Non-fungible tokens (NFTs) have transitioned from speculative instruments to utility-driven digital assets in sectors such as digital art, gaming, virtual environments, and AI-generated media. As transaction costs decline and infrastructure matures, platforms like Binance NFT Marketplace provide accessible entry points for independent creators. This article presents a structured, practical guide to minting NFTs on Binance, outlining preparation requirements, minting procedures, pricing considerations, and risk awareness for new participants in 2026.

1. Platform Overview: Why Binance for NFT Minting

Binance NFT Marketplace offers several features relevant to new creators:

Support for BNB Chain (lower transaction fees) and Ethereum (broader ecosystem exposure)

User-friendly minting interface requiring no coding knowledge

Adjustable royalty settings (typically 1–10%)

Integration with Binance accounts and wallets

The combination of low fees and platform visibility makes it suitable for creators testing initial NFT releases with limited capital.

2. Preparatory Requirements

Before minting an NFT, creators must complete several foundational steps.

2.1 Account and Wallet Setup

Users must create or log into a Binance account and access the NFT section through the platform interface. A compatible wallet, such as Binance Web3 Wallet or MetaMask, must be connected to facilitate blockchain transactions.

To cover minting fees, users should fund their wallet with a small amount of BNB (for BNB Chain) or ETH (for Ethereum).

2.2 Digital Asset Preparation

Creators should prepare a digital file in supported formats (e.g., JPEG, PNG, MP4, MP3). File size limitations apply and vary by platform guidelines.

Metadata, including title, description, and attributes, should be clearly defined to improve discoverability and contextual value. Well-structured metadata enhances long-term presentation and resale potential.

2.3 Eligibility and Access

As of recent platform updates, Binance allows open minting without exclusive invitation requirements. Users can navigate to the “Create” section within the NFT marketplace to initiate the process.

3. Minting Procedure on Binance

Minting converts a digital file into a blockchain-verified NFT. The process generally follows these stages:

3.1 Upload and Customization

Users select “Create” and upload their digital file. They must then input descriptive metadata and define royalty percentages, which determine the creator’s share of secondary sales.

3.2 Blockchain Selection

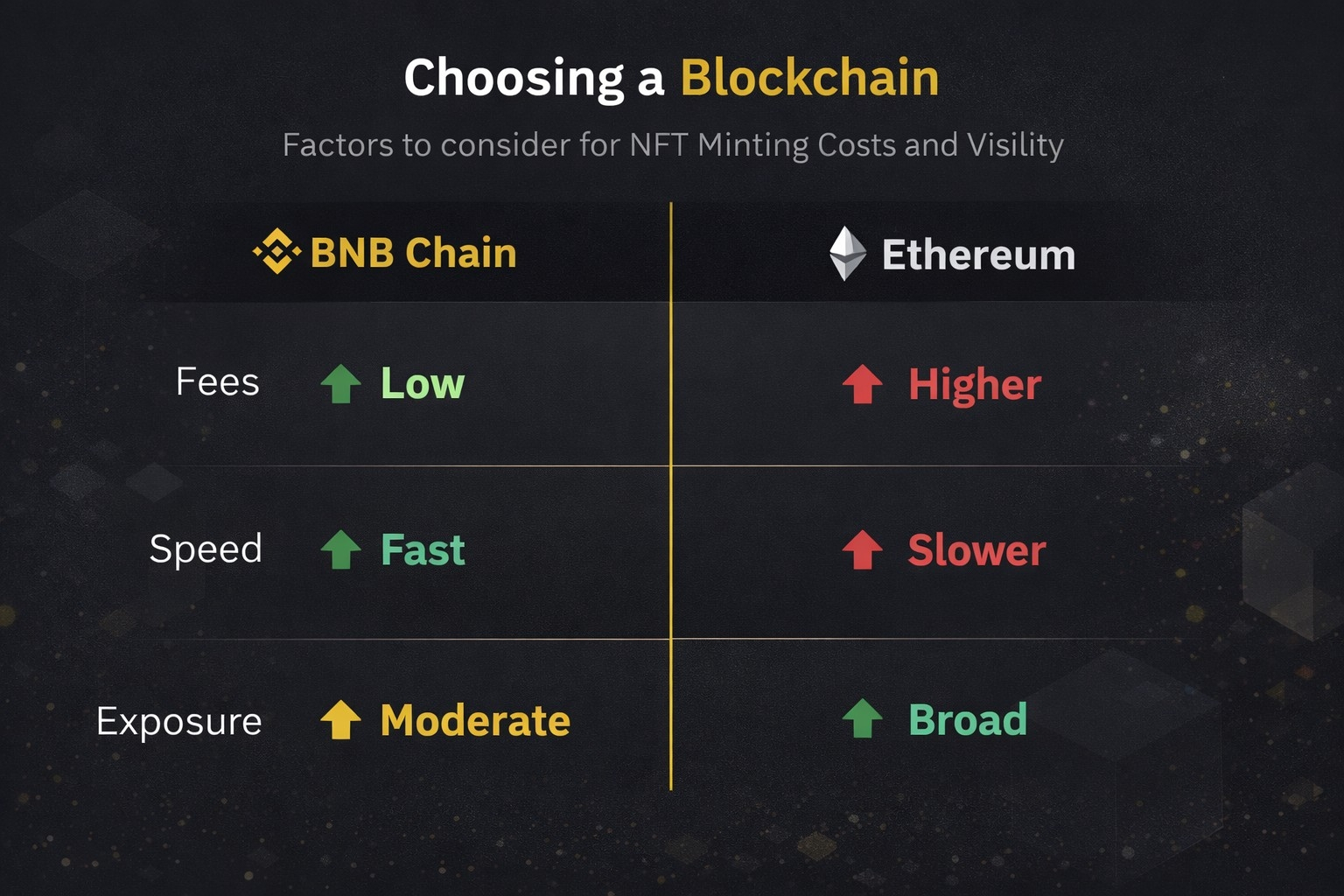

Creators must choose between BNB Chain and Ethereum.

BNB Chain: Lower transaction fees and faster confirmation times; suitable for beginners and low-cost experimentation.

Ethereum: Broader market visibility but potentially higher gas fees.

Cost considerations play a critical role in this decision, especially for creators working with limited capital.

3.3 Confirmation and Minting

After reviewing all details, the user confirms the transaction and pays the required blockchain fee. Upon confirmation, the NFT appears in the creator’s collection and can be listed for sale.

4. Pricing and Market Strategy

Successful NFT releases depend not only on minting but also on positioning and pricing.

New creators often adopt conservative pricing strategies to encourage early traction. Fixed-price listings provide predictability, while auction formats may generate competitive bidding in cases of community interest.

Marketing plays a significant role. Promotion through Binance Square, social platforms such as X, and community channels like Discord can increase visibility. However, market reception depends heavily on perceived uniqueness, artistic quality, and community engagement rather than minting alone.

5. Economic and Operational Considerations

While minting costs on BNB Chain are generally low compared to Ethereum, creators should also accounts for:

Transaction fees

Potential listing fees (if applicable)

Marketing time and effort

Market liquidity constraints

Importantly, not all NFTs sell. Oversupply remains a structural feature of NFT markets, and discoverability is competitive. Royalty enforcement may vary across marketplaces, and resale volume is not guaranteed.

NFT creation should therefore be approached as a creative and experimental endeavor rather than a guaranteed revenue stream.

6. Risk Considerations and Market Uncertainty

Participation in NFT markets involves material financial and operational risks. Digital assets remain highly volatile, and demand for newly minted NFTs is unpredictable. Market liquidity can fluctuate significantly depending on broader cryptocurrency conditions, platform policy changes, and shifts in user engagement. Additionally, regulatory frameworks surrounding digital assets continue to evolve across jurisdictions, potentially affecting trading conditions, taxation, and platform accessibility.

Creators should also recognize platform dependency risk. Marketplace visibility algorithms, fee structures, and royalty enforcement mechanisms may change over time. Furthermore, intellectual property disputes and unauthorized reproduction of digital content remain ongoing challenges within NFT ecosystems.

Accordingly, NFT minting should be approached as a creative and experimental activity rather than a guaranteed commercial venture. Capital allocation should remain proportionate to individual financial circumstances, and creators are advised to evaluate opportunity costs before committing resources.

7. Conclusion

NFT minting on Binance offers an accessible pathway for artists and hobbyists seeking entry into blockchain-based digital ownership. The platform’s integration with BNB Chain reduces transaction costs, while its user-friendly interface simplifies technical barriers.

However, successful participation requires more than technical minting. Strategic pricing, community engagement, and realistic expectations regarding market demand are essential.

In 2026, NFTs are increasingly defined by utility, integration, and sustainability rather than speculation. Creators who approach minting with structured planning and informed risk awareness are better positioned to build long-term digital portfolios.