I’ve read a lot of “next billion users” promises in Web3. Most of them sound great… right up until you picture real people actually using the app. Clicks, swaps, mints, tiny in-game buys, reward claims, all day long.

That’s where things usually break, mostly because fees stop being predictable and the chain starts feeling slow.

Vanar Chain is trying to dodge that trap by focusing on something oddly unpopular in crypto: making the basics boring.

Fast confirmation, stable costs, and a setup that developers can actually ship on.

Vanar calls itself an AI-first blockchain infrastructure stack, built to support AI workloads, gaming, and real-world scale.

I’ll admit my bias up front. I’m not impressed by huge numbers on a banner. I’m impressed when normal users can do normal things without worrying about gas roulette.

AI apps and games don’t act like a simple DeFi dashboard.

They generate lots of small actions.

They also create weird traffic patterns.

One moment it’s quiet, then something trends and suddenly everyone is minting, swapping, bridging, staking, doing the whole routine.

If each small action costs even a few cents, the app becomes a “maybe later” app. If confirmation is slow, anything interactive feels laggy.

In gaming, that kills immersion.

In AI workflows, it kills automation speed. In “real-world” apps, it just feels unreliable.

So the goal is not just cheap, it’s cheap and predictable. That difference matters more than it sounds.

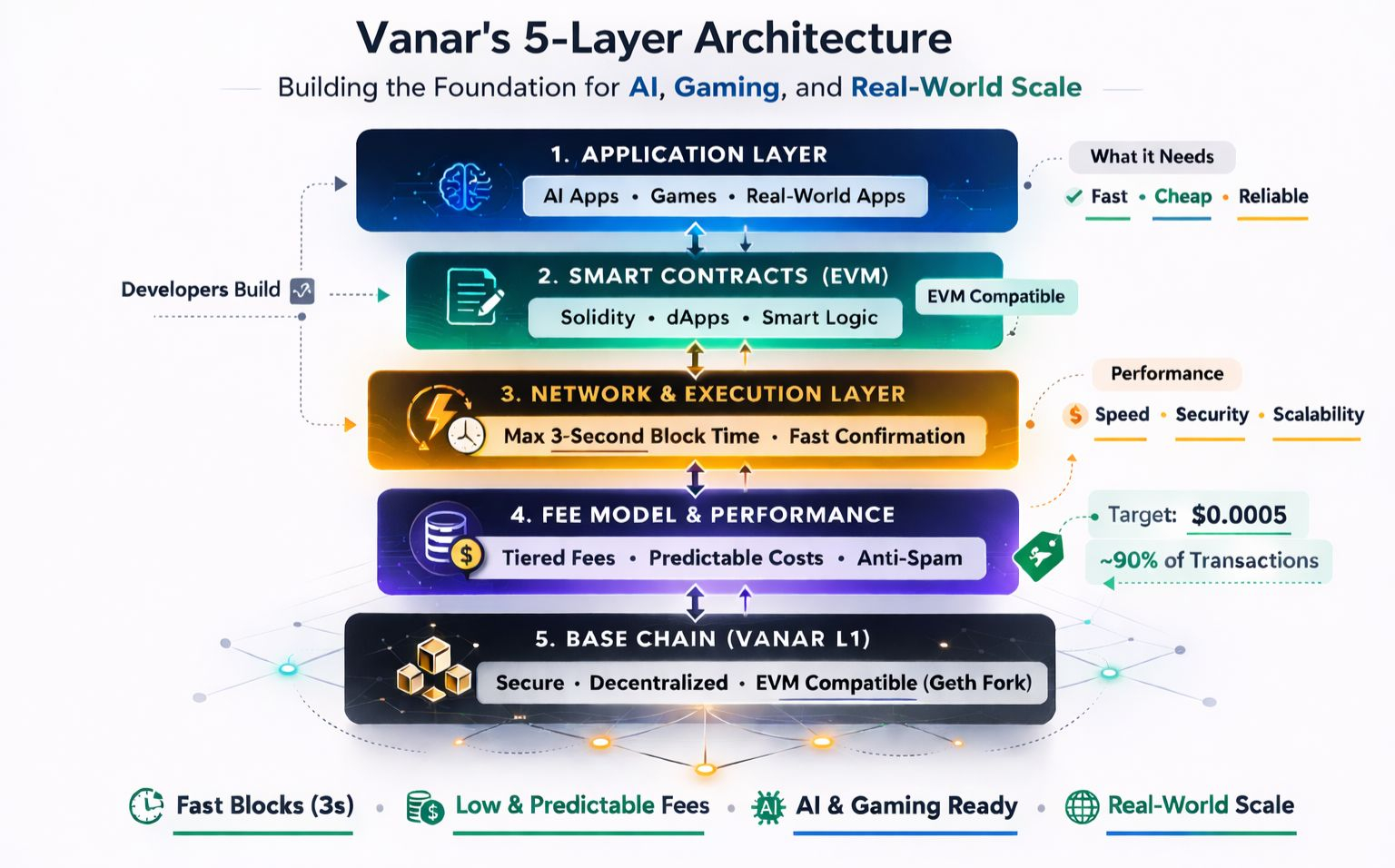

Vanar Chain positions itself as a modular Layer 1 built for AI-era apps, and it leans hard on a 5-layer architecture idea. Their site says the five layers are meant to turn Web3 apps from simple smart contracts into “intelligent systems,” basically apps that can learn, adapt, and run more complex logic by default.

Also, Vanar is EVM compatible, which is a practical win. Developers can use familiar Solidity tools instead of learning a whole new stack.

And the GitHub repo makes the “familiar base” point even clearer. Vanar describes itself as an EVM compatible chain and a fork of Geth, aligned with Ethereum’s infrastructure, with custom changes aimed at speed, affordability, and adoption.

That combination (new goals, familiar tooling) is often where adoption actually starts.

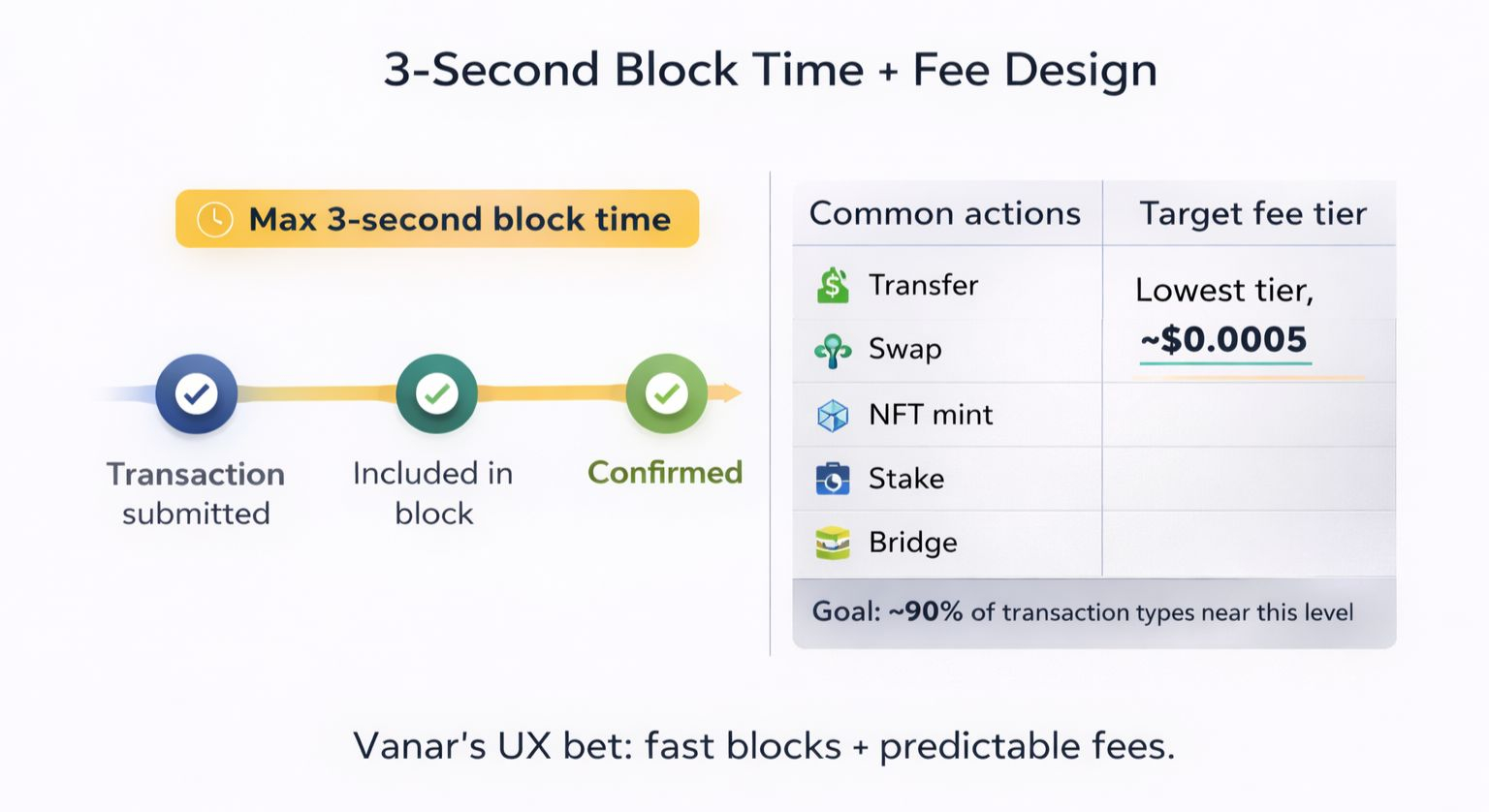

The big levers here are 3-second block time and fixed fee tiers.

Here’s where Vanar gets specific, and I like that.

The docs describe a block time capped at a maximum of 3 seconds, aiming for fast confirmations and lower latency. Not instant, but responsive enough for apps that need quick feedback.

Then there’s the fee model.

Vanar documents a tiered fee system based on transaction size (gas consumed). The important part is that common transactions like transfers, swaps, minting NFTs, staking, and bridging are designed to stay in the lowest tier. That lowest tier is described as a small amount of VANRY equivalent to about $0.0005.

They also state a clear goal: 90% of transaction types should sit around that same $0.0005 neighborhood.

This is the “boring” part I keep talking about.

Users don’t only hate fees, they hate surprise fees. Predictable costs let teams price actions simply. It also helps creators and builders explain things without a long warning label.

One more detail that’s easy to miss: the tiering is also a defense tool. The docs say this scheme makes it expensive to misuse or attack the chain with massive, block-hogging transactions. Bigger transactions move up tiers.

In other words, the cheap lane is for normal stuff, the expensive lane is for heavy stuff.

Now the question is, why this setup maps well to AI, gaming, and “real-world scale” ?

AI: AI agents are basically always-on users. If costs spike randomly, agents become risky to run at scale. Vanar’s core positioning is that it’s purpose-built for AI workloads, so these patterns aren’t treated as an edge case.

Gaming: Games need fast confirmation and low-cost micro-actions, otherwise teams shove everything off-chain and only settle the boring parts on-chain. Vanar’s 3-second max block time plus the ultra-low fee target is clearly meant to keep game loops smooth.

Real-world scale: This is where stable fees and consistent behavior matter. Vanar’s fixed-fee framing is explicitly about keeping costs low and predictable for apps built on top of it.

Nothing magical here, just choices that match the problem.

Vanar doesn’t seem focused on winning the “fastest chain” argument by volume. The sharper angle is: keep costs tiny and predictable, keep confirmations quick, and stay friendly to EVM builders.

Personally, that’s the part that feels most real.

Consumer apps usually fail for boring reasons, not because the chain wasn’t cool enough.

For a quick snapshot of market visibility, Binance’s price page currently lists VANRY at $0.00602, with a market cap of $13.79M, $1.78M 24-hour volume, and 2.29B circulating supply.

I’m optimistic about Vanar’s direction, especially the focus on fast blocks and fixed, tiered fees.

The next phase is about execution and proof in real usage, not just clean docs.

Fee consistency in real conditions: Vanar targets the lowest tier around $0.0005, and it also states the goal that 90% of transaction types stay near that level.

Keeping that predictability as activity grows is a strong signal.

App traction that sticks: More shipped apps, more repeat usage, more daily activity that doesn’t fade after a week. AI and gaming are unforgiving here. They either feel smooth, or users leave.

Network stability under load: A block time capped at 3 seconds is great for interactivity, and reliability during spikes is what turns “promising” into “real-world ready.”

If Vanar keeps delivering on predictable costs, responsive confirmation, and an EVM-friendly builder experience, it can become a practical base layer for AI-driven apps and games that need more than hype to survive.

And honestly, I like that the pitch is “make it work” instead of “make it loud.”