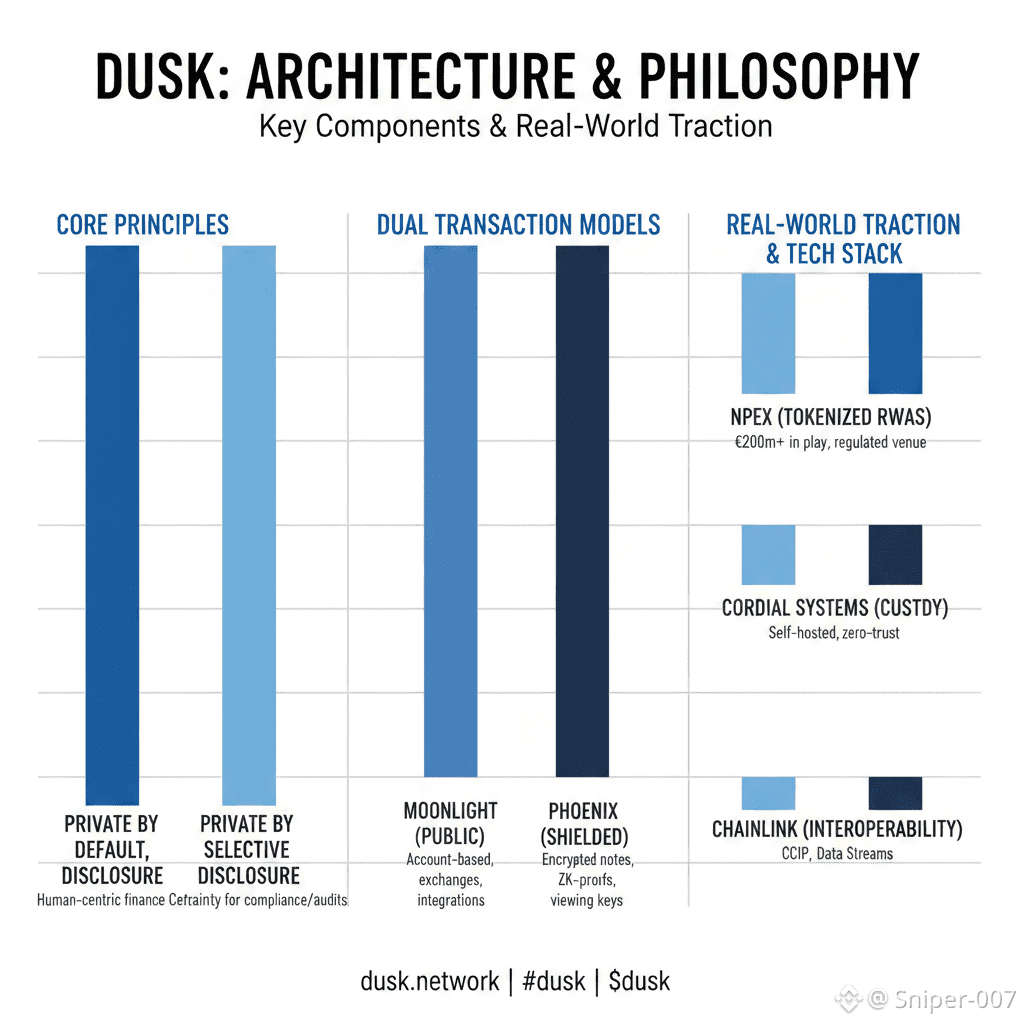

It's the mature, almost understated conviction at its core: serious financial systems have never been completely wide-open or totally hidden. They exist in that practical in-between space—positions stay confidential, counterparties are shielded, but when the right people (auditors, regulators, or risk officers) need answers, the books get opened cleanly and without excuses.

Most blockchains haven't quite figured out that balance yet. They either blast everything into the public ledger and label it "transparency," or lock it all down and call it "privacy." Dusk takes the road that actually matches how real-world finance has operated for decades: keep things private by default, but build in reliable ways to reveal exactly what's needed when compliance, disputes, or oversight come calling.

That mindset is front and center in how transactions work. The network doesn't make you pick one extreme—it runs two models comfortably side by side. Moonlight gives you clean, public, account-based transfers, the kind that play nice with exchanges, integrations, and situations where visibility makes sense. Phoenix, meanwhile, brings real shielded privacy through encrypted notes and zero-knowledge proofs, but here's the key human touch: it's designed for selective disclosure. With viewing keys, you can grant access to specific parties—like auditors or regulators—without exposing everything to the world. It's privacy that doesn't fight compliance; it works with it.

At its heart, this is about real trust. You don't broadcast your entire financial life to strangers, but you're fine sharing it with your accountant or the authorities when required. Dusk feels like it was built by people who've lived that reality and decided to code it in from day one.

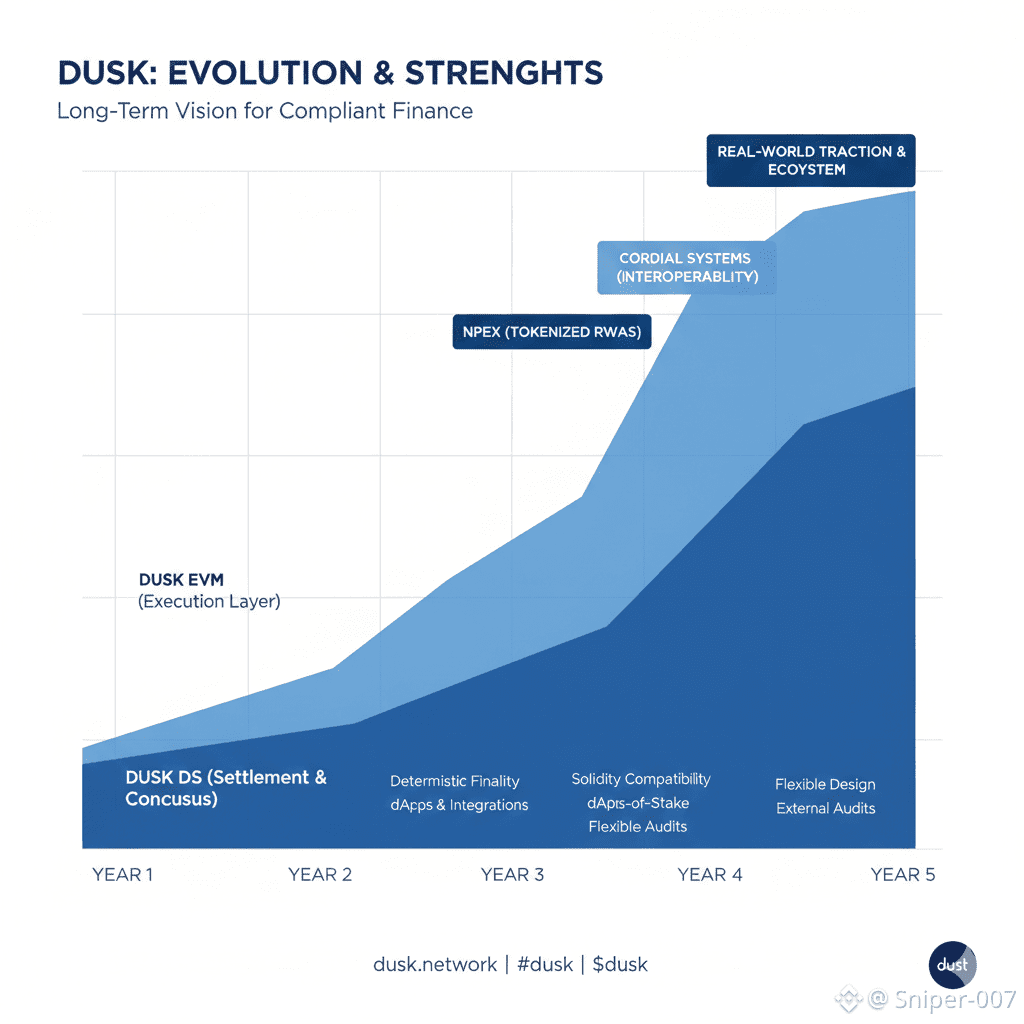

The architecture reflects the same grown-up thinking. The foundation (**DuskDS**) takes care of consensus, settlement, and data availability in a rock-solid, conservative way, while execution layers like DuskEVM (and others) can evolve on top. It's straight out of traditional finance's handbook: settlement and clearing systems change slowly, deliberately, and with heavy scrutiny; trading apps, interfaces, and new features move fast. No one's rewriting the core rails every time someone launches a shiny new dApp—**Dusk** just gets that instinctively.

Consensus is deliberately straightforward too: a committee-based proof-of-stake with deterministic finality through Succinct Attestation. Nothing flashy here, but when you're dealing with reconciliation, risk reports, or explaining settlements to a compliance team, you want certainty—not "probably final after a while." Probabilistic stuff is great for a lot of crypto play, but it's stressful when real money and regulations are involved. Add in multiple external audits on the consensus, networking (Kadcast), and other layers, and you get the sense this is a protocol that's ready to be poked, prodded, and questioned—and built to hold up.

The pragmatic side shines in the EVM choice. DuskEVM is fully compatible, leaning on familiar Solidity tools to make it easy for developers to jump in and build real apps. Sure, it has a slightly longer finalization window right now compared to the base layer—not ideal for ultra-time-sensitive trades—but that feels like a thoughtful trade-off: get adoption rolling on the execution side while keeping the settlement foundation steady and predictable. Infrastructure people make those kinds of calls.

The DUSK token follows the same long-term logic. It's there for staking to secure the network, validator rewards, fee payments (which get burned), and a stretched-out emission schedule designed for decades, not quick hype cycles. The supply picture isn't perfectly clean—historical versions (ERC-20/BEP-20), mainnet migration via burners—it's a bit messy, but that's honest accounting. If you're aiming at regulated spaces, you live with that complexity, just like institutions do.

What makes Dusk feel genuinely grounded is the real-world traction. The deep tie-up with NPEX (the regulated Dutch venue tokenizing serious RWAs, with €200M+ in play), institutional custody through Cordial Systems (self-hosted, zero-trust setups), and cross-chain/interoperability via Chainlink (CCIP for moving tokenized assets, Data Streams for reliable pricing) aren't flashy pumps. They're about creating a complete, workflow-friendly stack—issuance, trading, custody, settlement, cross-network access—that actually lowers barriers for institutions wondering if blockchain can fit without breaking their existing processes.

If I had to put Dusk's whole bet into everyday words: real financial privacy isn't hiding—it's choosing wisely when and to whom you reveal. That one idea connects everything—the dual models, the modular design, the focus on deterministic finality and audits, the patient ecosystem work, even the measured EVM rollout.

No guarantees here, naturally. Liquidity could stay fragmented, devs might flock to chains with zero compromises, institutions might drag their feet forever. But Dusk doesn't feel like another project chasing likes or virality. It feels like one that's quietly built to survive audits, regulatory deep dives, and years of real stress-testing.

In a space full of big promises and ideological takes, there's something refreshingly adult about a blockchain that starts from the assumption that trust isn't something you shout about or assume—it's something you earn through careful design, clear documentation, and the quiet confidence that when someone asks to see the books, you'll be ready to show them.