, to ensure predictable execution. Its architecture and zero-copy memory handling reduce jitter and execution variance.

For liquidation engines, predictability is more valuable than raw speed.

Deterministic processing ensures:

Precise margin threshold enforcement

Reduced variance between trigger and execution

Protection against chain reorganization risk

Stable derivatives market behavior under stress

In traditional environments, liquidation logic competes with congestion. On FOGO, it operates within an optimized execution pipeline purpose-built for financial workloads.

Reducing Systemic Risk Through Real-Time Enforcement

Efficient liquidation engines do more than protect lenders; they stabilize markets.

FOGO’s sub-second finality reduces the time gap between price movement and enforcement. This compression of uncertainty limits cascading liquidations that often destabilize derivatives ecosystems.

Additionally, FOGO’s optimized pipeline reduces MEV surface exposure during liquidation events. By narrowing latency windows, the opportunity for opportunistic extraction diminishes. Liquidation becomes procedural rather than adversarial.

This matters because derivatives markets are reflexive systems. When liquidations are unpredictable, volatility compounds. When they are precise, markets regain structural balance.

Designed for Complex DeFi Workloads

FOGO is not adapting to financial applications, it is architected around them.

Its SVM-based design allows advanced liquidation logic to execute without the friction of slow confirmations or unpredictable congestion. Complex margin models, cross-collateral triggers, and multi-asset liquidations can operate with execution integrity.

From my perspective, this shift reframes liquidation from being a defensive mechanism to becoming a structural pillar of decentralized market design. I think precision at this layer quietly determines whether DeFi can scale responsibly.

Liquidation engines reveal the true capabilities of a blockchain. They test latency, fairness, predictability, and systemic resilience; all at once.

FOGO approaches this challenge not with incremental optimization, but with architectural intent.

If decentralized finance is to rival centralized execution quality, precision must be embedded at the protocol layer. FOGO’s reimagined liquidation engines suggest that the future of DeFi stability will be written not in hype cycles, but in milliseconds.

@Fogo Official #fogo $FOGO $ENSO $RAVE