They fail in pauses.

A few seconds too long.

A missing balance.

A moment where someone stops and thinks instead of acting.

Most blockchains aren’t built for that moment. They assume attention. They assume preparation. They assume the user is willing to adapt.

Payments don’t negotiate like that.

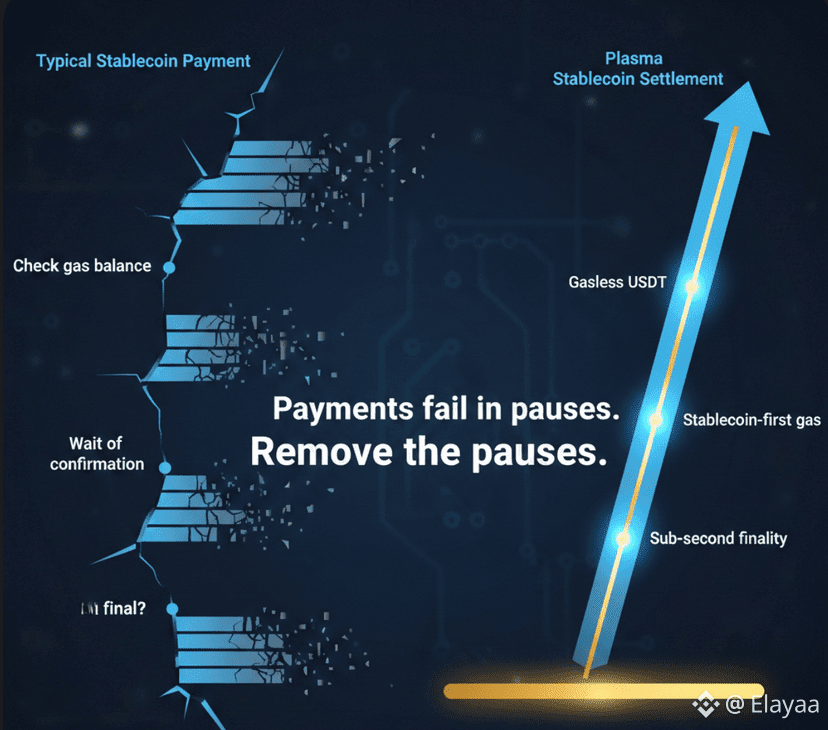

Stablecoins already behave like money. People use them when they want certainty, not discovery. But the infrastructure underneath still asks questions at the wrong time. Do you have gas. Do you have the right token. Are you willing to wait.

That’s where systems break, even if the chain is fast on paper.

Plasma is a Layer 1 that starts from this failure mode instead of avoiding it. Not by adding features, but by rearranging priorities. Stablecoins aren’t passengers here. They are the payload.

Gas is a good example. On most networks, gas is treated as a technical detail. In reality, it’s a psychological tax. The moment someone realizes they can’t move value because of a missing fee token, trust erodes. Plasma’s gasless USDT transfers and stablecoin-first gas aren’t conveniences. They remove a decision point that shouldn’t exist during a payment.

That removal matters more than raw throughput numbers.

Finality shows up differently too. PlasmaBFT delivers sub-second finality, but the real effect isn’t speed. It’s absence. No second-guessing. No refresh. No wondering whether the transfer is still pending somewhere in the system. The transaction ends when the user’s attention moves on.

That’s what payments want: to end.

There’s an assumption in crypto that users enjoy managing complexity. That assumption collapses the moment money is involved. Complexity isn’t empowering when rent, payroll, or settlement is on the line. It’s just risk.

Plasma seems to understand that risk isn’t only technical. It’s behavioral. A system that requires perfect conditions creates fragile usage. A system that assumes imperfect users survives longer.

This is also where Bitcoin anchoring enters quietly. Not as a brand attachment, not as a slogan. As a posture. Anchoring security to Bitcoin is a statement about neutrality over time. Payments don’t need constant upgrades. They need to be boring in the same way gravity is boring.

That choice hints at a longer view. One where censorship resistance isn’t an abstract value but a requirement for settlement infrastructure. Especially when stablecoins are already embedded in global flows that don’t stop for ideology.

Plasma’s Ethereum compatibility through Reth fits into this same pattern. Compatibility without imitation. Familiar execution, different priorities. The goal isn’t to recreate Ethereum’s ecosystem. It’s to allow builders to operate without relearning everything while operating inside a network that treats stablecoin settlement as the primary concern.

Retail users feel this first. Especially in high-adoption markets where stablecoins are already part of daily life. When payments work without explanation, usage grows quietly. No tutorials. No onboarding threads. Just repetition.

Institutions notice it later, but for different reasons. Predictable settlement. Clear finality. Fewer operational edge cases. Less support overhead caused by “almost worked” transactions.

What Plasma doesn’t do is try to impress.

There’s no attempt to win narratives about being the fastest, the most modular, the most composable. That restraint is intentional. Payment networks that chase attention tend to redesign themselves too often. Money doesn’t like moving ground.

Instead, Plasma seems built around reducing moments of hesitation. Reducing the number of questions a user has to answer before value moves. Reducing the surface area where something can go wrong.

That’s not glamorous work.

It’s also not immediately visible in dashboards or marketing metrics. But over time, those removed frictions compound. Systems that don’t interrupt get reused. Systems that don’t surprise become trusted.

In a space crowded with chains trying to become platforms, Plasma behaves more like infrastructure. It doesn’t ask to be explored. It expects to be used.

And maybe that’s the most telling signal.

When a payment network fades into the background, when users stop thinking about how it works, when money moves and attention doesn’t linger — that’s when the design has done its job.

Not perfectly.

Just reliably enough.