For the last two weeks, I’ve been doing something I don’t usually rush: slowing down.

Instead of chasing headlines or scrolling through launch threads, I’ve been sitting with different Layer-1 projects and asking a simple question — is this actually new, or is it just familiar ideas dressed differently? Most of what I saw felt incremental. Slightly faster. Slightly cheaper. Slightly rebranded.

Then I started digging into Vanar Chain, and I found myself thinking differently.

What stood out to me wasn’t hype. It was evolution.

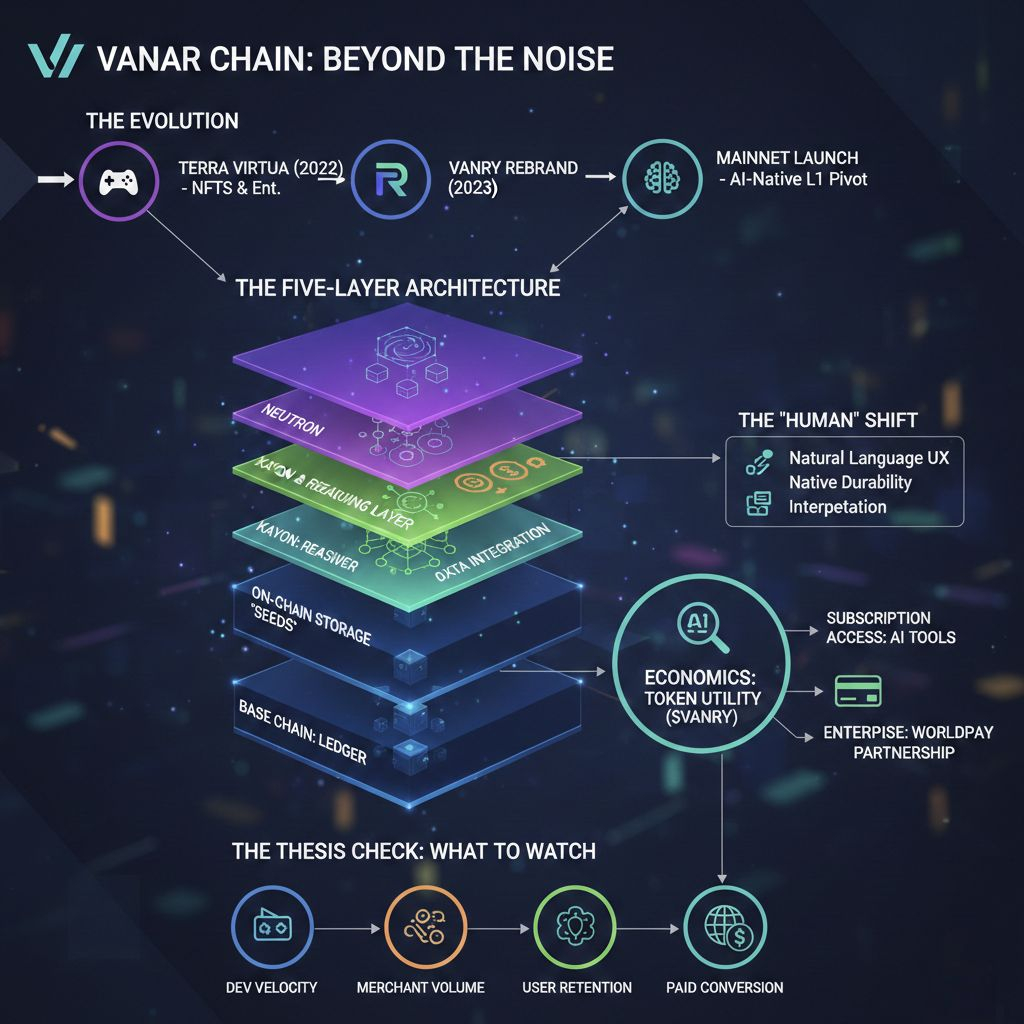

This project didn’t start as an “AI-native Layer-1.” It began as Terra Virtua, a platform focused on digital collectibles and entertainment. In 2023 it transitioned into VANRY, and by early 2024 it launched its mainnet. Since then, it hasn’t stayed static. The team has kept reshaping the infrastructure to align with a broader idea — building a blockchain that doesn’t just store data, but works with it.

That shift feels intentional.

Not Just Storing Data — Structuring It

Most blockchains treat data like cargo. They verify it, store it, and move on. Context is someone else’s problem.

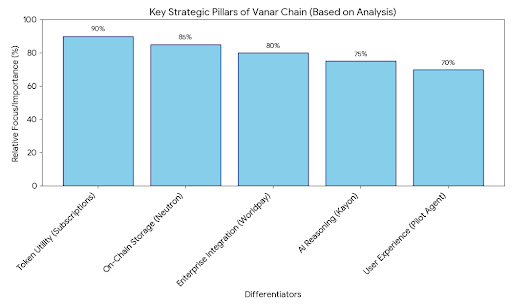

Vanar Chain’s five-layer structure — base chain, Neutron, Kayon, Axon, and Flows — suggests they’re trying to rethink that assumption.

Neutron compresses files into what they call “Seeds,” which are stored directly on-chain. That decision might not sound dramatic at first, but if you’ve been around NFTs or Web3 apps long enough, you’ve seen what happens when storage depends on external systems. When centralized cloud providers go down, “decentralized” apps suddenly feel very centralized.

Designing storage to live natively on-chain is a quiet but important choice. It’s about durability, not marketing.

Then there’s Kayon, described as the reasoning layer. What I find interesting isn’t the terminology — it’s the direction. Instead of blockchain as passive infrastructure, Vanar is experimenting with a system that can query and interpret its own stored data. The Pilot Agent integration later in 2025 pushed that idea further by allowing users to interact with wallets using natural language.

If that experience works smoothly and securely, it changes usability in a real way. Not in a “10x TPS” way — but in a human way.

A Token Model That Feels Tied to Use

This is where my thinking shifted the most.

In many Layer-1 ecosystems, the native token exists primarily because it has to. It pays for gas. It secures the network. Beyond that, its value often floats on speculation more than usage.

When Vanar announced that some AI tools — including the myNeutron assistant — would require subscriptions paid in VANRY, it signaled a different approach. The token isn’t just a transaction lubricant. It becomes tied to product access.

That changes incentives. It means adoption matters. It means people have to find value in the tools themselves, not just in holding the asset.

It doesn’t guarantee success. But it creates a more grounded connection between infrastructure and economics.

Looking Toward Payments

The collaboration with Worldpay also caught my attention.

Payments aren’t glamorous in crypto discussions, but they’re foundational. If Vanar is seriously exploring merchant-facing integrations instead of staying purely in retail speculation cycles, that suggests long-term thinking.

Enterprise adoption is slow. It’s measured. It doesn’t move with hype cycles. If that partnership leads to actual transaction flow, it will speak louder than any announcement thread.

What I’m Watching

I’m not approaching this blindly.

The AI + blockchain space is crowded. Execution in crypto can lag behind vision. Developer ecosystems don’t grow overnight. Subscription models only work if people genuinely convert and stick around.

So I’m watching:

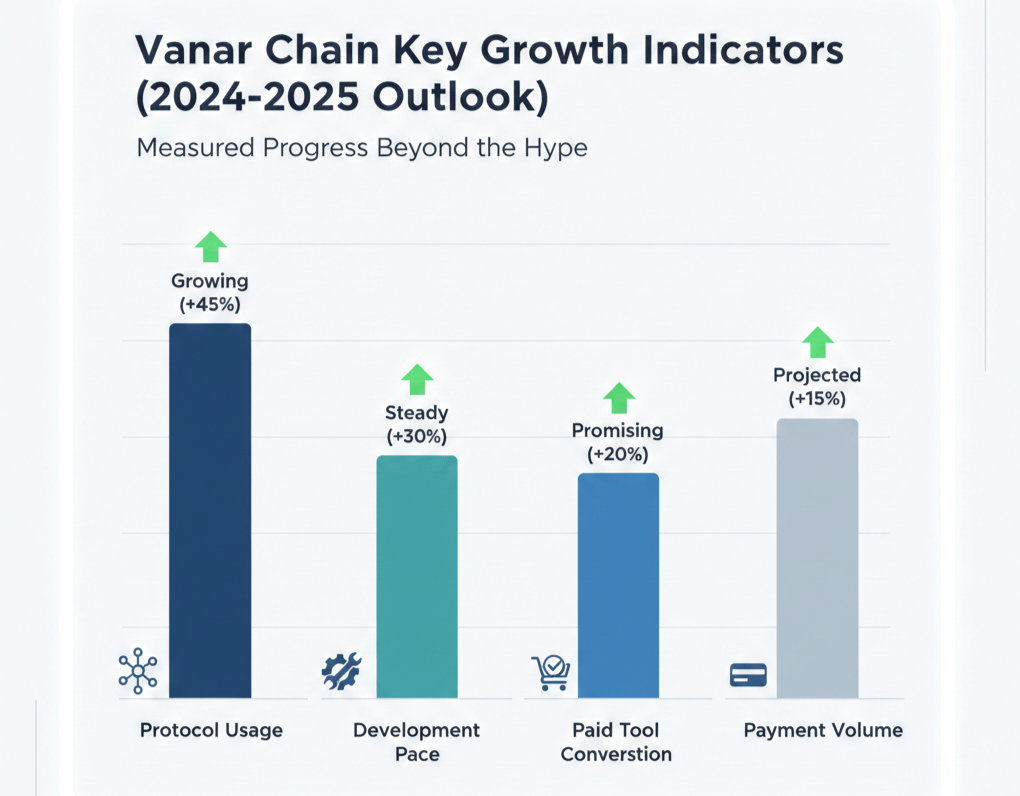

Are people actually using the protocol consistently?

Is development shipping at a steady pace?

Do paid tools convert beyond early adopters?

Does the Worldpay relationship turn into real payment volume?

If those signals appear, the thesis strengthens. If they don’t, the architecture alone won’t carry it.

Why It Feels Different to Me

What keeps Vanar Chain on my radar isn’t perfection. It’s alignment.

The infrastructure direction, the AI positioning, the token utility, and the payment integrations all point toward the same idea: building a system where the blockchain isn’t just a backend ledger, but part of a functional product stack.

In a market full of recycled narratives, coherence stands out.

I’m not making predictions. I’m not assigning price targets. I’m simply observing something that feels structured rather than improvised.

And right now, that’s rare enough to deserve attention.