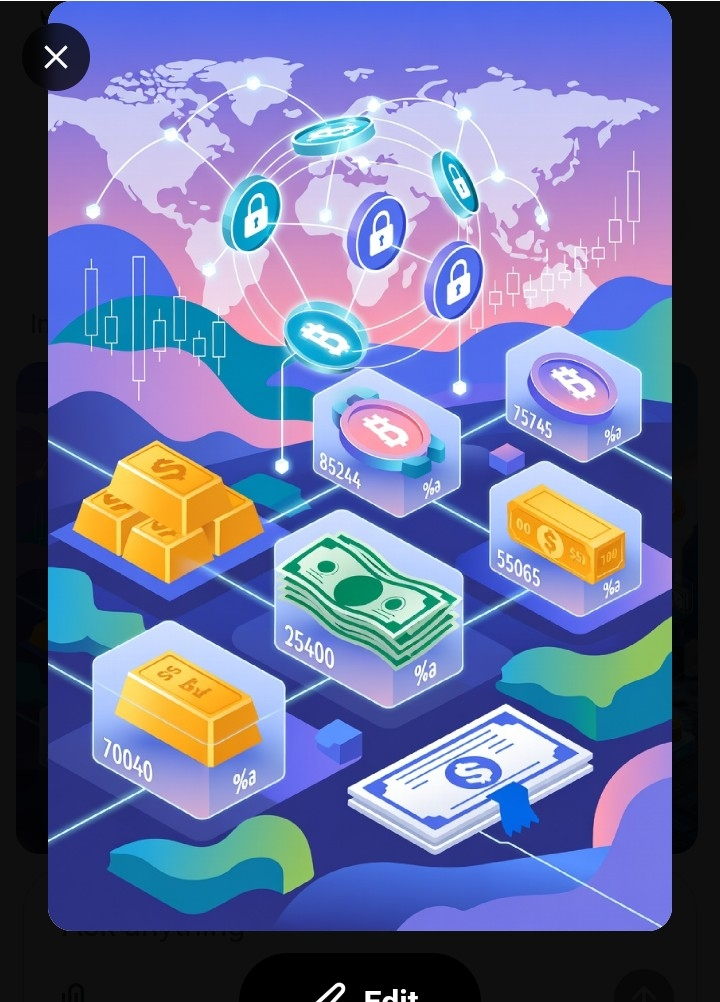

Real World Asset (RWA) tokenization refers to the process of converting ownership rights of tangible or traditional assets—such as real estate, commodities like gold, government treasuries, stocks, art, or even intellectual property—into digital tokens on a blockchain. This transformation bridges the gap between the physical world and decentralized finance (DeFi), enabling these assets to be represented as fungible or non-fungible tokens (e.g., ERC-20 or ERC-721 standards on Ethereum).The core benefits include:

Fractional Ownership: Assets that were once indivisible (like a piece of real estate) can be split into smaller, affordable shares, democratizing access for smaller investors.

Increased Liquidity: Tokens can be traded 24/7 on global blockchain platforms, reducing the friction of traditional markets like paperwork, intermediaries, and settlement times.

Transparency and Security: Blockchain's immutable ledger ensures verifiable ownership, provenance, and transaction history, while smart contracts automate processes like dividends or royalties.

Global Accessibility: Anyone with an internet connection and a crypto wallet can participate, bypassing geographic or regulatory barriers in some cases.

Efficiency: It lowers costs by eliminating middlemen, such as brokers or custodians, and allows for programmable features like automated compliance checks.

However, challenges exist, including regulatory hurdles (e.g., ensuring tokens comply with securities laws), the need for trusted oracles to verify off-chain asset values, and risks like smart contract vulnerabilities. #RWA #Tokenization #Blockchain #DeFi #CryptoAssets