To understand Fogo, stop thinking of it as another chain chasing throughput records. Think of it like a trading venue where the first design decision is where to put the matching engine. That is the essence of colocated validators: compressing distance and timing uncertainty before anything else. In markets, the real killer is inconsistent speed. Tiny variable delays jitterturn execution into a coin flip.

Most blockchains are constrained by the global internet. Validators are scattered, messages traverse oceans, and protocols must allow for the slowest path. The chain survives but it moves like a convoy. Fogo takes a different approach. By colocating validators, consensus is limited not by geography but by the hardware itself. Time to agreement drops, and execution becomes predictable. That’s what changes behavior not marketing.

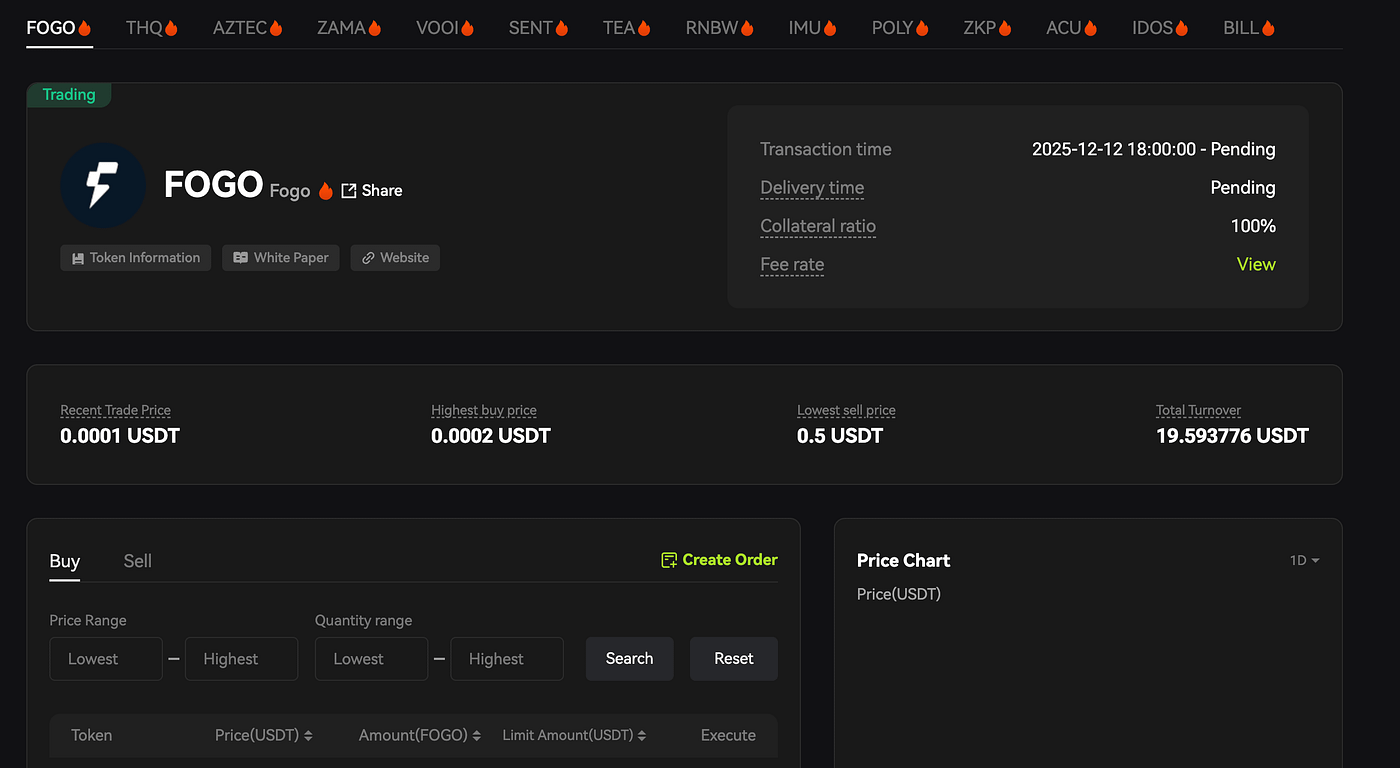

Traders feel this immediately. Unpredictable latency forces wider spreads, larger balances, and waiting for bigger mispricings. On colocation-optimized networks, jitter is reduced. Decisions can be tighter, spreads narrower, and arbitrage runs on thinner edges. Liquidity is preserved, not magically created. Predictable execution lets participants act confidently, even in a leaner system.

Yet there’s a tradeoff. Concentrating validators concentrates risk: data center outages, regional events, or network routing issues become correlated. Backups help, but failover under stress is a hard engineering problem. Operationally, colocation favors elite infrastructure. The validator set may shrink to those who can meet strict performance standards. This isn’t a moral question about decentralization it’s a practical one: low coordination costs make collective behavior easier but can centralize influence over upgrades, governance, and transaction inclusion.

Stress tests matter more than calm operation. Fast venues compress feedback loops: repricing, liquidations, and order flow accelerate. A chain that cannot handle surges risks empty books and chaotic execution. Traditional exchanges have volatility rules; execution-first chains need explicit overload behavior.

There’s also a financial effect. Faster, predictable execution reduces idle capital requirements. Funds rotate efficiently. The system becomes more efficient—and more reflexive. Money can flood in during favorable conditions and leave cleanly during stress. Speed cuts both ways.

So, when Fogo claims ultra-low latency from day one, it’s making a specific bet: pay for determinism with geography. Colocated validators are the price. The ongoing cost is managing correlated risk and incentive concentration without harming execution. If successful, Fogo becomes more than fast—it becomes a venue where onchain trading can be planned, sized, and risk managed like a real market. If not, it remains a fast chain that loses trust the moment volatility strikes.